SHANKAR SHARMA, vice chairman and joint managing director of First Global, made a case for global diversification at the Morningstar Investment Conference in Mumbai, on September 17, 2019.

Here are three crucial messages from his presentation.

#1. NEVER ignore currency risk.

The dollar exchange rate is around Rs 72. It was Rs 71.5 in 2013 when the Taper Tantrum happened. If you go with an inflation rate of 3%, that's 18% over this 6-year period. The rupee is vastly overvalued. It has to go to Rs 80 just to erase this overvaluation. I won't even call that a depreciation; it’s just getting fairly valued.

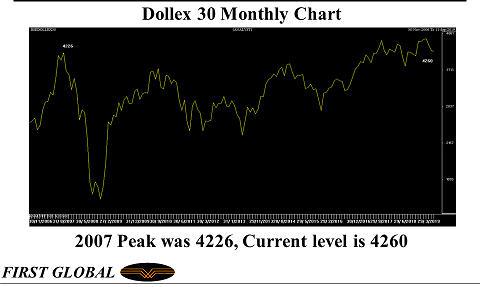

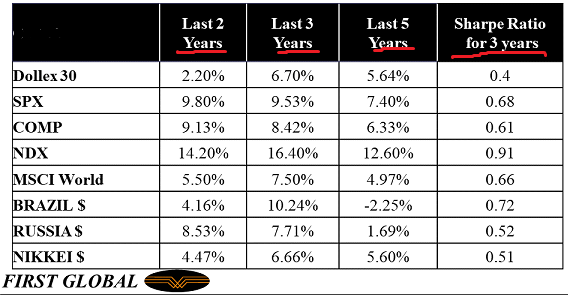

How much has the Dollex (Sensex in dollar terms) delivered? It peaked in 2007 at 4,226 and its current level (September 2019) is 4,260.

CAGRs over the past 10 years

- Dollex 30: 0%

- S&P 500: is 10.5%

- NASDAQ Composite: 9.7%

- NASDAQ-100: 15.7%

- MSCI World: 6.6%

- Nikkei (dollar terms): 5.59%

#2. NEVER downplay asset allocation.

Do I believe in bottom-up stock picking? Most definitely.

Have we made money out of bottom-up stock picking? Plenty. HDFC Bank. IndusInd Bank. Twitter. Domino’s. Netflix. Amazon. Apple. Shopify. Having said that, smart bottom-up stock picking is great party talk, but that's not where your big returns will come from. It is just one component of asset allocation.

The bulk of your returns; around 80% - come from your asset allocation decisions. One must be tactically positioned in all asset classes to avoid taking unaudited exposure to any single class or country. To bring home the bacon, you need to be positioned tactically across the major country asset classes of equity, debt, gold, real estate or REITs, and even commodities or precious metals. That's where you will win or lose this game.

We moved into gold a short while back. We've been bullish on U.S. tech for years. We favoured select emerging markets like Russia, Brazil and Thailand. We had some country bonds which are up this year.

#3. NEVER assume that India is immune from a crisis.

Remember the Asian Financial Crisis in 1997-98? Currencies halved. Inflation spiked. Banks went bust. Government upheaval. Economic mayhem. Stock market collapses. It hit the Asian Tigers hard – Malaysia, Singapore, Indonesia, Thailand, but the ‘Asian Contagion’ was not restricted only to them. A neighboring country like Taiwan was not left unscathed despite being a pretty strong economy then.

Why would any economy be excluded from such a possibility? Think about it.

Has India earned any divine right never to have a crisis? Just because we have the highest per capita penetration of gods and goddesses in the world doesn’t exclude such a possibility.

Investing requires you to be agnostic. You need to be detached. You cannot become attached and think objectively. You cannot be permanently biased towards any asset class.

Never mix nationalism and investing. Don’t conflate nationalism and stock market investing.

Barring a handful of bottom-up stock picks, we avoided the bullish noise coming out of India. We looked the macro data, met company managements, spoke to players with skin in the game - distributors, vendors, suppliers, even customers, we looked at the macro, and concluded that we were headed for a pretty serious downturn.

With investing, it is never an “either-or” strategy. It is just a case for smart diversification: across countries, markets and asset classes. The actual quantum of exposure being another subject of discussion altogether.

Also Read:

How Shankar Sharma made money on the Amazon stock

How Shankar Sharma made money on the Twitter stock