If someone asked you what the hardest part of investing is, what would you say?

It could be as rudimentary as getting started, or as elaborate as arriving at the fair value estimate of a stock. Alternatively, it could be figuring out an optimal investment policy or deciding whether to kick your fund to the curb. There is no right answer.

However, I would like to suggest one that tries and tests the resolve of virtually every investor.

Doing Nothing.

I have not read a more eloquent explanation than the one offered by Charles Ellis in his book Winning the Loser’s Game: Sustaining a long-term focus at market highs or lows is notoriously difficult. It’s a time when emotions are the wildest, when action appears most demanding and the “facts” most compelling. Staying rational in such an emotionally charged environment is extraordinarily difficult. But is also extraordinarily important because the cost of infidelity to your own commitments can be very high.

In a bull run, it seems extremely enticing to throw caution to the wind, discard your pre-determined asset allocation, and wholeheartedly pump money into stocks that promise to sizzle and can only go one way: Up.

In a slump, it is critical to sit back and do nothing while your portfolio loses value. But here’s something to remember; it is only a notional loss until you actually act on your impulse to sell. Does it mean you should never sell? Of course not. The point I am making is not to impulsively sell a good investment just because the market has tumbled and the buzz is that it is never going to climb back again.

This is precisely one of the reasons investing in equity mutual funds is always advocated via a Systematic Investment Plan, or SIP. It takes out the need to accurately time the market as well as the urge to act on your emotions.

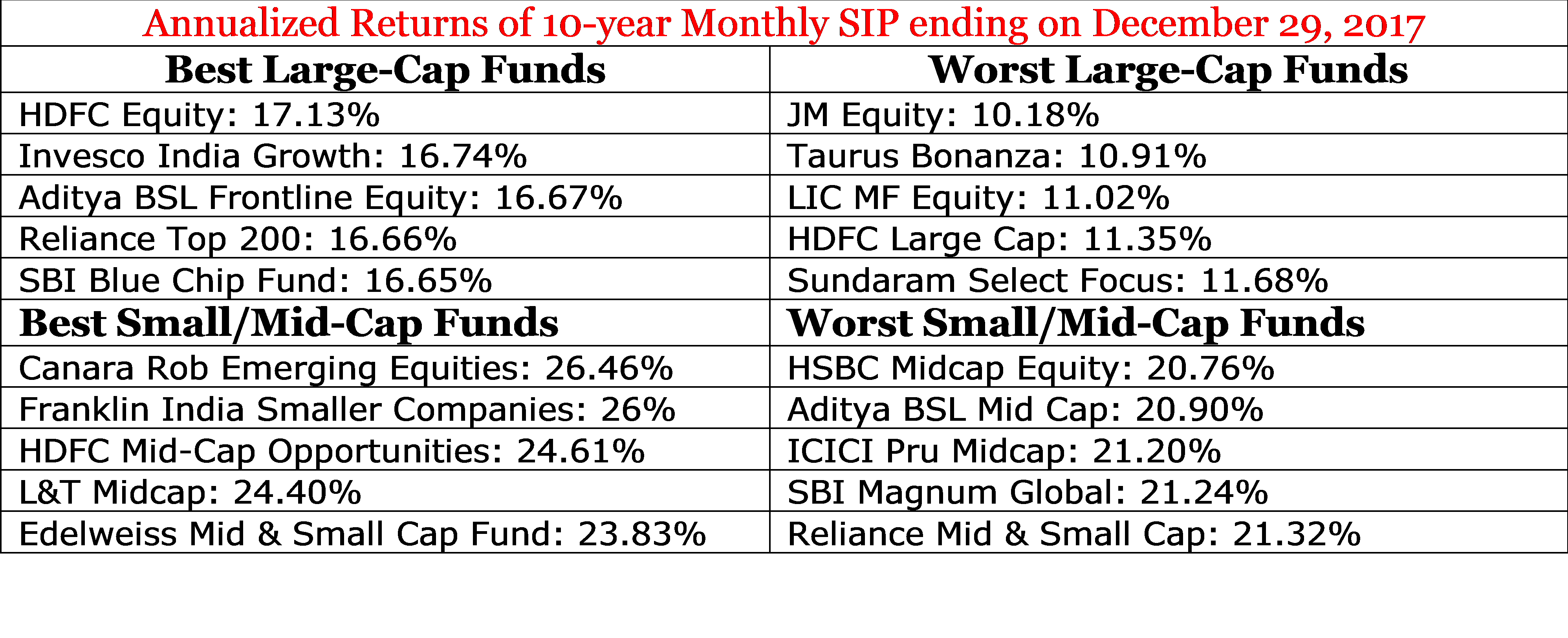

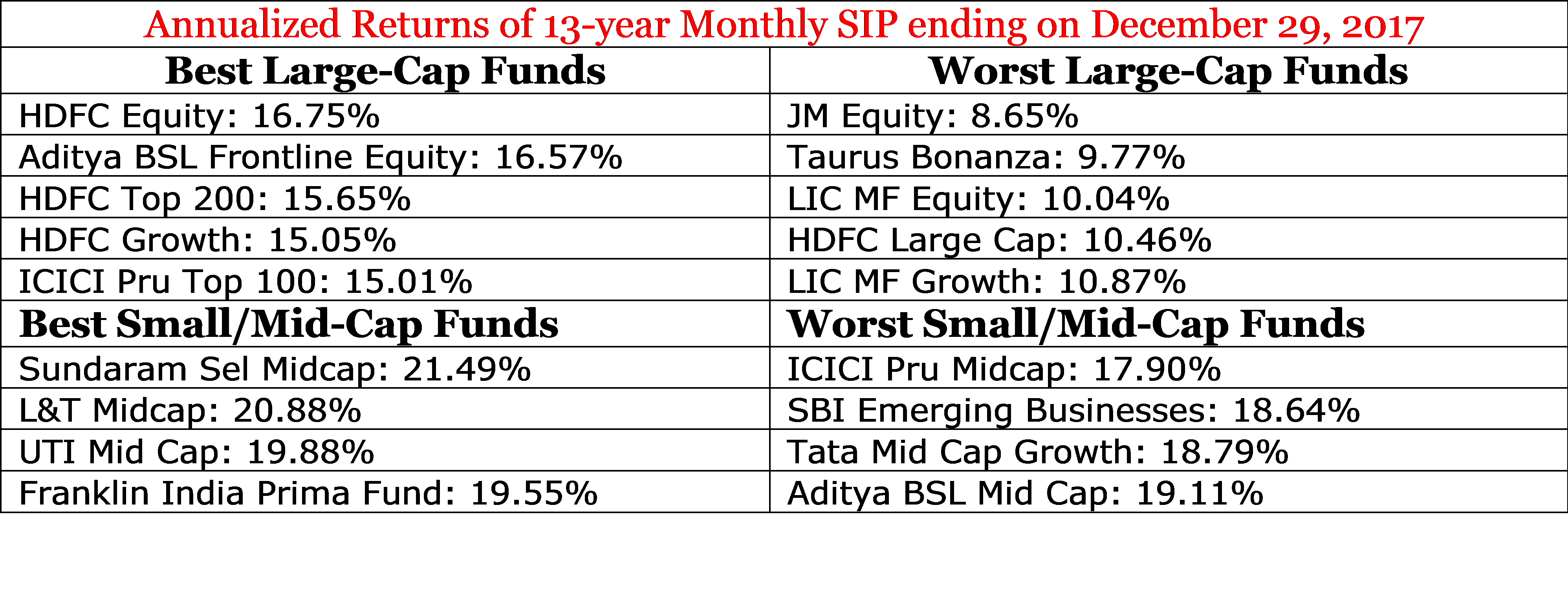

Let’s look at how a monthly SIP would have functioned over the years. If we look only at data which dates back 5 years, it won’t throw up a very accurate picture. But if we take it over a 10-year or 13-year time frame, we cover ample terrain. This period would cover the market high of 2007 and January 2008, the massive slump, the rally in 2010, the dip again in 2011 to be followed by a run up again.

Are there gaps between the best and the worst performers? Of course, yawning gaps. But the point being made here is that in the end, equity delivered. All that was required of the investor was to do nothing during all the upheavals but diligently continue with the SIPs.

I have so often read this statement that describes flying a small airplane: “It is hours and hours of boredom punctuated by moments of sheer terror.” While one can argue that it even applies to life, investing can also be thought of along the same lines.

Doing nothing may sound like terrible advice. But long-term investing is about doing nothing 99% of the time. In fact, the world renown investor Seth Klarman is known to have said that the greatest edge an investor can have is a long-term orientation. Should you manage to keep your wits around you when everyone is either getting euphoric or losing their cool, you will ultimately emerge the winner.

This post also appeared in Moneycontrol.com