In 2016, most of the IFAs got drawn towards digital "platforms" and using tech business solutions. In every IFA gathering across the country, the discussion on platforms was a seminal one.

However, these questions crossed my mind:

1) Can IFAs use all business functions seamlessly in one platform using their own ARN / business identity? (Business functions are: financial planning, client engagement, generate client and business reports and execute mutual fund transactions.)

2) Are there any comprehensive digital solutions for IFAs in India which have all elements of a "true MF platform"?

The answer is: "none". One can conclude that the learning curve for the mutual fund industry in B2B platforms business is still very steep. However, this is a great opportunity for fintech firms and asset management companies to provide comprehensive digital infrastructure support for IFAs.

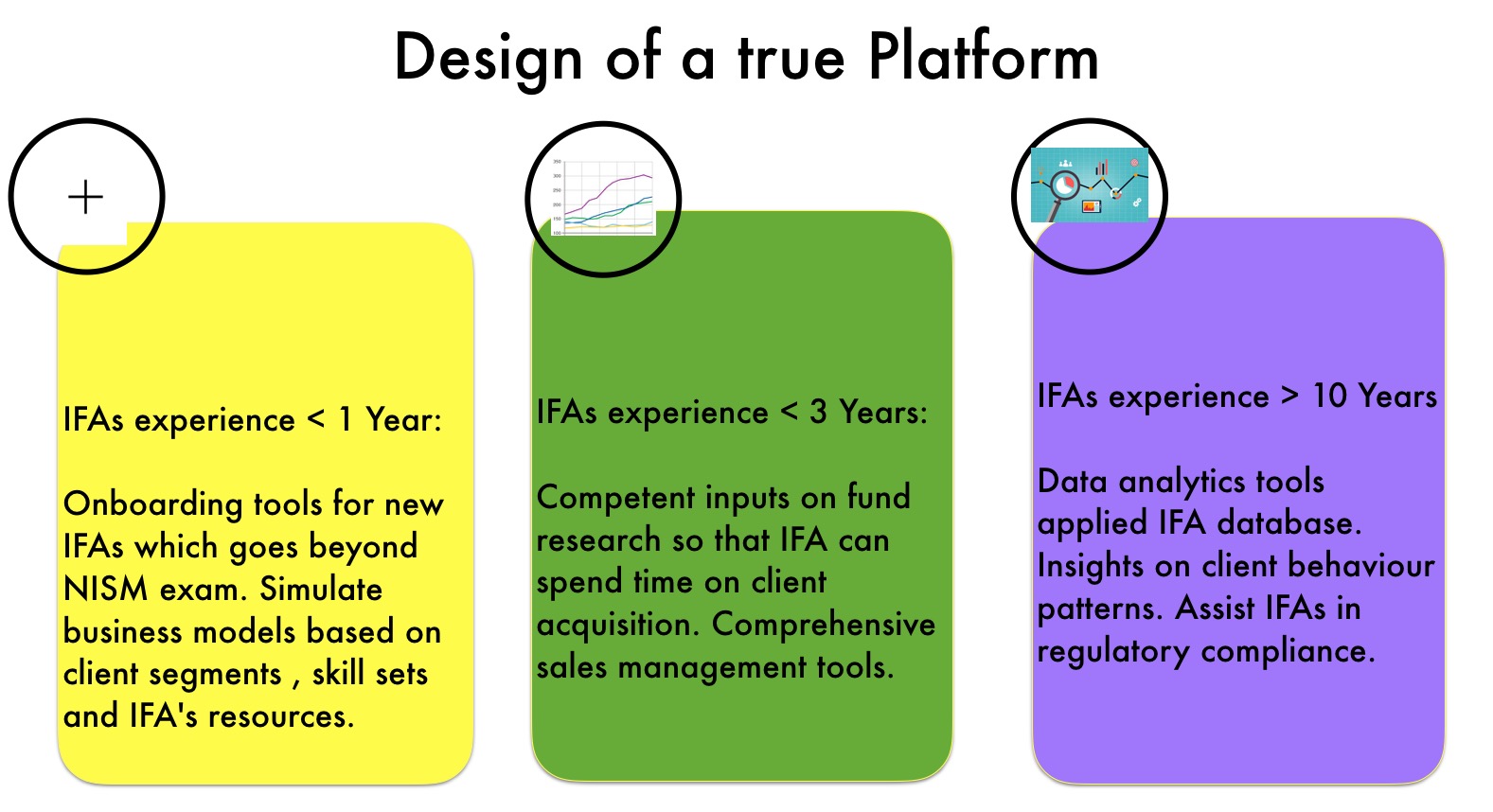

How will this "true MF platform" look like from a technology perspective? Platforms can be designed as ecosystems for IFAs wherein it helps to influence their existing clients to interact with IFA. Later on, these platforms can graduate to influence not only existing client’s but prospective ones (from a select market segment) to have meaningful interactions with the IFAs. It’s similar to Uber or Youtube platforms where in the creator and the consumer come together to orchestrate value-exchanging interactions. These kind of platforms can act as a client lead generating tool for IFAs.

In order to get to this level of business empowerment the architecture of existing platforms have to be rewired. The foundation of platform is "data". On the other hand, in India, data resides with multiple RTAs and IFAs have to fetch these and transfer it to their service providers. Getting a "one-view" of their business is itself a long drawn process for IFAs and applying business intelligence is far-fetched.

Now let’s look at the platform from client's perspective - many Fintech firms in India are working on robo-advisory model. In India B2C Robo-advisory platforms are in a nascent stage. Clients can execute MF transactions and can view reports only on a fraction of their total asset portfolio managed by the respective platforms. Can clients completely depend on Robo-advisory platforms for all their needs in the real volatile world? Referring back to the business functions of IFAs - Planning, Engagement, Reports & Transactions. I compared Robo-advisory vs. IFA Platforms proposition. Let’s for a moment assume, that these B2C platforms have fast-forwarded their learning and started offering complete automated investment advisory viz., asset allocation, portfolio management, periodic rebalancing. The missing link would continue to be client engagement.

It's a wise idea for IFAs to use institutional robo-solutions ie., B2B2C. This will save time for IFAs as they can increase their face-time with clients. The value add provided by advisors stands out and strengthens relationships. This signals that robo and IFAs can co-exist and it’s a compelling reason for platforms to be designed to cater to all business needs of an IFA.

It’s a strong opening for MF industry to understand the power of platforms and start working to build "true platforms". Where to begin and how to build these kinds of platforms for IFAs? This is a great space for Fintech.

To my mind, the starting point IFAs existing software should shift from MS Excel based interactions to APIs based. This will be a considerable progression.

The views are personal and not necessary those of the organization. Content of the article is generic in nature and does not represent views of Axis AMC. Reference to platforms or applications are to explain the concepts of systems and are for illustration purpose only.

This post initially appeared in the India Markets Observer 2017 where you can read the perspectives and views of other experts too. It is available to all for FREE. All you need is a minute to register.

Download your copy Now!