Founded by Prateek Mehta, Prithvi Raj Tejavath, Shashank Agrawal, and Vivek Agarwal in December 2015, Bengaluru-based online investing platform Upwardly has built assets under advisory of Rs 400 crore in just two years. Prateek Mehta, CEO, Upwardly, chats with Ravi Samalad about how they are attracting digitally savvy first time mutual fund investors.

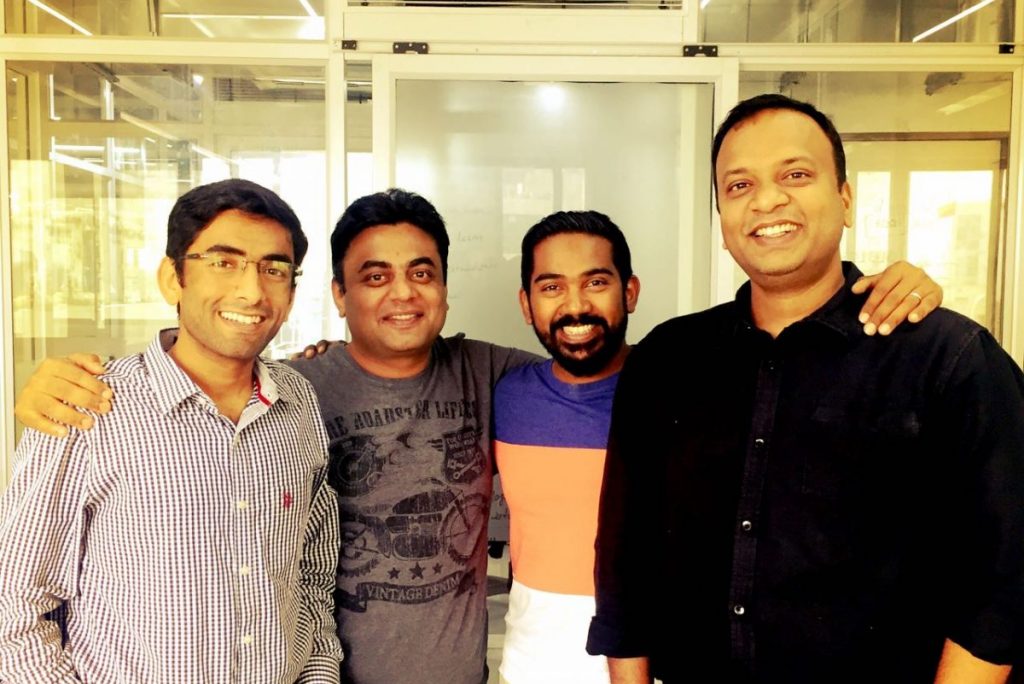

(LtoR) Prateek Mehta, Shashank Agrawal, Prithvi Raj Tejavath and Vivek Agarwal

(LtoR) Prateek Mehta, Shashank Agrawal, Prithvi Raj Tejavath and Vivek Agarwal

Your company started operations in 2016 and it currently manages assets worth Rs 400 crore. What has been your strategy to acquire customers?

We have been acquiring customers predominantly through digital channels. We use a mix of paid marketing and content marketing to get customers to our platform. Our customers are our biggest fans and they also actively refer their friends and family to Upwardly.

What are the challenges in acquiring customers online?

Digital is a good channel to acquire customers because it lets us do targeted campaigns and reach the right customer. Unlike offline marketing, digital marketing allows us to closely track and analyze the performance of campaigns. Ours is a trust led business; it takes us some time to establish trust through a digital channel.

Typically, how many days does it take to establish trust and convert one client?

On an average, it takes us between 7 to 14 days to establish trust with a user and convert him into an investor on Upwardly.

Who are your ideal clients?

Upwardly is democratizing investment advisory for Indian users across income groups and geographies. We currently have customers across 600 cities in India. Most Indians have been left unserved or underserved for proper investment advice by traditional banking and wealth management channels. They are our ideal customers. They start their investing journey with Upwardly, typically in the first few years of their careers. As and when they go through different life stages, they continue to get personalized investment advisory and invest with us. That said, we have people from across age and income groups investing through Upwardly.

How much of human intervention is required in onboarding a new prospect who is not KYC compliant?

Upwardly has a 100% online KYC process for customers who are yet to do their KYC. We have given the customers a facility to upload their documents like PAN card, address proof and photo. The documents upload feature works seamlessly both on web and mobile. Due to the simple process, human intervention is required in very few cases. Having said this, Upwardly allots a relationship manager to each and every customer who could be reached for any help or assistance.

Some robo advisers operate on hybrid model while others claim to purely algorithm driven. What’s your model?

We have multiple solutions designed for different customers. Our proprietary Top Mutual Funds ranking is completely algorithm driven. We also have in-house investment research and advisory teams. The research team analyzes the markets, sectors, funds and other macroeconomic data to shape the current nature of our advisory. They also create mutual fund portfolios which the customers can invest can pick in addition to goals or funds. Goal based investing is our signature solution which again is driven by algorithms based on user and market context. While we make all our investing solutions available online, we acknowledge that some of our customers will need to reach out to us. We will always be available where our customers need us! To sum it, I would say we use a judicious mix of technology and human expert knowledge to run our investment advisory.

There is a tendency among DIY investors to redeem when market turns volatile. Have you witnessed such behavior among your customers? How do you manage investors emotions when markets are bad?

You have brought about a very important aspect of investor behavior. A large section of Indian investors started investing in mutual funds only in the last one year. Therefore, many of them see low or negative returns in their portfolio due to recent volatility in the broader markets. Since these investors are new to equity investing, volatility makes some of them jittery. It translates into some investors pausing their SIPs and redeeming their investments in a few cases. We regularly communicate with our customers about the virtues of patience, SIP and long term investing to prevent this behavior.

What kind of ancillary/value add services do you offer?

We offer services like retirement planning, financial planning, portfolio diagnostics, re-balancing and lifetime assistance on management of investments. We can also evaluate a customer’s investment across asset classes - physical and financial. Upwardly also has a 100% online platform for Non-Resident Indians, Persons of Indian Origins and Overseas Citizens of India across the globe to start investing in the India growth story.

How do you plan to compete with portals which offer direct plans considering most online investing platforms offer similar services?

There are two parts of my answer to this question – A large section of Indians have been untouched by traditional wealth managers or investment advisers. Ironically, this is despite a healthy savings rate of 25% of income levels. Unfortunately, these savings have been going to inefficient instruments like real estate, gold, FD and ULIP plans due to lack of awareness and investment advice. Upwardly adds value to these customers by providing them quality investment advisory which takes them closer to their dreams aspirations and long-term goals. The customers care not just for ease of the online platform but more so for quality of advice and service provided over the years. By offering regular plans, our incentives are aligned with our customers’. Part II of the answer is around building a sustainable business model. Sustainability of the business model is important both for us and our customers. Without that, it will be difficult to innovate with technology and give quality investment advice. Even if a platform offers direct plans but fails to give service, the customers will get dissatisfied and eventually get lower returns.

While registering, your website asks if you have a partner code. Can you elaborate on this on why do you require this information?

Well, partner code is strictly optional. Partner codes helps us run referral programmes.

Besides mutual funds, which other products do you offer or plan to offer in future?

In the time to come, we will expand Upwardly to offer other crucial financial products like term life insurance, health insurance, portfolio management services, etc.

Since smartphone usage has seen tremendous growth, are you considering launching a mobile app?

Upwardly is fully functional on all smartphones through our mobile website www.upwardly.in which is a Progressive Web App (PWA). We see very high usage on mobile phones. We will also be launching our native Android and iOS apps very soon.

Globally, only a few robo advisers are successful. How do you see the situation panning out in India?

In this business, it is essential to have a long-term view. Also, it is important to have strong customer focus which means a penchant for innovation and high service levels. Once you have this along with the right revenue model which is aligned to customer’s interests, you are ready to grow and benefit from the India growth story. However, we believe that there will be consolidation in this space and smaller players with no clear business model will fizzle out.