Equity inflows fell by 27% from Rs 9,152 crore in August 2019 to Rs 6,609 crore in September 2019 due to profit booking. The Sensex was up 4% in September.

“Investors continue to invest through SIPs while lumpsum flows remain a mixed bag. There was some profit booking by investors after the market rally post the corporate tax reduction announcement,” said Kaustubh Belapurkar, Director – Manager Research, Morningstar Investment Advisers India. This is evident by the higher redemptions (Rs 9,444 crore in September 2019) as compared to redemptions of Rs 7,750 crore in August 2019.

Going ahead, Kaustubh believes that investors will look for cues for a broad-based economic recovery before making larger allocation towards equities.

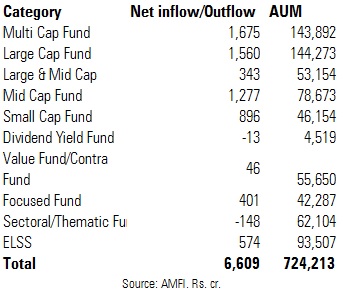

In equity category, multicap, large and mid-cap funds collectively accounted for 68% (Rs 4,511 crore) of the total inflows of Rs 6,609 crore in September 2019.

Open end debt funds saw net outflows of Rs 1.58 lakh crore, largely on account of outflows from liquid funds (Rs -1.40 lakh crore) due to quarter end trend. Credit risk funds continued to see outflows of Rs 2,351 crore on account of flight to safety.

Due to massive outflows from liquid funds, the total industry asset base fell by 4% from Rs 25.47 lakh crore in August 2019 to 24.50 lakh crore in September 2019.

Nevertheless, retail investor folio base continued to rise. As on September 2019, the total folio base of the industry stood at 8.56 crore while the number of folios under equity, hybrid and solution-oriented schemes, wherein the maximum investment is from retail segment stood at 7.68 crore. This was the 64th consecutive month witnessing rise in folios.