In the past we have witnessed fund houses latch on to a ‘hot’ sector by launching a relevant sector fund. In such instances, they made an entry at a time when the market had already discounted the price of these stocks.

This time, in the case of healthcare, it appears that fund houses are experimenting with a beaten down sector. Launch a fund when valuations are reasonable but expectations of a potential upside are significant.

Mirae Asset Healthcare Fund and ICICI Prudential Pharma Healthcare and Diagnostics (PHD) Fund have been launched, while Aditya Birla Sun Life has submitted a proposal to the regulator.

Why have pharmaceutical stocks been beaten down?

Pharma stocks have underperformed significantly given multiple headwinds such as the U.S. Food and Drug Administration regulatory issue, U.S. price erosion impacting Indian pharma players in the generic market and increasing competition through new entrants. This has resulted in many pharma stocks trading at multi-year lows with price-to-earnings lower than the historical average.

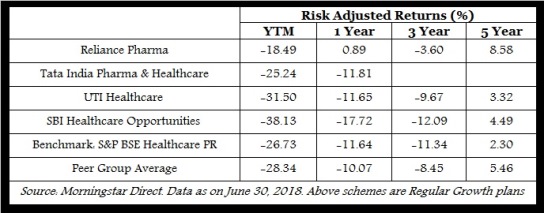

Consequently, pharma funds have also taken a beating and are at the bottom of the mutual fund performance charts.

Currently, there are just three funds that have completed more than 3 years and none of these have ended on a positive note. Reliance Pharma Fund has delivered negative returns of 3.60%, followed by UTI Healthcare (-9.67%) and SBI Healthcare Opportunities (-12.09%).

Where the sector is headed

The fund managers believe that the Indian healthcare sector is coming out of the woods. They expect double digit sales growth mainly from economic growth leading to higher disposable incomes, the thrust on rural health programme, improvements in healthcare infrastructure and GST-led disruption. The healthcare companies are also working on strengthening the quality management systems to meet U.S. FDA guidelines, which will help to keep the approval rate buoyant for domestic pharma companies. All this, in turn will lead to re-rating of stocks.

We could see buying interest coming into healthcare sector as mutual funds are increasing this sector weight in their portfolios.

As of June 2018, the healthcare sector got an allocation of 6.52% (477 funds) as opposed to 6.19% (408 funds) in December 2017, though lower that the December 2016 weightage of 7.70% (553 funds).

Popular stocks

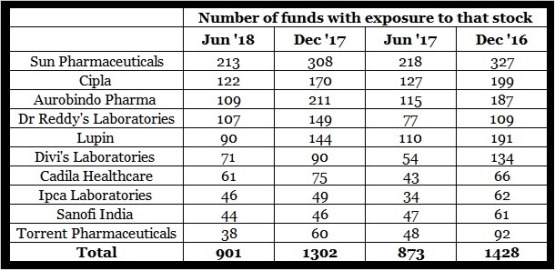

Sun Pharmaceuticals, Cipla, Aurobindo Pharma, Dr Reddy's Laboratories and Lupin were the 5 most owned stocks by the fund managers in June 2018.

Divi's Laboratories, among the top 5 picks of the fund managers at the end of 2016, has dropped off the list, replaced by Dr Reddy's Laboratories.

While the top 3 stocks have maintained their position as the most favoured stocks, their pecking order has undergone a change.

Our take

Pharma funds will invest at least 80% of their assets in industries such as biotechnology, pharmaceuticals, research services, home healthcare, hospitals, long-term care facilities, medical equipment and supplies.

Since past headwinds have largely been factored into street expectations and valuations, there is a lot of value in the healthcare sector for a long-term investor.

However, one should not forget that sector funds are risky and more volatile as compared to a diversified equity fund. Such funds are suitable for investors with a high risk appetite.