So once again we are faced with a situation where a virus spooks markets across the globe.

Is China’s Coronavirus the next Black Swan? There is no answer. In a situation where the dynamics are changing daily, no one can respond with certainty. But worth reading is how Ray Dalio of Bridgewater Associates addresses this issue: I’m a “dumb sh**” when it comes to pandemics because what I don’t know about them is more important than what I do know.

In his brutally honest way, he went on to say that he is clueless as to the extent this virus will spread, where it will spread to, its economic and market impact.

Not completely related, but I’m reminded of Robert Shiller’s book Narrative Economics.

Narratives drive our lives. We use it to help us make savings plans and design our retirement savings strategy. But they also help propel major economic events and policies. A narrative or public sentiment gone viral drives investor behaviour. Even if it does not cause a recession, it can prolong or deepen it. Most are aware that human behaviour exert its own influence on the market. But Shiller goes much broader by showing how the stories we tell ourselves about the world drive our behaviour — and thus the world itself, if enough people buy into them. The stories people tell affect economic outcomes.

All that is known now is that the effects of the outbreak may push China's economy into a period of slower growth, with stocks trading lower as investors seek protection. Equity Research Analyst Chelsey Tam wrote about how certain companies are going to be badly hit by the Coronavirus outbreak.

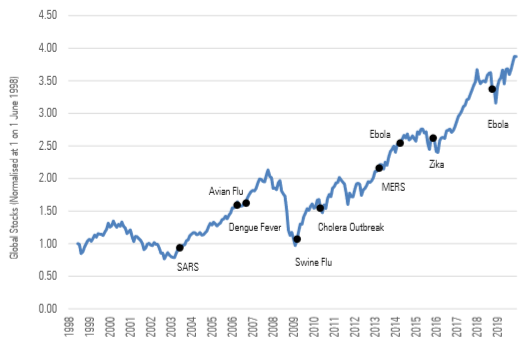

The Morningstar Investment Management team keeps a watchful eye on developments in over 250+ markets, looking at everything from fundamental risks to contrarian opportunities. Carolyn Szaflik, a portfolio specialist for MIM, looked at nine major outbreaks since 1998, and found that there is little evidence linking global epidemics with long-term investment fundamentals.

Here’s an extract from her article.

A peek into the past to predict the future

To understand the potential impacts of an outbreak, we must make a forecast—formally or casually. This is a complex task if done correctly. We are trying to peer into the future which is wrought with intellectual danger. No one can predict the future, but plenty of research suggests ways that forecasts can be improved.

One way to improve the accuracy of a forecast is to start with base rates.

How often do outbreaks become epidemics? What effect do epidemics have on economies or markets?

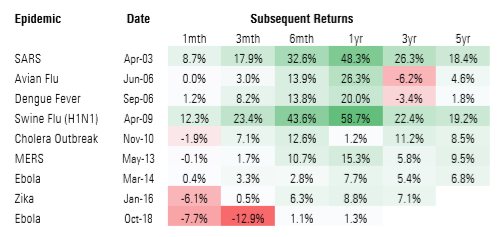

To answer, look at the visual below to gain a sense of base rates—market returns following major epidemics in recent history.

As depicted, market participants tend to react to such unforeseen outbreaks, but markets tend to recover by the six-month mark. This suggests that sentiment drives early losses, but sustained economic impacts are less than perhaps investors feared at the onset.

Another way to improve forecasts is through humility—especially knowing what you don't and can't know.

Expert epidemiologists might be able to produce base rates on spread rates, mortality rates, and so on, but no one can predict how unknowable factors might affect the spread of this or any outbreak. That's not to mention knowing how fear might affect markets.

What must investors do?

From an investor's perspective, we believe it is not time to act.

We certainly won’t be hitting the panic button and we hope you won’t either.

The Chinese economy may slow, perhaps even meaningfully, but that is not a reason to invest or divest. Long-term investing is often best disconnected from short-term economic reactions, so we implore investors to maintain their focus on what matters.

We are very watchful but are not taking any action.

We expect our holdings to deliver positive outcomes over the long term because they reflect a solid base of research and resemble a well-reasoned way to invest. It would require a clear impact on fundamentals for our view to change.

Once the facts change, we would expect to change our minds.

If we were to see a clear and significant potential impact on investment fundamentals, we would carefully study the situation, conduct rigorous scenario analysis, and try to incorporate the new information into our portfolios.

What are we looking at?

As long-term, valuation-driven, fundamentally based investors, our concern is any potential impact to businesses' cash flows. For example, will the collective impact of the outbreak (fewer flights, less trade, loss of productivity, etc.) affect a few businesses, a few industries, or entire markets? That's the question we are asking.

Our answer is that, at this stage, we have to assume the outbreak will take a similar path to other recent epidemics, and thus we feel there's no reason for investors to be alarmed.

Note that there's no "safe" approach for investors—for example, exiting stocks in favour of cash has its own risk, namely crystalizing any losses suffered to sentiment while almost surely missing out on a rebound if the virus were to be contained quickly. So, we want to proceed by assuming what we consider to be the most likely scenario while taking other possible outcomes into account.

How our global portfolios are positioned.

Across the portfolios we run, we do have a relatively small exposure to Chinese assets (both directly and indirectly) but remain confident these holdings will deliver positive outcomes for long-term investors.

While it remains very difficult to predict the impact that the coronavirus will ultimately have, it is worth highlighting that major equity markets (particularly U.S.) and developed bond markets, in general, are overvalued. This means that the risk of losing money is elevated and markets remain vulnerable to any bad news, whatever the cause.

In this regard, our portfolios remain defensively positioned, holding more cash than we otherwise might.

How the India Managed Portfolio is positioned.

We are underweight U.S. equities as a decade long bull market has left valuations stretched.

We are underweight Indian equities (particularly mid and small-caps) vis-à-vis neutral or benchmark allocation. We added allocation to Mid and Small-cap segments in the month of September 2019 (although we continue to remain marginally underweight) as our valuation-driven asset allocation process reflected value opportunity post recent downturn with the return profile improving.

On the fixed income side, we are currently overweight short- and medium-term debt segment as the real rates look attractive from a risk-reward perspective.