In its long history, Sundaram Select Mid Cap Growth has seen some stalwarts at the helm.

In fact, fund manager Anoop Bhaskar shot to prominence by doing an amazing job with this flagship fund. In 2006, this was the best performer in the category with a return of 60.77% (category average: 29.68%).

He quit in 2007 to head equities at UTI Mutual Fund and since then has moved to IDFC Mutual Fund.

Bhaskar was succeeded by Satish Ramanathan who had big shoes to fill. Ramanathan had to deal with the market collapse in 2008 but bounced back in 2009 with a return of 115%, beating Franklin India Prima and IDFC Premier Equity Plan A. That year Sundaram S.M.I.L.E put up an impressive performance of 120%.

Ramanathan exited the fund house in 2012. It was then that current fund manager S Krishnakumar took over, also the fund manager of Sundaram S.M.I.L.E.

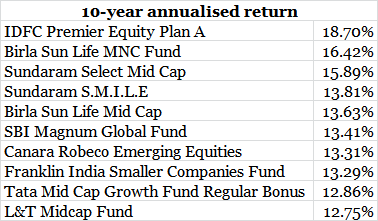

If one takes a look at the 10-year annualized returns (see table below), the fund is right up there, followed by Sundaram S.M.I.L.E.

(When arriving at these performers, only regular plans (not direct) and growth schemes (not dividend) of open ended funds in the mid- and small-cap category were taken into account).

However, if you look at the 5-year returns, Mirae Asset Emerging Bluechip tops with an annualized return of 23.15% while Sundaram Select Mid Cap has a return of 17.59%, not among the top 10, but nevertheless impressive.

The fund may not deliver the trail-blazing returns of the past, but it is still a good contender in this category. Over the past 10 calendar years, it underperformed the category average just marginally in 2012 and by less than 2% in 2014.

A noteworthy point is that this fund does not collapse like a pack of cards when the market drops. In 2008, 2011 and its year-to-date returns show a fall that hovers around the average.

Senior fund analyst Kavitha Krishnan has awarded the fund a Silver rating and says that there are few points investors must bear in mind:

- The fund manager invests in stocks that exhibit growth characteristics over the fund’s 3- to 5-year investment horizon. He seeks growth stocks with the potential to double over the fund’s investment horizon.

- The fund house has a strong thematic undercurrent that may influence sector selection, though stock selection remains primarily driven by fundamentals and the investment process is essentially bottom-up.

- The manager can be opportunistic in his approach at time and tries to balance the stock’s perceived return, growth, and valuations while maintaining lower liquidity risk.

Investors looking for a true-to-label mid-cap product can find it here. Our analyst notes that despite peers within the small/mid-cap Morningstar Category moving a considerable portion of their portfolios into large caps, especially when small caps and mid-caps are overvalued, this fund manager does not sway from his mandate. And neither does he take refuge in cash but prefers being fully invested. You can read Kavitha's analysis here.

- Fund Manager: S. Krishnakumar, a proficient portfolio manager and an astute stock-picker.

- Fund Category: Small/Mid-Cap

- Analyst Rating: Silver

- Star Rating: 4 star

- Portfolio: Based on high-conviction ideas and can tend to be sector-heavy.

- Investment Process: A well-defined process, aimed at constructing a growth-oriented long-term portfolio of stocks.