This post by Joachim Klement was originally published on CFA Institute's Enterprising Investor.

People sometimes ask how I come up with the ideas for the research I produce or my investment ideas in general. To be honest, this question always makes me uncomfortable. Why? Because after two decades as an investment strategist and chief investment officer, I still do not know what my process really is. But admittedly, telling people that these ideas “just happen” is not a satisfying answer either.

So, to give you a sense of how I do research, let me guide you through the process of writing one of my daily commentaries and then summarize some key steps.

Not long ago, I was getting off the train back home. The guy walking behind me was talking loudly on his phone. It annoyed me. And, of course, being annoyed, I started to eavesdrop on his call. He must have been a student or academic of some sort because he mentioned how surprised he was to learn that the influence of genes on human traits increases with age.

Now this made me perk up. The natural assumption is that genes would exert their strongest influence early in life and then decrease as we accumulate different experiences and “learn” how to interact in society. I made a mental note to check that out.

The next day, I looked for academic research on how genes influence different traits over the course of our lives. Thanks to Google Scholar, which along with SSRN, is the most important resource I use, I found a paper by Daniel Briley and Elliot Tucker-Drob from the Journal of Personality. The study demonstrates that genetic influence on both cognition — that is, IQ and intelligence — and personality varies significantly over time.

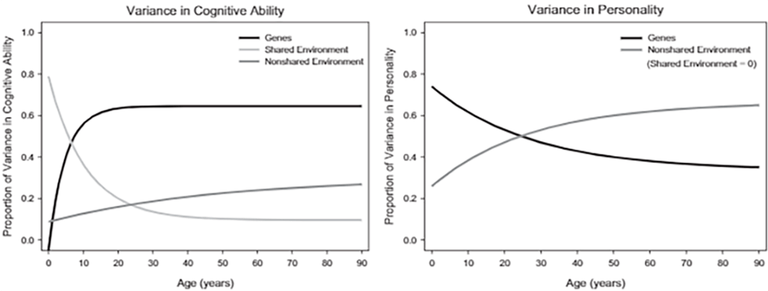

One of their charts shows that genetic influence on personality traits starts out high and explains about 75% of the variation in babies’ personalities. As we age, we accumulate more and more experiences that come to dominate our personalities. This may be what we’d expect, but I made a mental note that this also suggests our experiences influence our investment decisions. (Future research might explore how personality traits influence investment decisions so that personal experiences are linked not just to personality traits but also to investment decisions via personality traits.)

Proportion of Variation in Cognitive Ability and Personality Attributable to Genetic Factors

The chart on the left, however, blew my mind. How can it be that genetic traits increase in influence throughout childhood and into early adolescence? This doesn’t make any sense. Briley and Tucker-Drob offered their own explanation

“Early genetically influenced differences between individuals, be they small, may influence the manner in which they move through the environment and thus amplify over time . . . For example, some individuals may respond differentially to the same educational environment. Teachers may pick up on these individual differences and provide student-specific feedback.”

This reminded me of Malcolm Gladwell’s claim in Outliers that 10,000 hours of deliberate practice is the foundation of excellence in just about any discipline. This “10,000 hours” rule has by now been widely debunked: Practice is much less important to achieving excellence than previously thought. But beyond practice, little seems to be known about what other factors contribute. Briley and Tucker-Drob’s study hints at one possible influence: how our environment reinforces genetically determined talent and hones this talent through deliberate practice.

Idea Generation: Process Elements

- Once you have an idea to investigate, use data and academic studies to verify or falsify it. Keep an open mind and reject the thesis if the data does not support it. Learn to be resilient in dealing with such failures.

- Don’t rely on secondary sources like other research analysts or media reports. It is amazing how unreliable some this of research, particularly sell-side research, can be. Focus on the original sources, peer-reviewed academic studies, and your own models and analysis.

- Ask yourself what the idea means for your job and what conclusions follow from this idea. If possible, test these conclusions using past market data.

- Don’t just stick to your narrow area of expertise. Venture into history, psychology, neuroscience, and other disciplines to inform your work. Novel ideas often develop by connecting existing ideas and techniques from different fields rather than genuinely new insights.

- Keep some loose ends that you can pick up at a later stage to create a network of interconnected ideas that form your “world view” over time.

- Practice, practice, practice.

So what’s my conclusion from all this?

To be good investors, we need to have talent and the right personality to begin with. Investment success takes time, so impatience is probably detrimental to long-term success. Good investors also need resilience when investments turn out poorly. Both patience and resilience are to some extent pre-determined by our genes. In our youth and through adulthood, we learn how to deal with disappointments and failures. Exposing children to difficult challenges and then teaching them how to respond when they come up short is a vital ingredient to future success.

Obviously, those children who are genetically predisposed to recover from failure — or have “lower loss-aversion” in behavioral finance parlance — will probably encounter more challenging problems in the future, whether through their own initiative or the adults around them Thus, they build their resilience like bodybuilders build muscle. And because they’re genetically better equipped to deal with failure, they will probably train this muscle more often and more vigorously over time, creating a bigger and bigger gap relative to those who are more failure averse.

As the famous marshmallow experiments have shown, a similar process may be at work with patience.

To be good investors or research analysts, we need the right genetic predisposition and then must create the right circumstances to practice and hone these skills. It’s practice that makes us better analysts and investors and amplifies the small initial differences.

Think of Warren Buffett and other great investors. They started to invest very early in life and turned investing into more than just a profession: It became a lifestyle. They always try to learn new things about investments and reflect on past mistakes — something Buffett does in his annual letter to shareholders.

The combination of talent with experience and the ability to constantly look beyond the immediate task at hand and broaden the horizon seems to create these exceptional investors and researchers.

And this is what I aspire to in my job as well, though I am obviously not nearly as good an investor as Buffett. But I blame that on my genes . . .