HDFC Life has a pension plan known as the HDFC Life Pension Guaranteed Plan.

A number of people have mentioned that they were approached at HDFC Bank regarding this product.

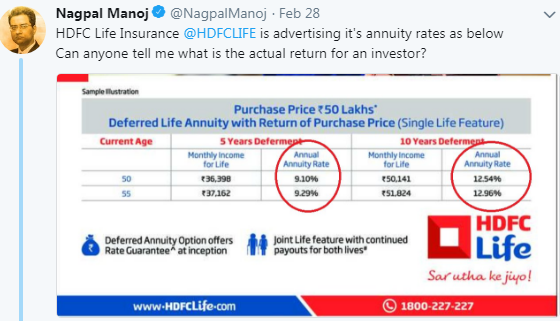

Last month, Manoj Nagpal tweeted about it and got a discussion started. To its credit, HDFC Life tweeted a response stating that the advertisement only mentioned the lifetime guaranteed annuity rates, never implied that these are IRRs, and clearly mentioned a deferment period of 5 and 10 years.

Deepak Shenoy of Capitalmind decided to answer that query and cracked the numbers in this post, which has been reproduced below.

What’s wrong with the above picture?

The “rate”.

Let’s say:

- You are 50 years old

- You buy this product for Rs 50 lakhs

- You don’t get anything back for 10 years (“deferred”)

- Then you get back Rs 50,141 per month for life

- And after you die, your money is returned; around 110% of the money you pay, which amounts to Rs 55 lakh

Rs 50,141 per month = Rs 6,01,692 per year

On 50 lakh rupees that’s about 12.03%

Close to the stated 12.54%, correct?

If that is how you are thinking, let me ask you one question: What happened in the first decade?

Getting a fix on the real return

It’s like this.

You give them Rs 50 lakhs at the age of 50.

Then you sit tight for 10 years.

Your hard-earned money works for them. It grows. When you turn 60, they will use this money to give you a guaranteed returns of Rs 50,141/month for the rest of your life.

Let’s say you live till the ripe age of 100. You keep getting this Rs. 50,141/month.

On your death, your nominee will then get the original amount invested (Rs 50 lakh) plus another 10%, totaling to Rs 55 lakh.

If you assumed a constant interest rate through out this period, and started with 12% per annum, then at the age of 100 you would be left with the princely sum of Rs 98 crores.

Since they are not giving you 98 crores, but only 55 lakh, obviously the return is lesser than 12%.

So 11%? That’s still going to leave you with Rs 57.3 crores.

10%? Rs 32 crores.

Still too much.

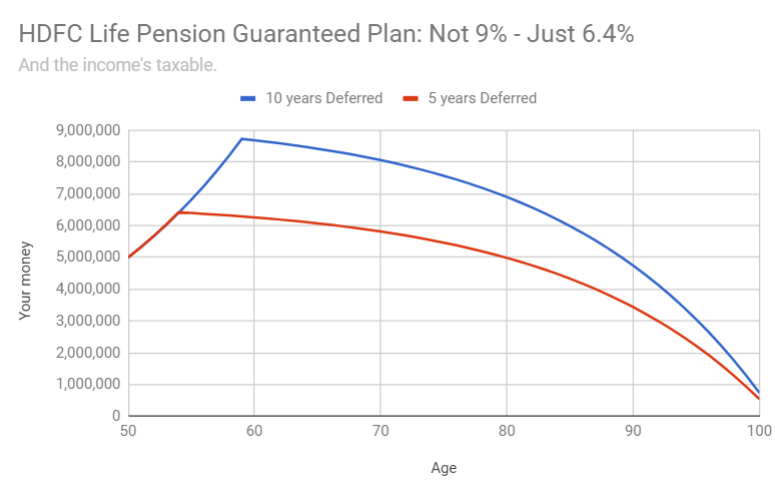

Let me break it to you: The final answer is around 6.4%.

The advertisement should read like this: We give you 6.4% taxable income after keeping your money for 10 years.

Here’s how the graph will look if you got an instrument that gave you 6.4%, reinvested for first 5 or 10 years, used the same payout they mention and kept it for till the age of 100:

As you can see, the taxable yield is 6.4%.

The full working is in this online excel sheet you can see and use for your benefit.

Hope that clears your doubts.

Deepak Shenoy is the CEO of Capitalmind, a SEBI registered portfolio manager. This post initially appeared on its website.