Not so long ago, non-banking finance companies, or NBFCs, were considered to be merely extracting a regulatory arbitrage over banks and could potentially be a systemic risk to the financial sector. At about one-sixth of the overall outstanding credit at the time of the global financial crisis, it was felt that there was a need to ensure more effective regulation.

The Usha Thorat Committee was constituted by the Reserve Bank of India, or RBI, in September 2010 to address some of these issues. At around that time, there was a clamor among NBFCs to apply for banking licenses. The commonly held view was that NBFCs would not be able to survive in their current avatar, and a banking license would be their ticket to salvation. In April 2014, barring two NBFCs, the rest of the applicants did not get banking licenses.

Just as stock market investors were writing obituaries of NBFCs that did not make the cut for banking licenses, a new cycle was emerging for some of these companies. The guidelines for NBFCs released by the RBI in November 2014 provided for more stringent recognition norms for nonperforming loans (NPLs) from 180 days past due to 90 days, but gave a three-and-a-half-year time frame for implementation. Similarly, the Tier I ratio requirement of 10% to be achieved by March 2017 was lower than the 12% proposed by the Usha Thorat Committee. This regulatory clarity helped, to a great degree, to clear the air of uncertainty for NBFCs. The asset quality for top-tier NBFCs over the last two years has held up better than expected.

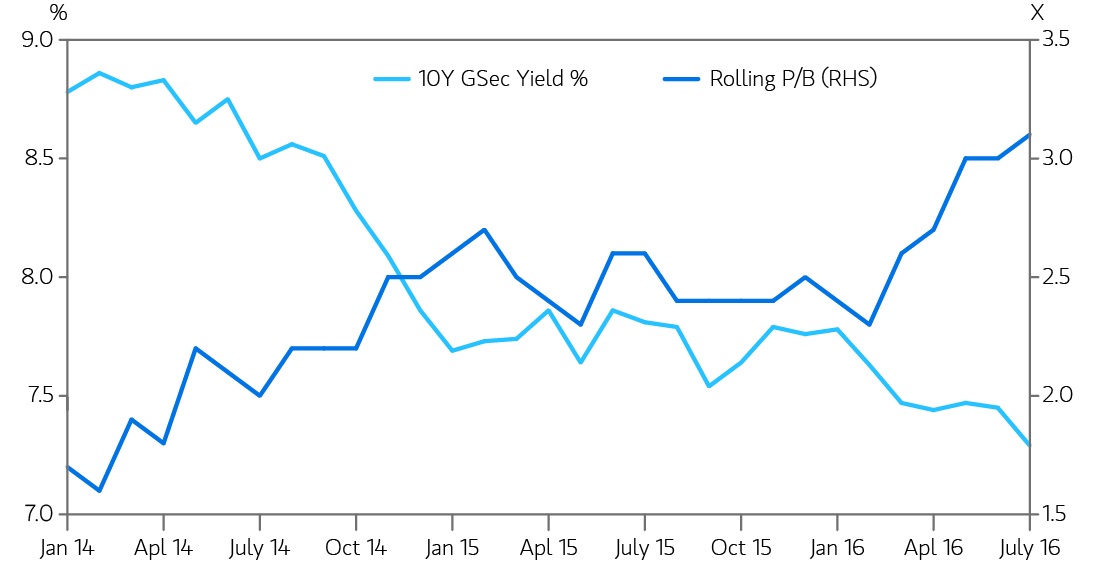

To add, from the beginning of 2014, the yield on 10-year government bonds, a rough proxy for wholesale borrowing costs of NBFCs, has come down by about 150bps. These factors led to an almost 100% rerating in NBFC valuations since early 2014, as measured by one-year forward estimated price to book.

NBFCs that have built a credit platform in areas related to consumer lending have been strong outperformers in the stock markets. While high-street branches in the metro cities, a wide network of ATMs and high-decibel advertising make it appear that private sector banks are leading the charge in retail lending, NBFCs are quite close on their heels. A closer look at the consumer lending book in India reveals that the top 12 NBFCs with about US$92 billion of retail loans are barely 5% smaller in size than the corresponding retail books of the top five private sector banks.3 NBFCs now have a large presence in most retail lending segments and are estimated to account for a 44% share in automobile loans and a 52% share in loans against property.

Over the last two years, the overall loan book of NBFCs grew at 16% annually, or almost twice as fast as bank credit growth over the same period. There is a huge unmet demand for credit among small enterprises, where cash flows are difficult to assess and a residential property may be the only collateral. The distribution reach of many NBFCs remain unmatched by banks in areas such as microfinance, used-vehicle financing or rural housing.

Microfinance is seeing a huge boom after having absorbed the shocks from the Andhra Pradesh crisis five years ago.

The market leader among microfinance companies almost tripled its loan book last year. The microfinance borrowers were historically dependent on the unorganized money lenders or self-help groups. The ramp-up of robust databases by credit bureaus has helped, in no small measure, to keep a check on the credit quality of retail borrowers. This has made small-ticket loans for consumer durables a more viable proposition. The better-quality NBFCs have introduced many best practices hitherto adopted only by a few private sector banks. Many are systematically diversifying their loan books to avoid the risk of concentration in cyclical businesses.

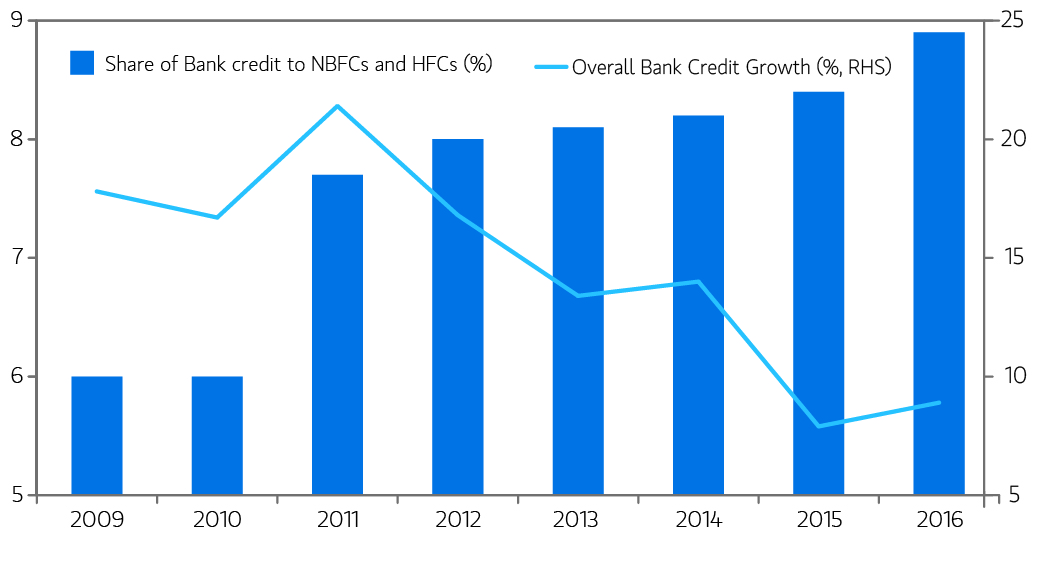

The outperformance of NBFCs has coincided with a period of rising stress in the corporate loan books of most state-owned and some private sector banks that were focussed on project finance. Arguably, these ‘corporate’ banks have been preoccupied with recognition and resolution of these nonperforming loans and have left an open space for NBFCs and consumer-focussed private sector banks to grab share. Moreover, these banks seem to be more than willing to fund these NBFCs, either to meet priority sector lending norms or merely because its ‘lazy banking’. Since the global financial crisis, the share of bank credit to NBFCs (including housing finance companies) has risen by 50% from 6% to 9%.

To conclude, as Bill Gates rightly says: “We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next 10.” The rise of NBFCs over the last few years clearly proves that their obituaries were premature. The financial sector will witness unprecedented changes in the coming years, and there will be new emerging models that will disrupt the old. It is difficult to predict what form or shape these will take.

As Nandan Nilekani says in a foreword to a recent report by Credit Suisse: “(The) gale winds of disruption and innovation, brought upon by technology, regulations and government action, will fundamentally alter the banking industry… The future will belong to those who show speed, imagination and the boldness to embrace change!”