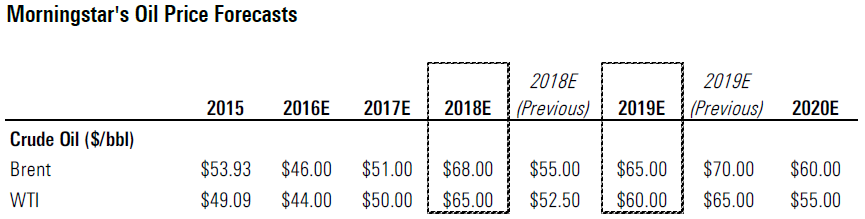

Crude markets have tightened a good deal in recent months, as strong demand growth and supply issues have pulled forward the industry recovery by about a year relative to our previous outlook. Fundamentals after 2017 are looking particularly bullish for prices, and an oil price rally in 2018 is looking more and more likely. We’ve raised our 2018 West Texas Intermediate, or WTI, forecast to $65 per barrel.

(You can gain a basic understanding of WTI and Brent here).

Even so, the strength of U.S. shale is lurking beneath the surface. Our analysis shows that the recent uptick in rigs and falling shale decline rates together are enough to stabilize U.S. crude production within six months. If activity isn’t scaled back, U.S. production will begin growing in 2017, albeit barely.

This underscores the strength of U.S. tight oil: Should a price rally ensue, it is far too strong to not overheat and eventually snuff out any future oil price rally. We remain bearish on oil prices longer term, and we reiterate our midcycle oil price outlook of $55 WTI ($60 Brent).

Medium-term supply shortages likely, but 2017 fundamentals fragile

The past few months have seen a good deal of progress with respect to global oil supply and demand rebalancing. The progress has occurred on multiple fronts, including oil demand being stronger than previously expected, with our 2017 demand forecasts now 500 thousand barrels a day higher than just four months ago. Additionally, supply issues in Venezuela and Nigeria have lowered production from the two countries by almost 500 mb/d relative to 2015. The issues plaguing both countries are far from resolved, particularly in Venezuela, where fiscal woes are throttling its ability to finance oil investment. The recent U.S. tight oil activity has somewhat offset these improvements, but the industry recovery is nonetheless running almost a year ahead of what we had previously projected.

The oversupply phase of this downturn thus finally appears to be nearing its end. The next critical issue for oil markets to deal with is elevated inventory levels, which have increased in OECD countries alone by 400 million barrels (for context, drawdowns of 1 mmb/d for an entire year still wouldn’t bring stocks back to predownturn levels).

However, large inventory draws don’t look likely in the coming quarters, particularly in the wake of recent U.S. activity increases. As a result, 2017 fundamentals don’t appear to support prices moving much above the $50 per barrel threshold. Oil markets simply don’t need additional 2017 production growth beyond what is already coming.

The biggest supply-side risk to oil prices at the moment is U.S. shale, which, given recent rig count increases, is set to stabilize and start growing again next year. Should another 50-100 rig additions occur, it could eliminate 2017 inventory drawdowns altogether, further delaying a sustained price recovery. With this in mind, we are setting our 2017 WTI forecast at $50 per barrel, which we believe is sufficient to prevent any further net U.S. shale activity increases in the coming quarters (some rigs will probably be added, but roughly 100 onshore U.S. rigs are rolling off long-term contracts next year, and we expect that not all of them will remain active).

Oil market fundamentals look far stronger by 2018

Assuming U.S. shale activity doesn’t materially increase in the coming quarters, much stronger crude market fundamentals look likely to emerge in 2018. If U.S. tight oil activity remains at current levels, supply will begin to fall well short of demand, a dynamic that will only intensify in 2019.

The root cause of the looming supply shortages in the medium term is the major cutbacks to upstream capital expenditure during the past two years. As a result of low investment levels, new capacity additions outside of shale are about to fall dramatically after 2017, a situation that is now unavoidable because of the long lead times associated with these projects. At the same time, OPEC will have little (if any) usable spare capacity, as the cartel has also been cutting back on oil field spending in response to low oil prices.

The industry is thus setting itself up to have few options to meet incremental supply needs besides U.S. shale in 2018-19. Although tight oil rig counts have recently risen as crude prices have recovered, and although we still think tight oil will eventually overheat in a high oil price environment, we nonetheless believe oil prices are likely to strongly rally at least in the medium term. The looming supply shortages are likely to require much greater increases in industry investment to meet demand than have recently occurred, and we are skeptical about whether these will be possible without a very strong signal from commodity markets.

As a result of these improving fundamentals being pulled in by about a year relative to our prior expectations, we have raised our 2018 WTI oil price forecast to $65 from $52.50; we believe this is the level required to drive the needed increases in U.S. tight oil activity.

A key risk to our 2018 price forecast is the possibility that U.S. activity continues to increase in the coming quarters. Assuming prices average more than $50 per barrel in the coming quarters, U.S. production could exceed our forecasts and reduce a fair portion of the anticipated 2018 supply shortages, leaving our price forecast too high. Over the next five years, our forecast for global supply and demand calls for a substantial increase in U.S. production that will eventually require prices higher than current levels. However, over the next 18 months, prices above $50 risk supply growth coming at the wrong time, thus prolonging the current price slump.

U.S. crude production set to start growing again in early 2017

Since peaking in March 2015, Onshore 48 crude production has fallen by 1.2 mmb/d (16%), providing immense relief to oil markets. It would seem logical that, with tight oil rig counts still well below 2014 levels--340 horizontal tight oil rigs today compared with more than 850 in 2014--production would continue to fall until shale activity levels are ramped up much further. In fact, this isn’t the case at all, which we believe many investors may find surprising. Unless tight oil activity is scaled back, onshore U.S. production will stabilize within the next six months and start growing again in early 2017.

Beyond the well-known efficiency gains that have occurred in recent years, a couple of fundamental causes are at work here. The first is that activity has begun to meaningfully increase, even if it remains well below prior peak levels. Tight oil rig counts have risen 30% (by 100 rigs) since their May trough levels. These rigs alone, if active through year-end 2017, will increase U.S. oil output by 240 mb/d.

Further, higher oil prices are likely to encourage more drilled-but-uncompleted tight oil wells being brought on line. Approximately 375 tight oil DUCs were completed during the first six months of 2016, and higher oil prices since then should provide at least a modest incentive to increase DUC completions (WTI averaged $39 per barrel in the first half). Altogether, we forecast quarterly tight oil completions to be about 25% higher in the fourth quarter than in the first three quarters of 2016.

Underlying decline rates in tight oil basins falling quickly

Another key factor leading to the end of U.S. production declines is that production decline rates in the tight oil plays are falling at the basinwide level. The decreasing percentage of tight oil wells that have been producing for less than 24 months (when declines are most severe) means the production-weighted average decline rate in each play is falling quickly.

The impact on supply from falling decline rates is enormous. Given this and the addition of well productivity improvements, significantly fewer well completions will be required to either stabilize or increase future production than was the case just two to three years ago. Approximately 2,000 tight oil completions per quarter would be sufficient to stop production declines and see tight oil output begin to grow in 2017 (on average, 4,500 such wells were completed each quarter in 2013-14).

Shale too strong to not eventually overheat

Negatively for long-term oil fundamentals, the reality that tight oil can stabilize at such low activity levels is equally relevant for considering its pent-up growth potential. This is why we’re so bearish on oil prices over the longer term: Tight oil will grow rapidly well below prior peak activity levels as soon as oil markets send a sufficiently strong signal.

This is the fundamental issue facing crude markets, no matter what part of the commodity cycle the industry happens to be in: The world is going to need a good deal of U.S. shale growth in the years to come, but nowhere near as much as it can supply. We still believe it’s wishful thinking to imagine that a group of producers acting independently and in their own financial best interest could ever be disciplined enough to produce only as much as global oil markets can handle at a given point in time. Instead, oil prices will ultimately need to find the level that can encourage just enough tight oil and stop unneeded shale growth in its tracks. We still believe that equates to approximately $55 WTI.