Thanks to the sustained effort of distributors in championing SIPs, the average monthly inflows through this route has risen consistently over the last two years.

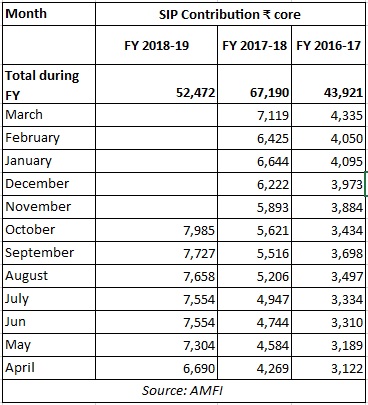

The average monthly SIP inflows were Rs 3,660 crore in FY 2016-17, which increased by 53% to Rs 5,599 crore in FY 2017-18. In FY2018-19, this number has increased to Rs 7,496 crore during April-October, which is an increase of 29%.

A bulk of these SIP inflows have come through distributors. Of 2.48 crore SIP accounts, 11% or 26 lakh SIP accounts belonged to direct investors. In terms of AUM, direct plan SIP assets were worth Rs 20,637 crore while the regular plan assets were worth Rs 1.97 lakh crore.

Monthly SIP inflows

Association of Mutual Funds in India, or AMFI, data shows that the industry has added an average of 10 lakh SIPs each month during FY2018-19 with average SIP ticket size of Rs 3,200. Despite choppy markets, the industry has seen steady inflows as investors are taking every opportunity to buy in the dips. This is a visible shift in investors behavior who used to hit the panic button by stopping their SIPs during volatile markets a few years back. The investor education drive unleashed by AMFI, fund houses and distributors has played a key role in reaching this milestone.