In 2015, TIME wrote about the end of the BRIC era.

This post came in 2015 after Goldman Sachs folded its BRIC fund into its larger emerging market fund. The fund made its debut in 2006 after the firm’s chief economist Jim O’Neill came up with the BRIC acronym. While investors were initially rewarded with huge returns, those gains soured and when the fund shut down, it noted that its assets had fallen 88% since peaking in 2010.

Even if the BRIC days are over, that does not mean the individual countries have lost their charm for investors.

Barrons recently reported that at the Goldman Sachs Global Macro Conference, investors surveyed believed that the best performing markets will be Russia (33%) and India (26%) followed by China (15%).

A strong 42% of those surveyed pointed to “protectionism and trade wars” as the largest macro risk with Trump’s protectionist policies likely to sink emerging markets. At the start of the year, Goldman analysts reckoned that China, South Korea and other Asian economies are vulnerable to that. By contrast, Brazil, Russia, India and South Africa are less at risk.

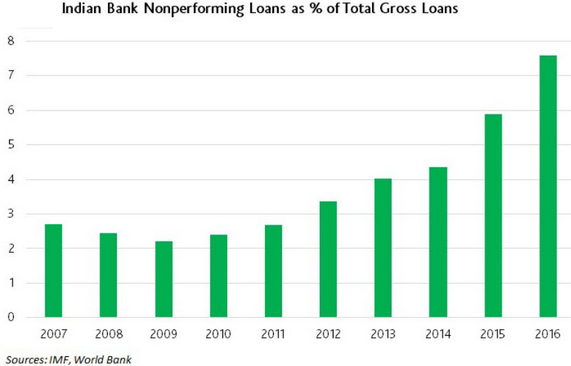

However, some are exercising caution. Rajiv Jain of GQG Partners told Forbes that a couple of things have dampened his enthusiasm for India. Valuations have to come off. Growth has to pick up. Non-performing loans are going up (the graph below from Wall Street Journal points to this). Credit growth in India is low at 5% because the underlying demand is weak.

Shankar Sharma in Outlook Business addresses the question of what investors are to do.

According to him, Indian large caps have almost no upside left. He is negative on large caps. Has been so for a while. Sees no reason to alter his view.

In June 2016 he told Economic Times that Indian mid, small and micro caps are the single best equity asset class in the world barred none. He reiterated his stance in October by stating that large caps are “more or less fatigued. I do not see where in large caps - barring a handful - are going to get great alpha.”

In his Outlook post, he believes that:

“Large caps are why India will lag its global peers such as Brazil, Russia, China. About the only exceptions in the large caps are commodity plays such as steel, which will benefit from a larger global upswing in commodity prices after a brutal four-five years.”

So where should the investor investor? Small caps and micro caps.

“That’s the only area of the market, I see, as still being in a bull phase – a long-playing one that. I see many companies, small in size, but big on balance sheet structure, governance, low capital intensity models of business. Those will win and win big.

“Further, many of them are exporters, many are infrastructure players which will benefit from lower rates. It takes tonnes of work to unearth even a single one, but just one is enough to make a fortune for most.”

Also Read: Smart tips for micro-cap investors