A doctorate holder in biotechnology recently wrote in to us saying he wants to hold an infrastructure fund. Despite having a brilliant mind, his knowledge of investing was zilch. In conversation, he revealed that he had no fund holdings at all and was clueless as to what is a core holding and why a sector fund must not be one.

(Let’s look at core holdings another time. Right now, let’s just say that a core holding is the central part of your portfolio which provides a stable foundation to build upon).

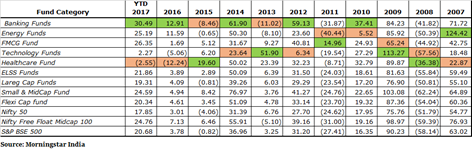

An issue with sector funds is that investors rarely act on a well thought out strategy. They simply gravitate towards the flavour of the year, which means that they are already behind. A financial planner noted that people who invest in today’s winners are “buying backward”. For instance, energy funds (Morningstar category: Sector – Energy), put up a stellar performance in 2007 with a return of 105% that year. Investors piled onto funds in the sector. The next year the category average was -53%. No doubt, the mayhem that year hit every single sector. While it bounced back the next year, its returns in other years has been far from impressive. In 2014 it made a comeback with a return of 47%, a far cry from its 2007 feat, only to fall again the following year.

Or, take a look at financial services (Morningstar category: Sector – Financial Services). For three years it kept sliding: 76% (2009) to 29% (2010) and -33% (2011). It picked up in 2012 to deliver a category average of 56% but once again dipped in 2013 to again pick up in 2014. Its returns over the past two years have not been great.

The best performing sector could change every year

An essential characteristic of sector funds is that they can shoot out the lights one year and be a loser the next because they essentially lack the diversification to ride out trouble.

One should never commit the grave error of investing in a sector fund simply because it has had a great run that year. Unlike a regular equity diversified fund, the fund manager does not have much latitude if the sector falls from favour.

In fact, John Bogle, the founder of Vanguard funds, is believed to have said that you “could go your entire life without ever owning a sector fund and probably never miss it." Bogle's point is simply that a well-diversified portfolio doesn't need sector funds.

Sector funds concentrate their investments in a single sector, such as FMCG, financial services, healthcare, and technology. These are sectors which an investor would find represented in a diversified equity fund. By and large, buy-and-hold investors should steer clear of sector funds altogether, because not only are they betting on a single sector, but they are betting heavily on a few companies.

This is why sector funds must never be core holdings. These funds should never corner the bulk of your portfolio and are the stop-and-go investments that may juice returns. They could make an appearance in your portfolio as they allow for the possibility of extraordinary returns.

Having said that, they do have a purpose. They can be useful tools for investors with strong views who want to give a tactical slant to their portfolio. In areas of the market you are confident about or see an upturn in the future, you can employ a sector strategy to increase exposure.

Sector funds will be able to deliver some stupendous returns on and off, giving your portfolio the muscle to outperform the market. Yet don’t lose sight of the fact that they can also log some dizzy falls. Be geared to take a hit. After all, you may get your call wrong.

Follow these guidelines when investing in sector funds:

* They must corner a very small portion of your portfolio. The exact amount will depend on the individual in question. But, by and large, don’t let it exceed 10% of your equity portfolio. As long as you limit the exposure, you aren't in any great danger.

* It’s always tempting to jump into sectors when they are hot. This is a mistake because its best days are probably behind it. Pick up sectors which have been languishing and there is sufficient reason to believe an uptick is in sight.

* Have a clear investment strategy as to why you want to invest in that sector and stick to it. You need to understand exactly what you’re buying — you should be in a position to articulate your stance on why you believe that sector is likely to outperform, and what your criteria are for exiting it.

* You may have a long wait if the sector goes into a deep slump. Be patient. During this period, don’t let hair raising volatility get to you. Know that volatility comes with the turf; don’t let it shake you.

* On the other hand, if you have earned substantially well, walk away. Don’t get upset about leaving potential gains on the table. Staying on in the hope that the sector will keep sizzling could backfire.