This post was written by Carl Richards for Morningstar Advisor, from where it has been taken.

When I started my career, I worried about a lot of things. But at the top of my list was trying to figure out how I could stand out. How could I convince people that they should work with me rather than someone else?

I hear about this worry a lot from other financial professionals. First, they were told to spend thousands of dollars on a beautiful marketing brochure. Then, consultants suggested a website was the only way to get taken seriously. Most recently, it’s all about social media.

But I’ve got a secret, one that took me a few years to figure out. The true differentiator, the big thing that attracts clients, isn’t some marketing gimmick. It’s honesty.

I know. Honesty sounds obvious, even simple. But I keep seeing some members of the industry act like they don’t understand its value.

Think back to the U.S. Department of Labor’s announcement about the fiduciary standard. The proposal was pretty simple. Anyone who gives advice on retirement accounts and defined-benefit plans needs to act as a fiduciary. In other words, professionals would be required to offer advice that wasn’t just suitable, but that was in the client’s best interest.

(This was proposed in 2015 - you can view it here).

Let’s put aside what we call it and unpack the response. Instead of leaping at the chance to be honest with clients, I read a lot of reasons why some financial professionals think it’s a bad idea. Contracts would be complicated. Legal liability could increase. Investor choices might be limited. All of those things could come true. But this response revealed something even more interesting: Honesty has become a differentiator.

We’re reaching the point where what we call ourselves matters less to clients than whether we’re willing to explain ourselves. I know many financial professionals who can’t or won’t call themselves fiduciaries. But they go out of their way to make sure clients understand any conflicts of interests or fees connected to the advice they provide. These professionals aren’t necessarily required to share this information. They’ve simply figured out that there’s a competitive advantage to total honesty.

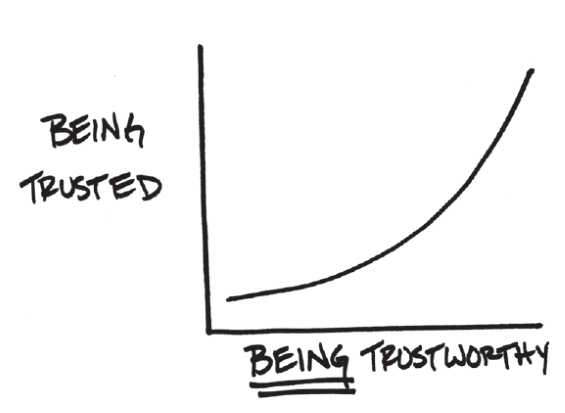

So, why doesn’t an industry that wants to be trusted embrace behavior that makes it trustworthy? It comes down to a couple of reasons.

1) We’re scared

We don’t know, for example, how people would react if we were to tell them that we earn a commission on the advice we offer. Maybe they won’t care, but maybe they will. Then what do we do?

2) We’re too comfortable

The status quo in the industry has been the status quo for a long time. Things like the fiduciary standard are relatively new. For some professionals, total honesty may require some big, uncomfortable changes.

Look, I understand that what I’m suggesting here is radical. But we’re an industry in desperate need of a revolution. Instead of worrying that we’ll be replaced by robo-advisors in the future, we need to worry that we’ll be replaced now by someone who’s willing to tell the truth. Don’t you want to be one of those truth-tellers?

After all, the real value in working with a financial professional doesn’t come from any single piece of advice. It comes from building a lasting relationship based on honesty and the sense that you want clients to reach their financial goals. Both of those objectives are more difficult if we insist on holding to a standard that doesn’t really suit us as professionals or as people.

We want to be trusted, but we’ve got to give people a reason to trust us.