As Earth Day approaches on April 22, around the world countries are working to reduce their carbon footprint.

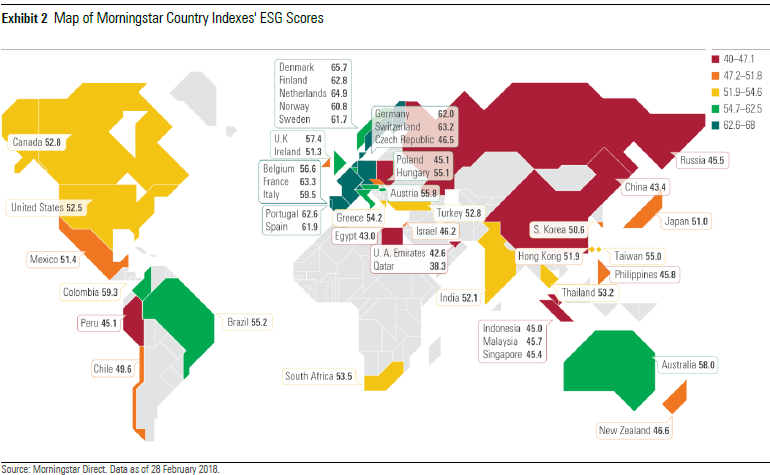

The latest Morningstar Sustainability Atlas shows that environmental, social, and governance (ESG) leadership can come from surprising corners of the globe. This semiannual report examines the sustainability profiles of 46 equity markets based on the constituents of their Morningstar country indexes.

The leading markets

According to the company-level ESG assessments of Morningstar’s specialist partner Sustainalytics, leading markets are mostly found in Europe. The Nordics and eurozone are especially strong. But several emerging markets also score well.

Colombia is among the global leaders, with Turkey, Hungary, and Taiwan also posting impressive scores. This shows that ESG leadership can come from surprising corners of the globe. It isn’t true that sustainability is a luxury that only rich countries can afford.

Click on the image to expand

India’s position

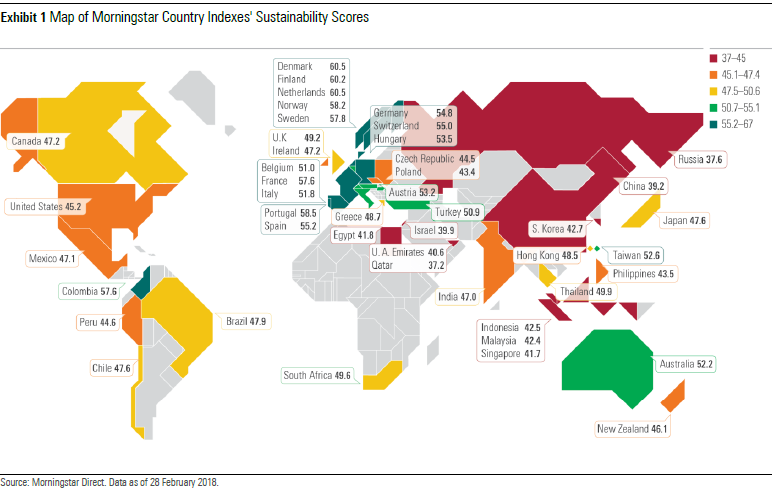

- Though India still has a long road to travel before becoming a global sustainability leader, the country scores reasonably well across environmental, social, and governance parameters.

- As a market for sustainable investors, India is superior to the U.S., South Korea, New Zealand, and China. The U.S. is weighed down by ESG-related controversies plaguing constituents like Wells Fargo and Apple.

- The Morningstar India Index achieves an overall score of 47, ahead of several markets typically considered more developed.

- Key index constituents Reliance Industries, Infosys, and Tata Consultancy Services all achieve high scores relative to their global industry peers.

Click on the image to expand

Key takeaways

- The Netherlands is the world's leading market for company-level sustainability. Dutch companies especially distinguish themselves with regards to governance.

- Colombia, Taiwan, Hungary, and Turkey uphold high standards of ESG, with South Africa, Brazil, and Chile posting strong scores as well. This proves that emerging markets companies can be leaders in sustainability.

- The U.S., U.K., and Swiss markets are especially heavy on companies embroiled in ESG-related controversies.

- Eurozone and Nordic markets are the globe's green leaders.

- Social practices are strongest within Europe, but Colombia, Australia, and Taiwan also score highly.

- Australia scores well on sustainability factors, especially in the area of governance.

- China, Russia, and the Middle Eastern markets have the most work to do when it comes to sustainability.

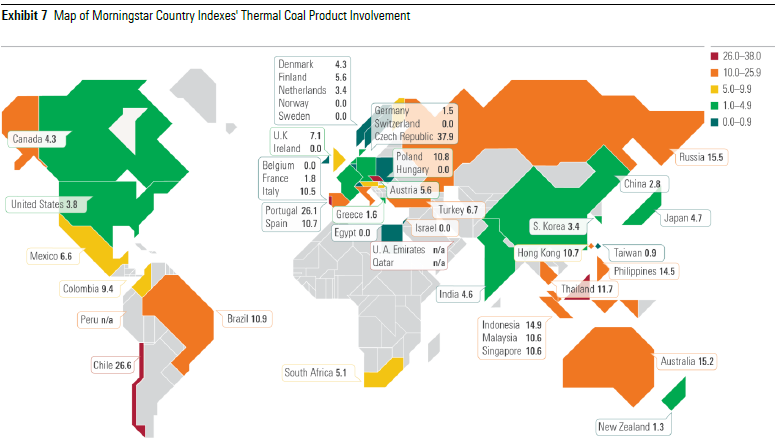

- Exposure to thermal coal is heaviest in the Czech Republic, Chile, and Portugal.

Click on the image to expand

Other features of the report

New to the report is Morningstar Portfolio Product Involvement data, which allows investors to screen for and analyze exposure to a range of products, services, and business activities such as animal testing, controversial weapons, GMOs, tobacco, or thermal coal—a carbon-intensive energy source. Exposure to thermal coal is heaviest in the Czech Republic, Chile, and Portugal.

The company-level scores are sourced from Sustainalytics, which also powers the Morningstar Sustainability Rating™ for funds. Investors can use the report to identify countries with the greatest ESG investment opportunities and risks.

You can learn more about the Morningstar Sustainability Rating here.