Ravichand of StockandLadder always advises the equity investor to imagine herself to be Sherlock Holmes or Hercule Poirot when studying the annual reports of a company. Be skeptical. Don’t blindly believe what is dished out. Eventually, your investigative and analytical skills will hold you in good stead.

He recently tweeted two interesting observations, which have been reproduced below.

No matter how badly the stock market does, there will be some stocks that will fare well. And the stark importance of Margin of Safety.

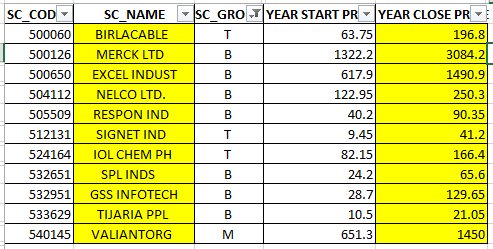

The good performers

In the calendar year 2018, 44 stocks from BSE ended the year (December 31, 2018) at more than double their price at which they began the year (January 1, 2018).

Removing X, XT and ST categories, there were 11 stocks which gave at least twice the return.

Equity securities of companies that are only listed/traded at BSE and satisfy certain parameters are classified into separate sub-segments called "X", and "XT". At the time of review any securities falling in Trade-for-Trade segment ('DT' or 'T' groups) are classified under "XT" sub-segment. You can read more here.

Equity securities under “S+ Framework” are placed in a separate group “SS” (Securities being settled on normal rolling basis) and “ST” (Securities being settled on trade to trade basis). You can read more here.

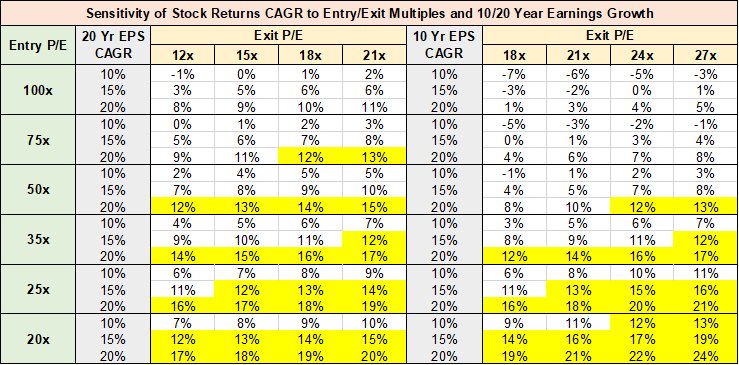

The importance of Margin of Safety

While everyone tells you that equity investing must be conducted with a long-term perspective in mind, that does not imply you can buy at extremely high valuations and hope to get wealthy.

The table below clearly indicates that when entry valuations are steep, even a long period of high growth may not be sufficient to deliver good stock returns.

Some investing principles are timeless: NEVER overpay, however good the story is. ALWAYS buy with a margin of safety.