The assets under management of India’s top distributors increased from Rs 9.23 lakh crore in FY17-18 to Rs over Rs 10 lakh crore in FY18-19, shows the latest Association of Mutual Funds in India (AMFI) data. During the same period, the total AUM of the industry went up by 8% from Rs 22.70 lakh crore to Rs 24.58 lakh crore. A large portion of the net inflows last fiscal year flowed in equity funds which collected Rs 1.07 lakh crore. A large portion of these inflows came through SIPs which collected Rs 92,693 crore last fiscal.

The number of distributors whose AUM data is disclosed by AMFI annually has gone up from 1,017 to 1,037 during the same period. Collectively, the top 1,037 distributors earned gross revenues of Rs 7,938 crore, down 7% from Rs 8,550 crore previous fiscal. This was despite a 17.30% growth in Sensex in FY18-19. These 1037 distributors collected net inflows of Rs 48,359 crore last fiscal.

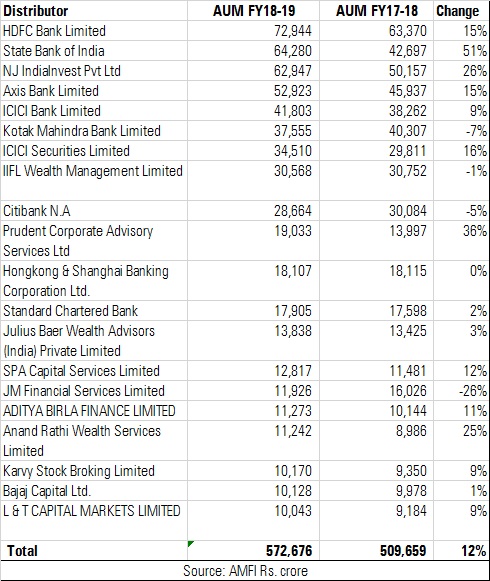

HDFC Bank continued to hold the mantle of being the top distributor in terms of AUM at Rs 72,944 crore in FY18-19. State Bank of India recorded the highest growth in assets (among the top 20 distributors), climbing from number four position last fiscal to second rank this fiscal. Its AUM increased from Rs 42,697 crore in FY17-18 to Rs 64,280 crore in FY18-19, a jump of 51%. Thus, Surat-based national distribution firm NJ India was pushed to third position with AUM of Rs 62,947 crore, from Rs 50,157 in FY17-18 last fiscal recording a growth of 26%. Other players which recorded a healthy growth in their AUM were Anand Rathi (25%), ICICI Securities (16%) and Axis Bank (15%).

Top 20 Distributors

It has been one of the most challenging phases for distributors, which is evident by the fall in overall commissions earned by the top 1037 distributors due to upfront ban. Going ahead, their revenues are expected to come under pressure due to the cap on fund expenses. That said, the demand for mutual funds is only increasing. This coupled with the adoption of technology is likely to boost assets under management of most distributors.