All of us have goals that we need to save for. Some of our goals may be identical, saving for retirement being virtually universal, but our time frame and ability for risk and saving patterns will differ.

Having said that, successful investing follows basic principles that can be applied universally to investors.

Faiz Memon is a SEBI registered investment advisor, healthcare entrepreneur and a Cryptocurrency and Blockchain enthusiast.

He shares a few parameters that every single individual must keep in mind when they decide to invest in stocks. In an attempt to make it relevant, he looks at the personal situation of an individual, and attempts to draw an analogy with a business.

Free Cash Flow = Cash from Operations – Capital Expenditures

You: Saving is mandatory for anyone who earns. How much you can save every month will depend on what you have with you after all your bills are paid. The more you save, the better off you will be in the long run. It is a good measure for future financial success.

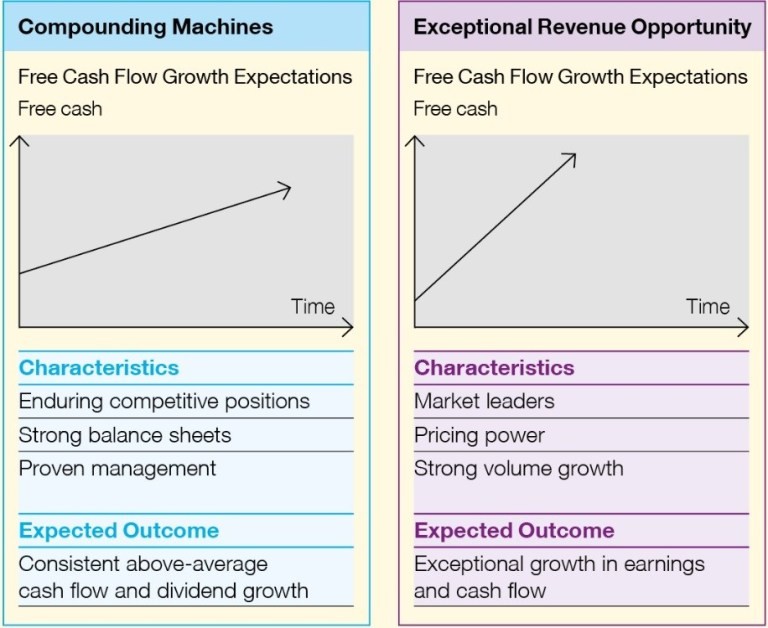

The investment: This metric is analogous to a company's Free Cash Flow, the lifeline of any viable business. A concept that may seem sacrilegious in the current environment where startups making huge losses rake in big investor bucks. Yet FCF is the simplest way to measure if a company is a viable investment. It gets us quickly to the bottom line; how much money is available for distribution to shareholders or for reinvestment into the business?

Observe FCF over a period of a few years rather than a single year or quarter. No one is saying that this is the only parameter to follow, but by employing it, investors can at least eliminate most bad investments.

Growing Free Cash Flow + High Return on Invested Capital = Happy Long Term Investors

You: What does an investor do with his savings? Keep it in a bank fixed deposit or use it to buy investments which will create wealth for him?

The investment: What does the company do with its money?

A mature company might reinvest into its own business but won't earn much more than a fixed deposit rate at your local bank (crude measure for cost of capital or opportunity cost). Others may give a dividend to shareholders. A company may buy back their own stock (reducing supply). Some many keep their cash and re-invest into the business, because it yields a higher rate of return than deposits (cost of capital).

A standard measure for the rate a company can re-invest its capital is Return on Invested Capital (ROIC). It is a measure of how efficiently a company employs its resources to generate profits or, more importantly, free cash flow.

An investment into a growing company with a high ROIC, compounds money faster, with lower tax implications and a lower transaction cost relative to a mature dividend payer but consistent compounding machine.

This simple but powerful concept is the widely known secret of earning consistently high investment returns.

Live within your means

You: Remember the words of Polonious to his son Laertes in Hamlet, “For borrowing dulls the edge of husbandry”.

The investment: A company that borrows heavily, is less inclined to earn a high ROIC. Companies earning a high return on capital can sustain over levered operations but only for a while.

Shun businesses that need significant leverage to generate returns; seek out those who can reinvest their cash flows at high rates of return.

Don’t get lured

You: Decide what is good for you in terms of asset allocation and risk you can take. Just because one investment is good for a friend, does not mean it is a good fit in your portfolio.

The investment: Avoid companies that make sharp turns; I mean cyclical stocks that turn viciously on a dime. Cyclical stocks are known for following the cycles of an economy through expansion, peak, recession, and recovery. These stocks are volatile and you have to get your timing right.

There are many specialists making a nifty living, trading tops and bottoms of such cycles and they have impeccable timing for each decision. For the rest of us mortals, avoiding investments in a cyclical industry is necessary to earn high returns over long stretches of time.

Practice patience

You: You cannot save lakhs overnight. You cannot accumulate knowledge all at one go. Everything takes times. When learning a new sport, you need practice and patience and will appear silly and clumsy. Ditto when learning a new instrument. Be patient.

The investment: Your investment will go through ups and downs. If you have taken a contrarian bet, or picked up a stock that has bottomed out, it will be a while before the market recognizes its worth. There will be times where our strategies will look foolish, dangerous, stupid and outright detrimental to our wealth, yet persevere we must. Patience is the only virtue that counts. Only patience will allow one to look foolish and wrong in the short term, to earn well deserved long run returns. You need to overcome yourself, not the market. You must identify with our inner scorecard vs. the outer score card forced upon you.

Bull markets don’t last forever. Neither do bear markets. But your attitude will be the clincher.

Stay emotionless

You: You cannot go through life having an emotional reaction to everything and everyone.

The investment: Nothing ever lasts forever. Be it good times or bad. Ditto for stocks and the companies we invest in. There will come a time where our favourite investments start to falter. Some known unknowns (not exhaustive) are, free cash flow turns negative, returns on capital go down, taking on debt or buying a cyclical business. We also have unknown unknowns, which confusing as it seems means we just don’t know what we don’t know. At that fateful time, we make the wise choice and jump ship immediately. Do not be emotionally attached to your stock.

Saving hard earned capital is the first and only job we have.

You can follow Faiz Memon on Twitter