Over the past decade, Neelesh Surana’s funds have outperformed the majority of their peers to stay atop the heap every year. This through various bull markets and (specifically through) turbulent phases such as the Global Financial Crisis (2008), the European Sovereign Debt crisis of 2009-10, and the Chinese stock market crisis (2015-16).

His funds - Mirae Asset Emerging Bluechip (MAEBF) and Mirae Asset India Equity (MAIEF), both with contrasting mandates, stand tall.

Let’s look at the investing style of this equity fund manager from Mirae Asset Mutual Fund.

Like any consistently outperforming fund manager, Surana follows a rigorous investment process that leads to alpha generation.

Surana’s investment philosophy is built on three core principles:

- quality businesses with stable earnings

- strong management

- attractive valuation

While evaluating businesses for picking stocks, his key focus is on growth-oriented companies that meet quality parameters such as a high RoCE and high cash flows.

One cannot ignore the fact that quantitative approach is susceptible to strong trend reversals, but the consistency of returns across different market cycles is testament to the quality of the team’s work, which Surana and his team have proved it time and again.

Surana with his grasp over macroeconomic trends and his ability to connect the dots between various dimensions, has translated this understanding skillfully into successful sectoral views. His most favoured sectors in the past five years have been Financial Services, followed by Consumer Cyclicals and Basic Materials.

Equipped with his ability to think differently, he sometimes wades into stocks that are in operational distress which may have prompted other investors to overlook the company’s long term prospects. It is with the same measured confidence that he gets rid of detractors as a corrective measure when they move in a direction opposite to that envisaged. And above all, Surana has the modesty to learn from his mistakes, as he understands that to generate alpha, weeding out underperformers is equally important as holding onto outperformers.

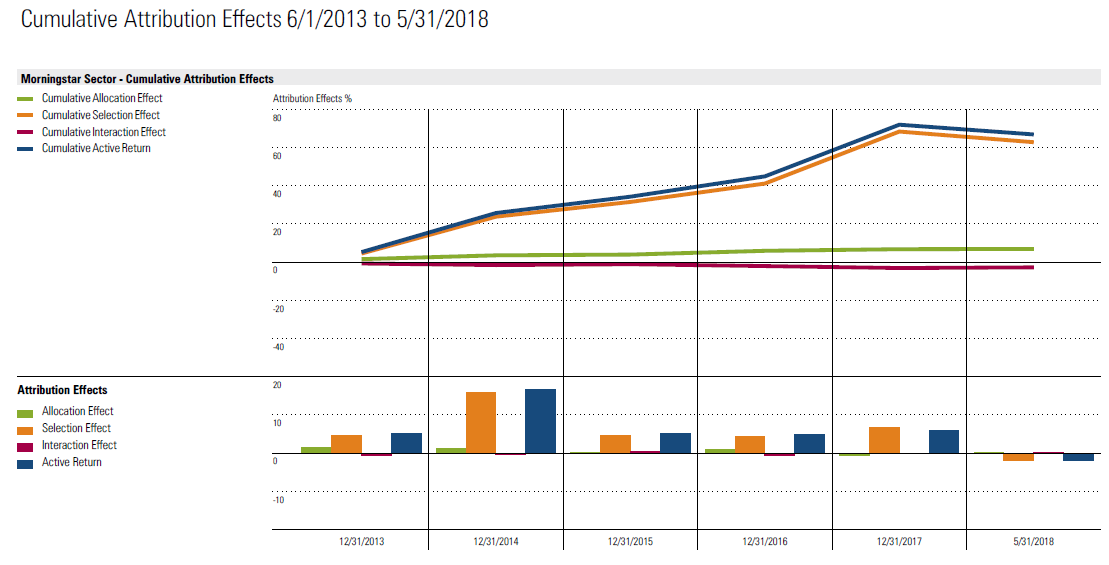

Most of the alpha is generated through stock selection rather than sector rotation.

Any cook will tell you that the secret of his recipe lies in its ingredients. It is no different for the fund managers; what's important is what goes into the construction of the portfolio.

Let’s see how this has played out in MAIEF.

The Monthly Performance Attribution Analysis of the last 5 years shows that there were 42 months when he demonstrated a positive selection return skill, and this only confirms that his stock picks during this period were very strong.

Taking a deeper dive into holdings indicate that his bets on GAIL, HDFC Bank, Exide Industries, Vinati Organics and State Bank of India made the most positive contributions in the last five years. And for further granularity on the selection effect, which indicates that out of 42 months, 19 times the value add has come only through superior security selection. Sector exposures during the same period detracted value, but the manager’s security selection capabilities compensated and offset the poor sector performance.

The role played by overall allocation contribution is marginally positive.

The fund’s lower exposures to cash have also helped during these periods. This is no mere stroke of luck as Surana is highly conscious of the importance of portfolio diversification, and tries to ensure that the fund remains fully invested with allocation to equities at around 95%, at all times.

The success of his funds all points to one thing – consistency in his approach which has paid off throughout the market’s ups and downs.

MAIEF has beaten the majority of its peers over the last 1-, 3-, 5- and 10-year periods, and its risk/return profile is much better than that of the benchmark/category average. Over the 5-year period, the risk adjusted returns of MAIEF (11.85%) are significantly higher than the erstwhile Large Cap category average (6.35%) and the benchmark, S&P BSE 200 (5.66%). The drawdown profile of the fund, vis-à-vis the benchmark and category average, has also been relatively better for a similar period.

In conclusion, Surana has made his mark in the mutual fund industry with his intelligent stock picking, execution abilities par excellence and consistency of approach.

Here are my views on each fund:

Mirae Asset Emerging Bluechip

Mirae Asset India Equity