The New York Times profiled Sylvia Bloom, a longtime secretary who died holding $9.2 million in assets. Learning that Bloom had amassed so much wealth was an "oh my God moment," said her estate's executor. For example, a Wisconsin shopkeeper who had accumulated $13 million; an Illinois woman with $7 million who lived in a one-bedroom apartment.

(Upping the ante considerably was the mild-mannered academic couple that compiled $750 million. That account, I confess, took me aback. How could such a thing happen? The answer: By growing up in the right neighborhood. The couple invested mostly in the shares of a company that was run by a friend from Omaha. Yes, that friend.)

The story intended to shock and awe. In that, it surely succeeded; two days later, it led the paper's "most emailed" list.

Many, no doubt, read the tale as an updated, saner version of Hetty Green the "Witch of Wall Street" who combined extreme miserliness with savvy investing. That was the reporter's take. The "frugal" Bloom cultivated her fortune by "shrewdly observing the investments" that the firm's lawyers made, then piggybacking onto their trades.

The contrarian view

My reaction was somewhat different. I wondered why I should be surprised. In addition to being parsimonious, Bloom also chose her parents wisely, living until age 96. She worked for 67 of those years. If given enough time, investment acorns need be neither large nor particularly fast-growing to become tall money trees. Two thirds of a century would seem to qualify as "enough time."

Happily, the Lord created spreadsheets. Sylvia Bloom worked "until she retired at age 96 and died not long afterward in 2016." I set her retirement date as December 31, 2015, and her start date as January 1, 1948. Assume that she invested steadily during each of the next 67 years, adjusting her annual contributions by the amount of inflation, and that she earned the S&P 500's rate of return. What initial contribution in 1948 would be required for this investment scheme reach $9.2 million by year-end 2015?

My investment intuition said, "Probably not that much. Probably a believable amount for somebody who maintained a modest lifestyle, with no children to support, and who for many years had the benefit of a second income. (Bloom was married until 2002 to a firefighter.) I think the primary moral here is the power of compounding rather than the extraordinary talents of Sylvia Bloom."

Facts and figures

That proved to be the case. The answer to the initial-contribution question was $652. To be sure, the buying power of $652 in the year that Cheetos were invented isn't the same as $652 today. To match that 1948 purchasing power, Ms. Bloom would have had to boost her contribution rate over the decades, such that it reached $6,932 in 2015, the final year of her purchase. But because of compounding, her early investments would account for the bulk of her fortune.

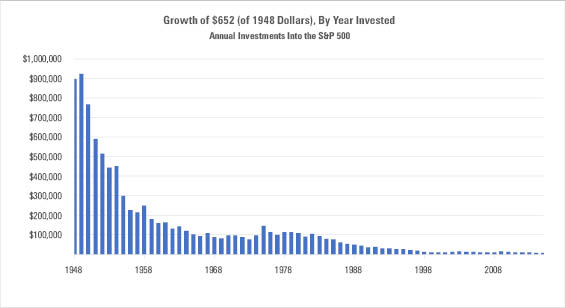

At this point, my intuition began to struggle. I knew that a contribution made in 1955 would be worth more than that made in 1995, even though the nominal dollar amount of that 1995 investment was much larger. With the stock market outpacing inflation, that had to be the case. But how much larger? About 10 times so, it turned out. The 1955 vintage grew to just under $300,000. That of 1995, about $29,000.

The chart below depicts the numbers

Each bar represents the December 2015 value of the investment made for that year, beginning with $652 in 1948 and concluding with $6932 in 2015. To simplify the calculation, I assumed that the purchases were made on the first day of each year. That's slightly unrealistic, but making the investments monthly, rather than annually, would have very little effect on the final results.

That hypothetical investment schedule looks achievable. Senior legal secretaries in New York currently average $65,000 in salary, and Bloom lived in a rent-controlled apartment. Certainly, one can't save $7000 per year on a $65,000 pre-tax income without being financially careful. Sylvia Bloom was indeed that. She was not the type of person who wore minks, to cite her niece's words. But neither would she have needed to emulate the miserliness of Hetty Green, who allegedly once spent hours searching for a lost 2-cent stamp.

Changing times

When I showed this data to my colleagues, they responded, "Too bad there were no index funds in 1948." Fair enough. However, that observation does not invalidate the exercise. Although Bloom could not buy an almost-costless replication of the overall equity market, over some time her stock-by-stock portfolio would become so diversified as to arrive at much the same place. And her ongoing costs would be nothing.

(Of course, she would owe taxes on her dividends, and while that would not matter much in the first few years, later those would be big payments. So sue me, I did not model that. Either her initial payment would need to have been somewhat more than $652 --- although not that much more – or those lawyers were skilled at picking stocks. Or more likely yet, Ms. Bloom invested just that much more.)

Today's investors, of course, need not back into a cheap, diversified portfolio. They can get one, immediately, from any number of fund providers. Nor must they show initiative, as Bloom was forced to do. Check a couple of boxes, sign a statement, and for the next several decades a portion of each paycheck will be diverted into a tax-deferred 401(k). Easy peasy.

The Millionaire next door?

No doubt, few everyday investors will amass the future equivalent of Bloom's fortune. The stock market is unlikely to match its fat 1948-2015 real returns; minimum-withdrawal rules don't permit 67-year holding periods on tax-deferred accounts; and who invests until age 96? However, as long as the financial markets remain at least reasonably healthy, a disciplined investor can reasonably hope to become Sylvia Bloom lite. That would not require a miracle.

This post initially appeared in Morningstar.com