The government has hiked interest rates of various small savings schemes for the third quarter (October 1 to December 31). This includes the Public Provident Fund, or PPF.

Return

The return is assured but the exact amount keeps fluctuating. The investor is assured a fixed return, though the exact figure varies. Earlier, the returns would be set every year. Now, to keep it more market aligned, it is reset every quarter according to the yield on government securities. At one time, the instrument earned 12% per annum. At the turn of the century it dropped to 11% and went further down to 8%. It moved up for a while touching 8.8% before beginning a downward journey to 7.6%. The current rate is 8%.

Tax

Investments in PPF are entitled to a tax exemption. What’s more, even the interest earned is tax free. The interest is added to the principal investment and compounded, and the accumulated amount is also exempt from tax on maturity.

This makes it an EEE investment; which is an acronym for Exempt, Exempt, Exempt.

- Your investment is allowed for a deduction. So, you don’t have to pay tax on part of the income that equals the invested amount.

- You don’t have to pay any tax on the returns earned during the accumulation phase.

- Your income from the investment would be tax-free in your hands at the time of withdrawal.

Limit

Each financial year, a minimum of Rs 500 is needed to keep the PPF account active. On the other end of the pendulum, the annual investment cannot exceed Rs 1.50 lakh. This is the upper limit not only for Section 80C but even PPF individually. The PPF deposit need not be invested in one go. It can be done in a maximum of 12 instalments in a financial year.

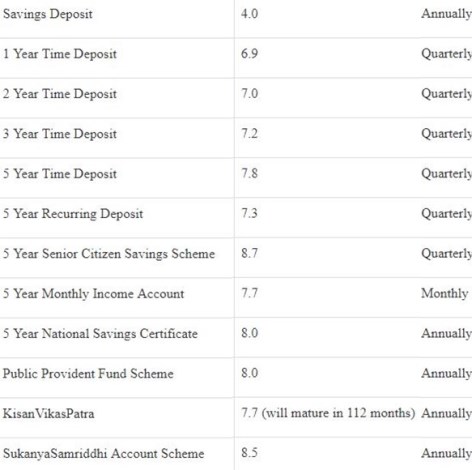

Rate of interest (%) for December quarter and Compounding frequency

Source: Ministry of Finance; rates applicable for the October-December 2018 quarter.