Long term bond yields in most of the regions including Europe, Asia and other emerging markets corrected in CY2016 on continuing easy monetary stance and stimulus measures. In a sharp contrast the U.S. bond yields inched higher driven by policy normalization stance being undertaken by the U.S. Federal Reserve.

The start of 2017 has signaled a reversal in the falling bond yield trend as economies shift gears to grapple with strengthening fuel and metal prices which have a tendency to stoke inflationary expectations.

Policy normalization in the U.S. and likely reversal of exceptionally accommodative monetary policy stance in other advanced economies could tighten global liquidity conditions going forward. The risks emanating from these global events have the potential to disrupt flows into emerging market debt segment.

Current domestic market trend

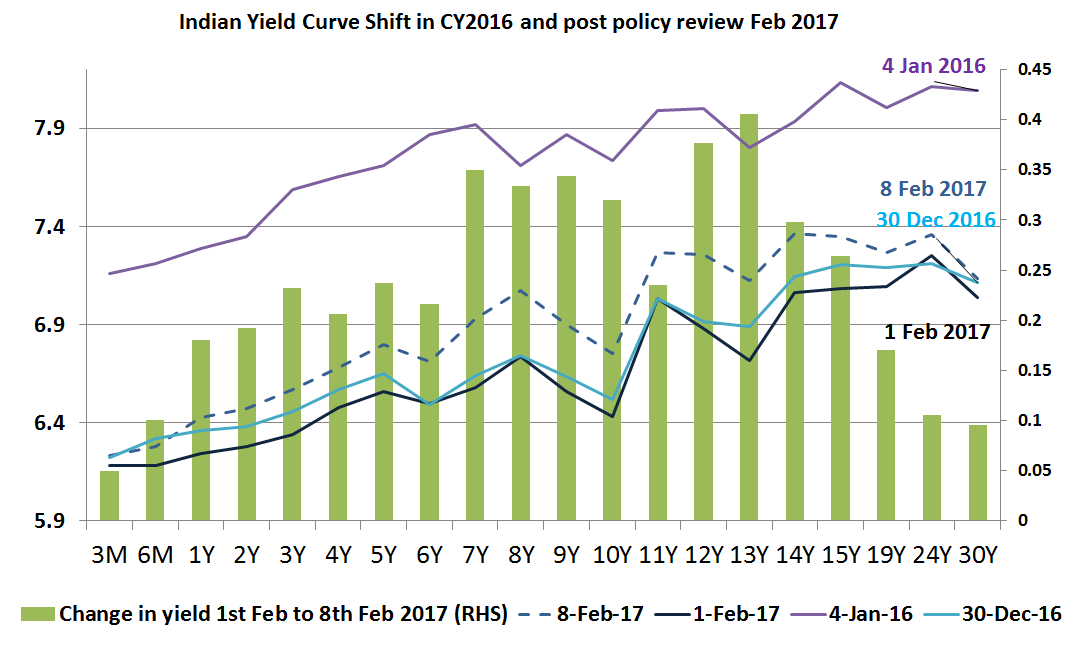

The Indian debt market has displayed a divergent trend in the last three months since November 2016 with falling bond yields majorly driven by domestic events even as global bond yields firmed up. Key events that are likely to influence the domestic fixed income market include a move towards fiscal prudence as enumerated in the Union Budget 2017-18 and change in monetary policy stance from being accommodative to becoming neutral. While adherence to fiscal deficit is a positive for bond markets, the change in stance from accommodative to neutral by RBI is a big negative as expectations for further rate cuts are belied. Consequently, post the change in stance, we have seen bond yields rise markedly across the curve.

Where are domestic interest rates headed?

Macroeconomic indicators have begun to show signs of improvement with a pick-up in the manufacturing and services activities, moderation in retail inflation, lower trade deficit and positive growth in industrial activities. However, sticky core inflation, the firming up of global commodity prices, especially oil and the strengthening of the USD are expected to impart upside risks to inflation going forward.

The spectacular rise in systemic liquidity from currency transfusion program has aided effective lowering of deposit rates and consequentially, some easing in the lending rates. This drop in interest rates in effect replicates the impact of a policy rate cut, thereby allowing the central bank to conserve its policy rate ammunition to tackle inflationary conditions going forward. Having changed its policy stance from an accommodative to neutral on account of upside risks to inflation and prevalent suffuse systemic liquidity, the RBI hints at restricted scope for further monetary easing in the near term.

What does the yield curve indicate?

Post the surprise change in stance from RBI, yields have increased across the curve as market forces adjust to the altered policy landscape. Understandably, we have seen a larger impact on the long end as term premia rise while the short end remains anchored to the policy rate, which is expected to remain stable for the foreseeable future. This presents an opportunity to investors to take advantage of higher rates at the shorter end of the curve through accrual based strategies as the rate cut cycle ends.

Action: Moderating the portfolio duration will be a prudent strategy. Repositioning of the fixed income portfolio to increase exposure to short duration funds will lower the weighted average duration of the portfolio.

How have corporate bond spreads moved?

Over CY 2016, we have witnessed some amount of spread compression in the AAA PSU bonds while spreads on the non-AAA segment have remained more or less stable. Going forward, we expect the spreads on AAA bonds to increase as the market moves from this segment towards higher carry instruments (which is the non-AAA bond space), especially at the short to mid end, which protects from duration risk as well.

Action: Including accrual strategy in the fixed income portfolio by the way of exposure to managed credit funds operating in the short to medium term maturity space and investing in sub-AAA rated bond segments allows one to part take of the decently high spreads in the corporate bond segment and also lends effective diversification to the fixed income portfolio. The accrual strategy focuses on higher yields and is less prone to the change in the interest rates. This aspect complements the duration strategy thereby ensuring diversification and cushioning for the portfolio from interest rate volatility.

Global events such as pace of policy normalization to be adopted by the US Federal Reserve, fiscal stimulus policies likely to be implemented by the new US government, diminishing focus on quantitative easing as a tool to aid growth in the advanced economies pose risks to the debt capital flows into emerging markets like India. General global risk aversion along with a rise in the domestic inflation expectations and low scope for policy rate cuts are likely to result in further steepness in the yield curve. Hence we believe that the primary focus of the investors should be on protecting downside risk in a rising interest rate scenario. Lowering portfolio duration and adding to accrual strategies to diversify the portfolio can provide the requisite downside protection as well as attractive carry to the fixed income portfolio.

This post initially appeared in the India Markets Observer 2017 where you can read the perspectives and views of other experts too. It is available to all for FREE. All you need is a minute to register.

Download your copy Now!