Equity funds, including equity linked savings scheme and balanced funds, have added 1.06 crore folios in the last one year. The total number of folios in these categories went up from 5.78 crore in February 2018 to 6.84 crore in February 2019, shows Association of Mutual Funds in India (AMFI) data. Equity funds are dominated by retail investors.

Across all categories, the industry added 1.18 crore folios during this period, majority (90%) of this growth was contributed by equity funds which added 1.06 crore folios. As on February 2019, the industry has a folio base of 8.17 crore, 83% of which consists of equity funds.

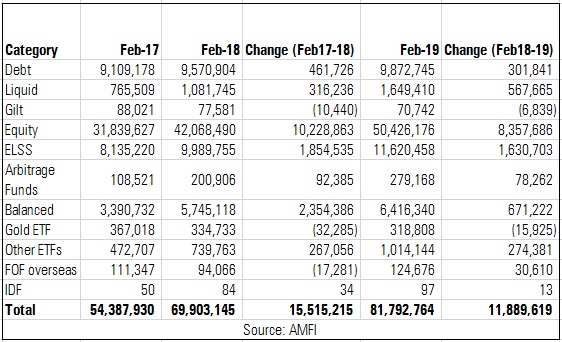

Growth in folios during February 2017-19

ELSS

ELSS folios have seen a consistent growth, rising from 81.35 lakh in February 2017 to reach 1.16 crore in February 2019. The assets under management (AUM) in this category went up from Rs 56,724 crore to 87,220 crore during the same period.

ETFs

ETFs are also gaining traction due to government’s divestment in public sector enterprises through central public sector enterprises (CPSE) ETFs. As a result, ETF folios have more than doubled from 4.72 lakh to 10.14 lakh during the same period. Reflecting this trend, the AUM in ETFs went up from Rs 40,147 crore in February 2017 to reach Rs 1.13 lakh crore in February 2019

Liquid

Liquid fund folios have also witnessed a health growth, from 7.65 lakh in February 2017 to 16.49 lakh in February 2019. During this period, the AUM in this category has grown from 3.31 lakh crore to 4.87 lakh crore.

Growth in folios across categories