Why they may hire you

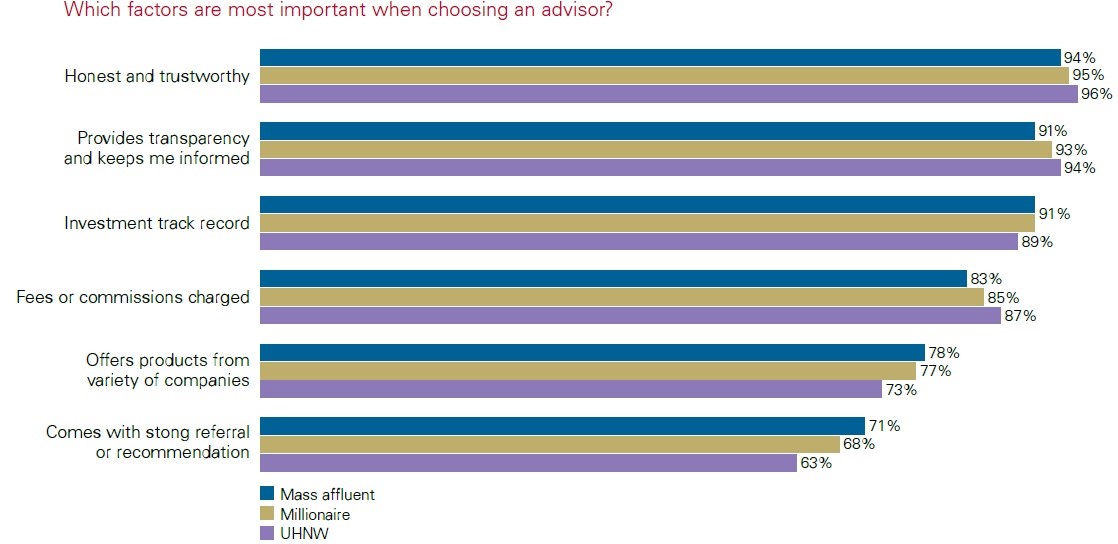

While hiring an adviser, high net worth individuals assign greater importance to honesty and trustworthiness, followed by transparency, investment track record and fees, finds a joint survey titled ‘The Affluent Investor’ conducted by Spectrem Group and Vanguard. The survey covered 1,500 mass affluent, 1,000 millionaire, and 500 UHNW households in United States.

Although the study found that the number one way an investor meets the adviser he or she will eventually hire is through a referral from family or friend, it’s reasonable to assume that doubts about your level of transparency can be a deal-breaker at any stage.

Action plan

Evaluate your opening pitch. Do you emphasize the factors that matter most? You may assume that honesty is a given but earning trust may require more effort than you expect.

When self-directed investors were asked why they didn’t use an adviser, a whopping 48% of millionaire respondents said, “I don’t believe an adviser would be looking out for my best interests.”

Why they may fire you

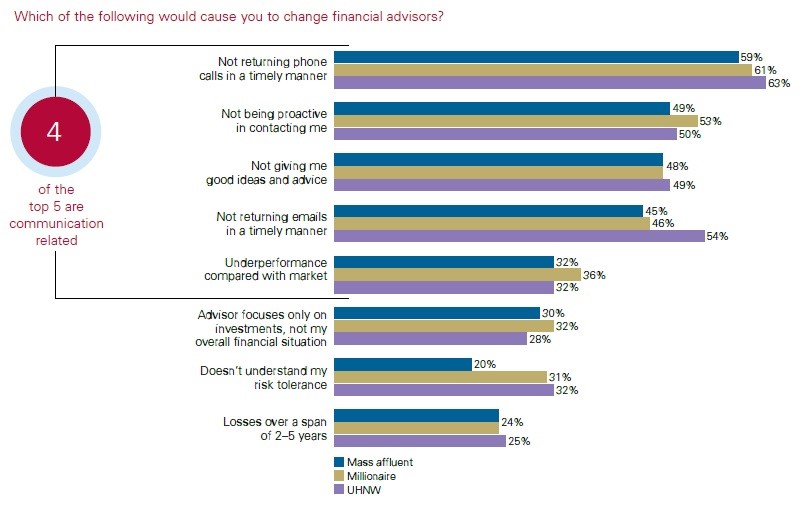

Four of the top five factors that would cause an affluent investor to leave an adviser are communication-related. Not returning phone calls and emails in a timely manner, not being proactive in contacting clients, not giving good ideas and advice and underperformance compared with market are some of the top reasons why HNIs can fire you.

The survey reveals that more than one-quarter of millionaire and one-third of UHNW respondents want a response to a phone call in two hours or less. Clients who heard from their advisers at least once per quarter were significantly more satisfied than those who received outreach semiannually.

Affluent investors expect advisers to accommodate a variety of communication options. More than 50% of wealthy investors are willing to video chat with their advisers. Among millionaires aged 36–44, nearly one third said they wanted to text with their advisers.

Action plan

You have only 24 hours in each day. If you spend a majority of time on investing strategies that attempt to outperform, it may be time to reprioritize your efforts. For example, investment tools such as the use of model portfolios can free up time and allow you to be more accessible to clients and get to know them on a deeper level, which clients consistently rank as most important.

Edited excerpts from The Affluent Investor Study.