The mutual fund industry grew at a robust pace of 22% from Rs 17.54 lakh crore in March 2017 to Rs 21.36 lakh crore in March 2018. This was commensurate with the growth in assets advised by top fund distributors.

Top distributors are those who satisfy one or more of the following conditions with respect to non-institutional (retail and HNI) investors - multiple point of presence (more than 20 locations), AUM raised over Rs 100 crore across industry in the non-institutional category but including HNIs.

The latest AMFI data shows that the number of distributors making to this list of top distributors has gone up from 732 in FY16-17 to 979 in FY17-18. This suggests that many new and existing distributors are seeing a growth in their business. These 979 distributors earned gross total commission of Rs 8,534 crore last fiscal. They contributed to net inflows of Rs 1.15 lakh crore. Collectively, they manage assets worth Rs 9.20 lakh crore which is 41% of total industry AUM of Rs 22.70 lakh crore during FY17-18.

The growth came on the back of rise in SIP inflows in equity funds and mark to market gains. The average SIP inflows in equity funds (including balanced funds) are rising steadily from around Rs 3,000 crore in 2016 to Rs 7,000 crore in March 2018. Overall, the industry received net inflows of Rs 2.71 lakh crore in FY17-18 across categories. Of this, Rs 1.17 lakh crore net inflows came in equity funds.

A number of factors including demonetization, investor awareness campaigns and AMFI’s advertisements have contributed to industry’s growth.

Bank distributors share goes up

Of Rs 9.20 lakh crore AUA, banks advise 36% or Rs 3.34 lakh crore assets. Currently, there are 29 banks selling mutual funds. Their market share or AUA has gone up by 37% from Rs 2.45 lakh crore to Rs 3.34 lakh crore in the last fiscal. Reflecting this trend, their collective commission earnings too have gone up by 79% from Rs 1,940 crore to Rs 3,480 crore last fiscal. Bank distributors collected net inflows of Rs 64,094 crore in FY17-18, up 59% from Rs 40,198 crore in FY16-17.

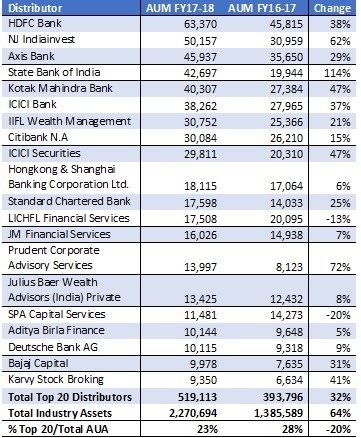

Top 20 distributors by AUA

HDFC Bank held the mantle of being the largest mutual fund distributor with AUA of Rs 63,370 crore, followed by NJ India (Rs 50,157 crore) and Axis Bank at Rs 45,937 crore. Collectively, the top 20 distributors advise on assets worth Rs 5.19 lakh crore which is 23% of total industry assets.

AUA of Top 20 Distributors