Last year, I was taken aback when a friend informed me that he did not have a Public Provident Fund (PPF) account. I convinced him on the need to do so. I soon realised that my persuasive skills left much to be desired. He never acted on the advice and put it down to laziness.

I asked another. His response: “What’s that?”

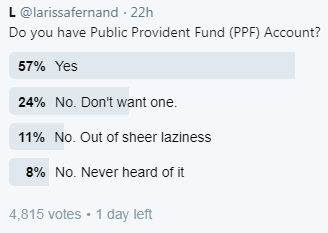

Curiosity got the better of me and I decided to find out how many individuals out there are clueless or not interested in this tax-saving option. A Twitter poll on February 7, 2019, was the path of least resistance.

Well, surprise, surprise. Going by the poll participants of over 4,800, the PPF is far from being the ubiquitous tax-saving instrument.

I would like to examine four statements/observations made in response to the poll.

#1) PPF can be supplementary to ELSS, not an alternative. ELSS is better suited to manage the risk of loss of capital and the erosion of purchasing power due to inflation.

This view reveals all that is wrong with most individuals’ tax-planning strategy: If the equity portion of your portfolio is heavily skewed towards large-cap stocks and funds, then a mid-cap fund would be supplement it. It cannot be supplemented by a debt holding.

So PPF (debt product) cannot be an alternative or supplement to ELSS (diversified equity mutual fund) as both are intrinsically different.

In fact, the different asset classes in a portfolio must complement each other. To draw an analogy, the 64 black and white squares on a chessboard complement each other. Each occupies a different position and serves a purpose. A chess board must have both black and white squares.

The PPF and ELSS comparison is unfair and wrong. Eventually, the decision on whether to opt for PPF or ELSS must be taken after viewing your entire asset allocation. If you are heavily tilted towards equity, PPF can be considered. If you have a debt-heavy portfolio, ELSS should fall within your purview.

Your investment plan must be proactive, not reactive. By this I mean that tax saving should be in sync with the overall strategy and not a hurried exercise at the fag end of the financial year, where you pick up PPF or ELSS simply because you don’t know what else to do.

Tax optimisation of individual financial products has to be the last step in the overall financial plan and not the basis for selection or comparative analysis. Just because ELSS and PPF both offer a tax deduction under Section 80C, it does not mean they are similar and can be blindly compared with each other.

#2) I do not see the motivation to sacrifice liquidity.

Very pertinent point.

Many find the PPF tenure to be agonizingly long, a 15-year investment with a 16-year lock-in. The first year is not taken into consideration when looking at the maturity of the account. The end of the financial year in which the deposit was made is what matters. So if you opened the account on July 15, 2000, the 15-year tenure will commence from end of FY2000-01 (March 31, 2001). That means, it would have matured on March 31, 2016.

Here’s a look at the “motivation”.

1. Safety

The investment is as safe as it gets. Any sovereign backed investment (which means it is issued by the national government of a country) stands for the highest safety. Since the funds in PPF are backed by the central (not state) government, the investment does not get any safer than this; the underlying assumption being that the government will not default on its payment obligation.

2. Assured Returns

The return is assured and compounded annually. This could appeal to many individuals as it works out to be an excellent long-term savings tool. It is a great way to accumulate money for a goal. For instance, if you are 30 years old when you open an account, on maturity the money could come in handy for your child’s higher education. It could be a retirement kitty. Or, if you and your spouse are each managing your own PPF accounts, one account can be used for retirement savings, the other for another goal – such as child’s education or marriage.

An individual explained that each member in his family of four had their own PPF accounts. On maturity, neither of them extended it and all (parents and sibling) pooled it together to enable them to buy a house.

3. Tax Benefit

The investor gets a tax break all the way –Exempt-Exempt-Exempt (EEE). That means you get a tax break on Investing, during the Accumulation stage, and at the Withdrawal stage. The investment up to Rs 1.50 lakh per annum is eligible for deduction in a financial year (investing stage), the interest earned is exempt from tax (accumulation stage), and the amount on maturity is exempt from tax (withdrawal stage).

Investment Adviser Mahesh Mirpuri believes that “as part of one’s debt allocation, PPF is a great investment and a long-term savings tool. Putting money away for 15 years in a guaranteed investment, that is completely tax free and risk free.”

#3) PPF is pointless when there is EPF with VPF option.

If you are have opted for EPF and VPF, the PPF may not be best suited for your portfolio. PPF is actually an excellent option for non-salaried individuals. It can form a part of your long-term savings goals.

Deepak Khemani of Khemanis admitted that the equity allocation in his personal portfolio is done via SIPs in equity mutual funds and direct purchases of stocks. He maxes the PPF level, which forms part of his debt allocation. The balance debt allocation goes into debt funds or balanced funds.

For the Employee Provident Fund (EPF), a salaried individual will contribute 12% of his Basic + Dearness Allowance and the employer will match the contribution. The employee can also opt for Voluntary Provident Fund (VPF) and top up the contribution to the provident fund, though the employer won’t match this. The returns too are marginally higher than PPF and the safety factor holds as does the tax benefit.

#4) To each his own.

Indeed.

Basavaraj Tonagatti of Basunivesh believes that "PPF is a wonderful debt product, but one must not make the mistake of blindly investing in it simply for tax-saving purposes. It must align with your overall financial goals."

If you are contributing to EPF and VPF, you could bypass the PPF. If you are looking at a long-term assured return kitty, you could consider it.

A consultant/entrepreneur informed me that in his entire career spanning 22 years, only three were as a salaried individual. For him, cash flow was not a given, as it would be in the case of an individual earning a monthly salary. So while technically, PPF is targeted for his profile, he found no point in locking up money for an extremely long duration which could not be easily accessed.

Another investor pointed out that PPF made sense at one point in his life. But now his contribution to the EPF and VPF and insurance premiums have enabled him to max the Section 80C limit. So once the account matured, he opted out of it.

When I asked some my colleagues at Morningstar India if they have a PPF account, virtually all admitted to having one, though their levels of enthusiasm and commitment to parking Rs 1.5 lakh per annum were mixed.

Two analysts found it "pointless" to have a PPF account as their debt allocation is taken care of by debt mutual funds and they max the limit in Section 80C through investments in ELSS.

In investing, there is no one size fits all.