Occasionally, Prashant Jain, Executive Director and Chief Investment Officer of HDFC Mutual Fund, pens down his views and sends them out. In 2012, he wrote It's tomorrow that matters and prior to that was It's always darkest before dawn. Here are some lessons he would like every equity investor to make note of.

Lesson No. 1:

Over the long term, stock market indices have grown around the same rate as the country’s nominal GDP (GDP Growth + Inflation).

This implies that when in any extended period of, say 10 years, indices grow less than nominal GDP, they tend to make up in the future by delivering higher returns.

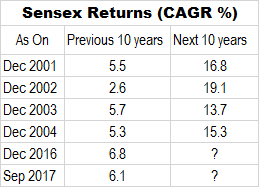

The table summarizes the returns of the Sensex in those 10-year periods (since its inception in 1979), when the returns were less than 7% CAGR (approximately half of long term nominal GDP growth rate of 12-16%), and the returns of Sensex for the next 10 years.

Every 10-year period of below 7% CAGR of returns by the Sensex was followed by a period in which the Sensex delivered 14-19% CAGR over the next 10 years.

We are at such an instance again, as CAGR of the Sensex in the last 10 years is just 6.1%.

Lesson No. 2: The stock market is volatile year to year and hard to forecast in the short term.

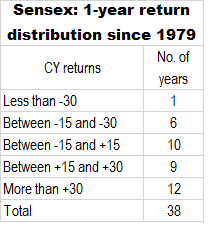

The wide variation in the annual Sensex returns clearly brings out the futility of attempts to forecast short-term movements in the stock market.

And this applies to experts as well!

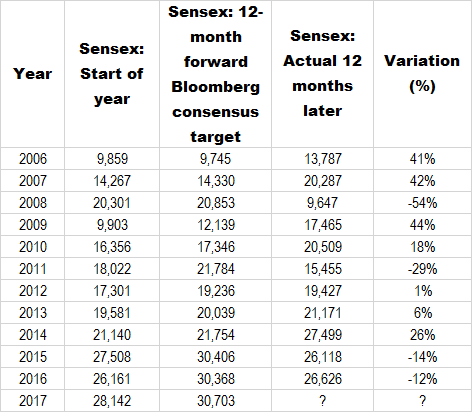

The table below shows the value of the Sensex at the start of the calendar, the 12-month forecast of the Sensex at the beginning of each year (as per Bloomberg consensus), the actual Sensex at the end of each year and finally the variation between the forecast and the actual.

The wide variations between the actuals and forecasts, particularly in years when the Sensex was not range bound suggests once again, that the markets are not amenable to near term forecasts, even by experts.

In a lighter vein, probably only those who can correctly forecast the outcome of a toss of coin, can forecast 1-year returns of the market.

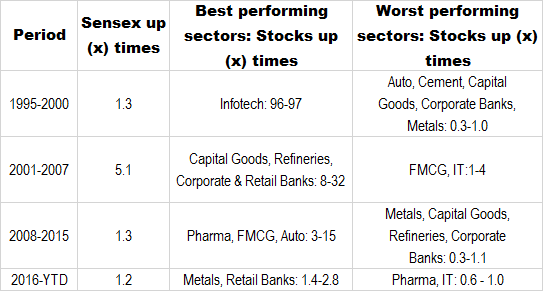

Lesson No. 3: Few sectors are perpetually good or bad investments. There is a time and place for virtually every sector in the markets.

Markets are fickle and their loyalties change. It is evident that repeatedly, sectors that were popular at one point of time fell out of favour and sectors that were considered untouchables became market darlings.

Lesson No. 4: Irrespective of what the majority think or feel, the market in the long term is perfect and driven entirely by logic and rationale.

For example, Infotech was wildly popular in 1999 and enjoyed a nearly 100% fan following only to underperform massively over the next few years. On the other hand, a uniform dislike for Banks, Capex and Metals around 1999-2000 could not prevent these sectors from delivering 5-30 times returns over next several years.

Pre Lehman in 2007, the majority opinion favoured Infrastructure, Capital Goods and Real Estate while FMCG and Pharma were out of favour. As things turned out, the latter two became the best performing sectors while the other three destroyed large amounts of wealth.

More recently, oil marketing companies, that were shunned almost uniformly few years back when they were bearing subsidies, are up between 5-10x since.

These examples and several more remind one of the memorable words of Benjamin Graham: You are neither right nor wrong because other people agree with you. You are right because your facts are right and your reasoning is right.