This post by Todd Wenning was originally published on ClearEyesInvesting.com. He works at Johnson Investment Counsel as a generalist analyst on the firm's SMID-cap strategy.

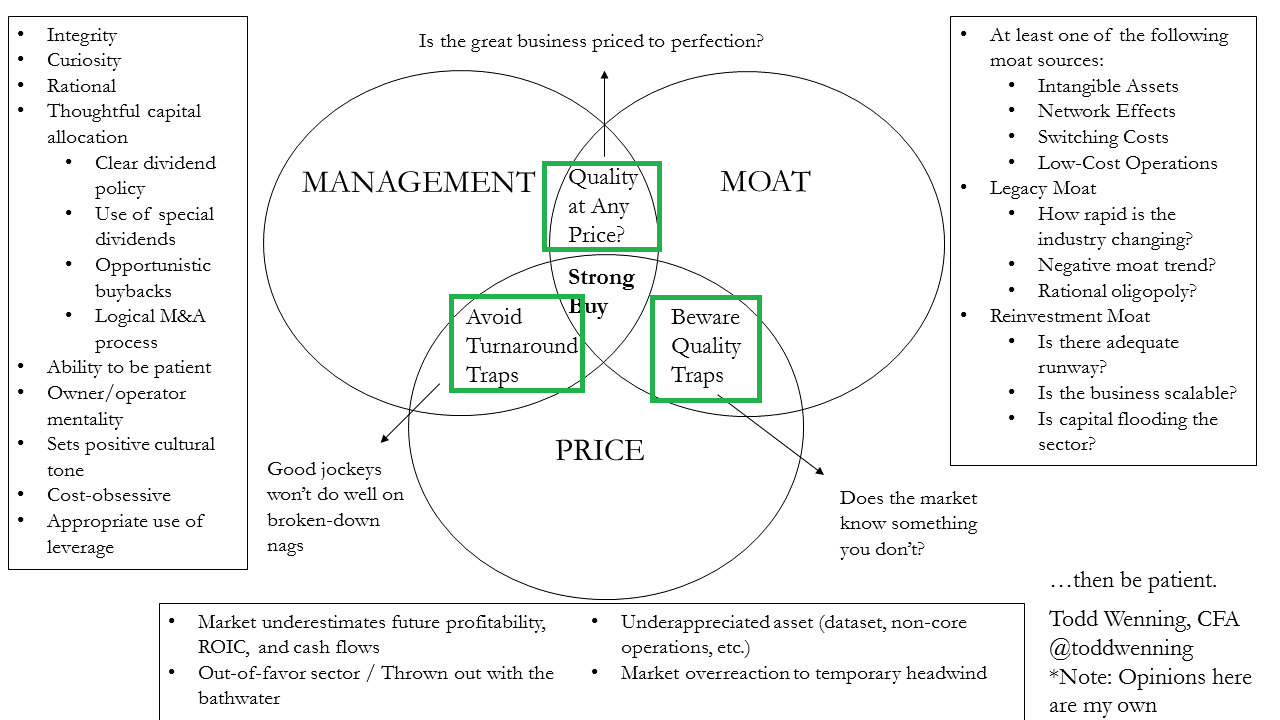

One night, I sketched out my investment philosophy in a “one pager” format.

I found the process to be useful, so I shared it on Twitter before heading to bed, thinking others might give it a try themselves.

In the morning, I discovered the post was going viral - at least FinTwit's version of viral.

The feedback on the post was overwhelmingly positive, which, while appreciated, also made me a little nervous. A cheery consensus around a company or a strategy doesn’t lend itself well to outperformance.

That said, there’s a difference between prescription and practice. Advocating regular exercise is sound and non-controversial, yet the temptation to be remain sedentary can be hard to overcome.

Indeed, part of the motivation for doing the one-pager was to hold myself accountable and stay focused during a bull market when there's pressure to relax standards.

The one-pager isn't meant to be a magic formula of any sort. No company will check off all the boxes. Instead, it serves as a personal framework for evaluating businesses and investment opportunities.

Most of the questions I received about the one-pager regarded the three highlighted sections below.

To be a “strong buy,” I want the company to have an economic moat, be managed by excellent stewards of shareholder capital, and trade at an attractive valuation.

These opportunities are rare, to be sure, but it's good to know when you might have a "

fat pitch" heading your way.

The highlighted sections address three challenging - and comparatively more common - scenarios that quality-value investors encounter.

In each case, two of the three requirements are present, but one is missing. Here, I’ll address the problem, pitfall, potential, and process for analyzing companies within the three scenarios.

“Quality at any price” (Moat and Management only)

Problem: Great companies don’t always make great investments.

Pitfall: Even if the underlying business performs well, if the company doesn’t live up to high market expectations, you’re in for a bumpy ride. Consider an investor who bought shares of Wal-Mart in September 1999 when the stock traded with a price-earnings ratio over 30 times. Though Wal-Mart as a business grew earnings and dividends per share at an impressive rate over the next decade, the stock price didn't fully follow suit because the business performance wasn’t enough to match lofty initial expectations. Formidable competitors like Costco, Target, and Amazon were also chipping away at Wal-Mart's competitive position. Ultimately, Wal-Mart's price-earnings multiple contracted and the 10-year total return was about 2.4%.

Potential: Investors can underestimate optionality in a well-run business. Those that considered Amazon, Facebook, or Google wildly overvalued early in their public market histories, for instance, didn’t foresee the new opportunities these businesses would create or discover in the subsequent years. Similarly, firms with existing moats may look expensive now, but if management can further widen the moat, today's price may look cheap in hindsight.

Process: Don’t rely solely on relative valuation and market multiples. Instead, make explicit forecasts to determine what the market price might imply. Then, consider whether or not you think management is capable of beating those expectations by introducing new products, entering new markets, becoming more efficient operators, or adding new lines of business.

“Beware quality traps” (Moat and Price only)

Problem: The market knows something you don’t.

Pitfall: Though the stock's premium may have diminished, there could be good reason. The company’s legacy moat could be under assault by new and motivated competition or a disruptive technology. If management is incentivized to protect the old cash-flow-rich operations or if the corporate culture is bureaucratic and stagnant, there could be further to fall. Kodak is a classic example – a former blue-chip darling that had a dominant market position, saw the coming of digital photography in plenty of time, but its culture refused to embrace the change.

Potential: A management transition could lead to cultural change, which could reinvigorate the business and make it more competitive. To illustrate, a positive cultural change happened at Sealed Air after the board brought in a new executive team following the controversial $4.3 billion acquisition of Diversey in 2011. In the twelve months following the deal's announcement, Sealed Air's stock price dropped about 60%. Despite the poor M&A decision by prior management, Sealed Air (makers of Bubble Wrap) and Diversey still had some durable competitive advantages. The new management team overhauled the corporate culture and got the company back on solid footing.

Process: Ask yourself if the company has a culture of innovation and change. Could a new management team realistically step in or is the board too close to the CEO and CFO? Review management’s incentives and the board structure and determine whether or not they have enough skin in the game to want to improve operations.

“Avoid turnaround traps” (Management and Price only)

Problem: Even excellent capital allocators can struggle to fix a broken business.

Pitfall: Turnarounds have low odds of success. Ultimately, management facing such a situation needs to identify a potential moat source and attack it full force. Then, hope for a lucky break or two. When there are massive secular headwinds in place, this becomes a near-impossible task, even for great management teams. Eddie Lampert at Sears Holdings is a good example. Lampert has done a remarkable job playing a tough hand, but the long-rumored turnaround has struggled as department stores face immense competitive pressures from changing consumer tastes and from online retail.

Potential: When turnarounds happen, the rewards can be enormous. Steve Jobs' second stint at Apple is one of the best – if not the best – turnaround story of our generation. Though the full story is more complex than this, what Jobs did was make Apple (traditionally a beloved niche personal computer maker) into a premium global consumer brand, starting with the iPod and later the iPhone and iPad. Jobs' efforts, along with the rest of Apple's staff, spawned a brand (intangible asset) advantage that, when paired with the switching costs created by the iTunes platform, led to a solid economic moat.

Process: Is management facing secular headwinds in their core operations? Are industry dynamics stable and asset growth slow or is capital flooding the industry? Does management attempting a turnaround have to reckon with a debt-laden balance sheet or an under-funded pension plan?

Rarely will the stars align so that management, moat, and price are all clear and a strong buy is evident.

Much more frequently, quality-value investors must wrestle with one of these three scenarios where one factor is missing - or at least isn't obvious.

As such, it's helpful to approach the scenarios with both the pitfalls and potential in mind.

Weigh the pros and cons, make a decision, and then be patient!

Stay patient, stay focused.

Disclaimer