In April 2018, Schroders conducted an independent online survey of more than 22,000 investors across 30 countries, India being one of them. Investors being those who will be investing at least €10,000 (or the equivalent) in the next 12 months and who have made changes to their investments within the past decade.

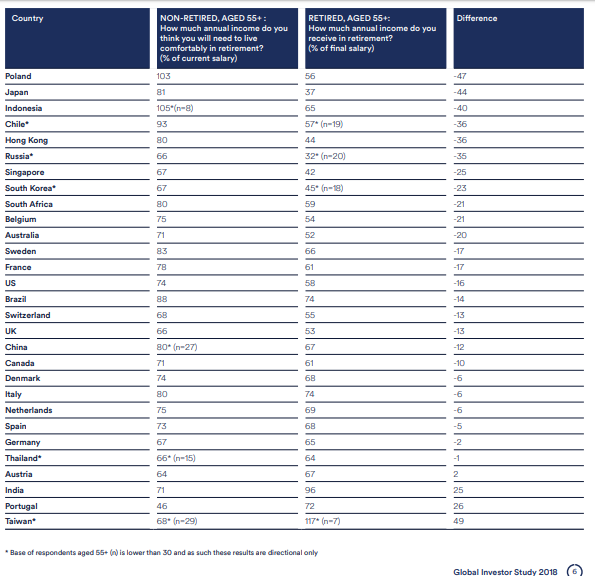

People aged 55+ expect to need more income to live comfortably in retirement than retirees actually receive.

This is particularly true in Asia, where non-retired people in this age group expect to need 76% of their current income to live comfortably, but retirees are only receiving an average of 59% of their final salary.

The cost of living in retirement takes up more income than expected.

The Americas show the greatest misalignment, with the non-retired anticipating that they will spend 32% of their income on living costs, while retirees actually spend 53%.

The majority of retired people consider their income to be sufficient, but most could do with more.

The countries where people feel most in need of increasing their income in retirement include Poland, South Africa, Japan, Chile, Russia and South Korea.

On retirement, people allocated more of their financial resources to investments than non-retired people expect to.

Retired people in the UK, Spain, Austria, Australia, South Africa and Belgium allocated around three times as much of their retirement savings to investments as their non-retired counterparts expect to. Retirees in Asia allocated marginally more than the other continents on average (20%, compared to 18% in Europe and 19 per cent in the Americas).

Expectations for financial allocation at retirement matures as people approach the age of retirement.

Millennials expect to allocate 23% of their retirement savings and investments to their retirement income, while non-retired Baby Boomers expect to allocate 38%. In reality, retired people globally actually allocate, on average, 36%.

Globally, people feel they should be saving more of their income for retirement.

This sentiment is most acute in Chile and South Africa, where respondents think they need to be saving six per cent more of their income than they currently are. The global average is two per cent more of current income. There is little difference across generations.

The level of investment knowledge people feel they have correlates with particular retirement expectations and behaviours.

Those claiming more knowledge and who are not retired have a smaller gap between what they save and what they think they will need than respondents who rated themselves as having lower levels of knowledge. Those who are retired and claim high levels of investment knowledge are significantly more likely to say they have enough to live comfortably.

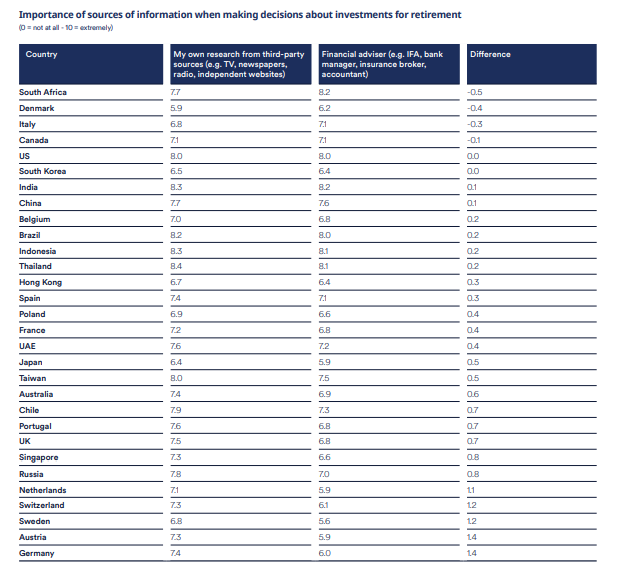

People’s top two sources of information when making decisions about investments for retirement are their own research from independent sources and insight from financial advisers.

Only in three of the countries surveyed were financial advisers considered the most important source. Younger generations consider their friends, family and colleagues as a more important source of information than older people do.

This is just an excerpt, the entire survey results are detailed here.

Click on

the visual to enlarge.