The Wealth-X World Ultra Wealth Report 2017 analyses the state of the world’s ultra-high net worth (UHNW) population, an exclusive group of wealthy individuals located across the globe, each with $30 million or more in net worth.

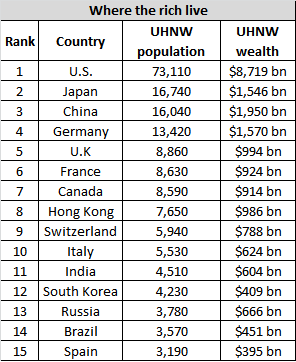

New York, Hong Kong and Tokyo maintained their top-3 city status as the world largest UHNW cities. London remains the largest UHNW city in Europe, but its lead over Paris narrowed sharply. Though China has the world’s 3rd largest ultra-wealthy population, Shanghai came in joint 29th, emphasising the point that robust wealth creation is occurring not just within its top-tier cities.

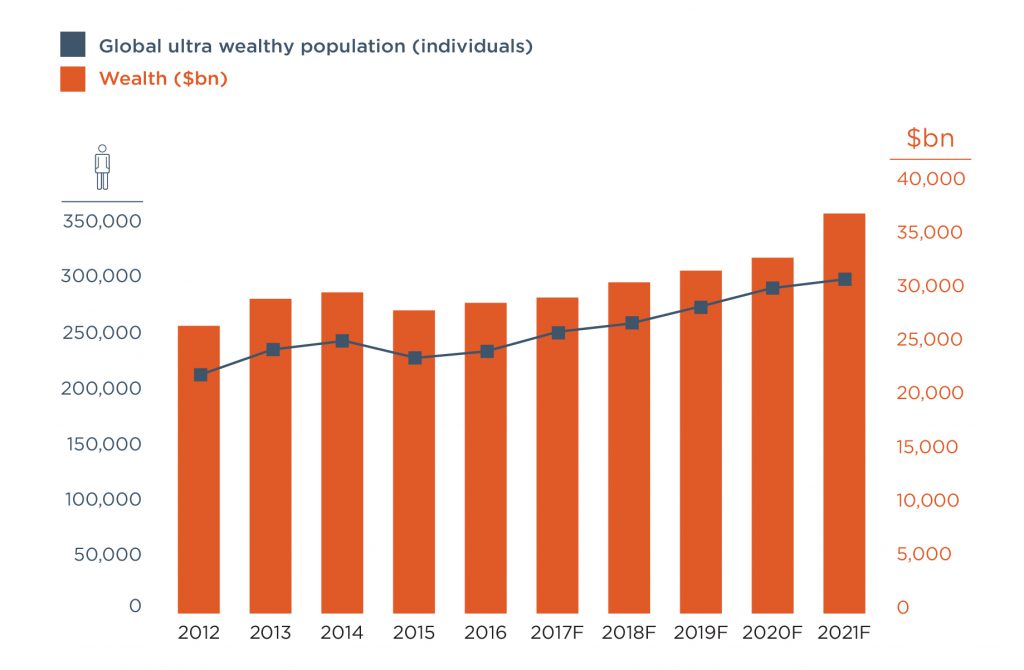

In 2016, the world’s UHNW population grew by 3.5% to 2,26,450 individuals, a partial recovery from a sharp fall a year earlier. Their combined wealth expanded by 1.5% to $27 trillion. However, the average net worth of the ultra wealthy declined for the first time since 2013.

The global population of ultra wealthy individuals is still very male dominated, with women accounting for a modest 12.8% share in 2016. This proportion has remained fairly steady over recent years, while average net worth is largely similar for both genders, at $110 million for women and $120 million for men. There is a clear distinction in wealth source between the genders, with a much larger proportion of ultra wealthy women having received some or all of their fortunes through inheritance. The past two decades of wealth creation have been driven largely by self-made individuals; without a sizeable influx of new female entrepreneurs, female representation is unlikely to change substantially.

North America and Asia recorded the only significant rises in wealth in 2016. The picture was subdued in Europe; fortunes remained largely unchanged in the Middle East; Latin America and the Caribbean registered a significant fall; and Africa posted a decline. Currency movements played a role (contributing to gains in the U.S., Japan, India, Indonesia and losses in the U.K., Russia, Mexico, Brazil), along with rising equity markets.

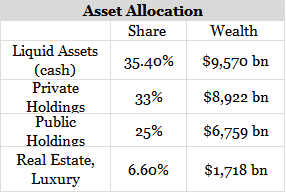

Liquid assets (primarily cash) account for the largest share of holdings and stood at $9.6 trillion. Abundant liquidity also reflects a continuing ‘search for yield’ and underlines the enormous spending potential of the world’s ultra wealthy.

All data is of 2016 and sourced from wealthx.com