Yes Bank, Too Big to Fail? – What’s in it for Mutual Fund Investors?

“Too big to fail”, was a common term used during the global financial crisis in 2008 and more recently in India since the fallout of the IL&FS crisis. Yes Bank, India’s 4th largest Private Bank has been reeling under the stress of increasing bad loans. Several months of failed attempts of trying to raise capital has resulted in a continuing deterioration of the financial position of the Bank.

On 5th March 2020, Reserve Bank of India (RBI) imposed a Moratorium on Yes Bank stating as follows:

“The financial position of Yes Bank Ltd. (the bank) has undergone a steady decline largely due to inability of the bank to raise capital to address potential loan losses and resultant downgrades, triggering invocation of bond covenants by investors, and withdrawal of deposits. The bank has also experienced serious governance issues and practices in the recent years which have led to steady decline of the bank. The Reserve Bank has been in constant engagement with the bank’s management to find ways to strengthen its balance sheet and liquidity. The bank management had indicated to the Reserve Bank that it was in talks with various investors and they were likely to be successful. The bank was also engaged with a few private equity firms for exploring opportunities to infuse capital as per the filing in stock exchange dated February 12, 2020. These investors did hold discussions with senior officials of the Reserve Bank but for various reasons eventually did not infuse any capital. Since a bank and market led revival is a preferred option over a regulatory restructuring, the Reserve Bank made all efforts to facilitate such a process and gave adequate opportunity to the bank’s management to draw up a credible revival plan, which did not materialise. In the meantime, the bank was facing regular outflow of liquidity.

After taking into consideration these developments, the Reserve Bank came to the conclusion that in the absence of a credible revival plan, and in public interest and the interest of the bank’s depositors, it had no alternative but to apply to the Central Government for imposing a moratorium under section 45 of the Banking Regulation Act, 1949. Accordingly, the Central Government has imposed moratorium effective from today.”

The Moratorium comes with a withdrawal cap INR 50,000 and the bank board has also been superseded. Later in the day on 5th March State Bank of India (SBI) also announced that the bank Board had given an in principal approval to explore an investment opportunity in Yes Bank. RBI released a draft resolution for reconstruction of Yes Bank on 6th March announcing that SBI has expressed its willingness to participate in the reconstruction scheme in Yes Bank and will pick up at 49% stake in the reconstructed bank. The document also outlined that “The instruments qualifying as Additional Tier 1 capital, issued by the Yes Bank Ltd. Under Basel III framework, shall stand written down permanently, in full, with effect from the Appointed date”.

What does it mean for Mutual Fund Investors?

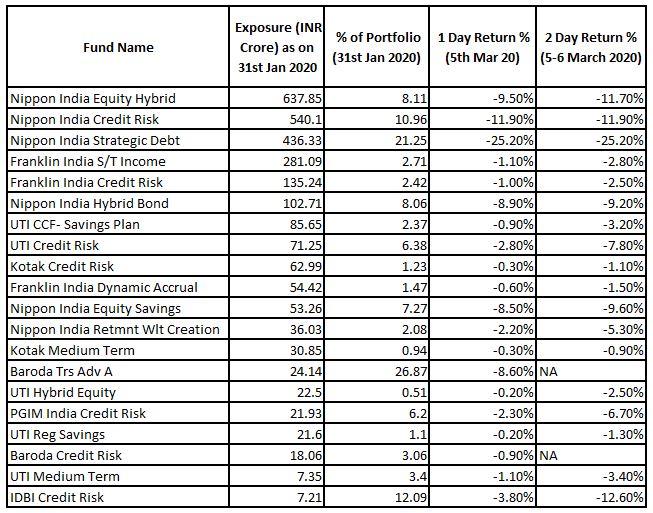

Several Mutual Funds across fund categories have exposure to Yes Bank bonds and stock in varying quantities. (See tables below). As expected, there was a sharp fall in Yes Bank stock prices on 6th March given these developments. In light of these developments the valuations of Yes Bank bonds were also marked down significantly by most fund houses, with Nippon marking the bonds down to zero on 5th March. On 6th March the ratings on Yes Bank instruments were downgraded to default by the ratings agencies. The draft resolution released by RBI states that all Additional Tier I Bonds issued under Basel III framework will be permanently written down. Given that majority of the Mutual Fund holdings are in these bonds, Mutual Funds have now marked down their holdings to zero and created segregated portfolios for these bonds. The NAVs of funds holding these bonds have already seen a significant impact between 5th to 6th March 2020.

Debt Holdings in Yes Bank Bonds & NAV impact (Top 20 Exposures):

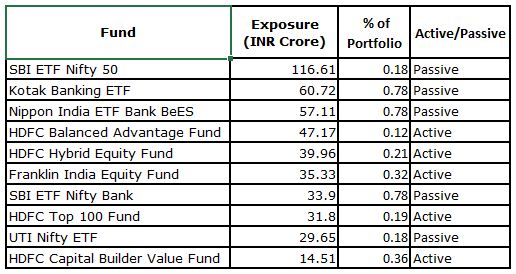

Equity Exposure in Yes Bank

Yes Bank is a part of several indices like the NIFTY, Bank NIFTY, Private Bank NIFTY, etc. Which resulted in several Passive Funds tracking these indices holding Yes Bank in their portfolios. A few active funds also have exposure to Yes Bank in their portfolios. Although the exposures for most funds is small (< 1%), thus the impact on the fund NAVs should be limited to that extent.

Top 10 Funds with Yes Bank Equity Exposure:

What next?

Given the systemic importance and the size of the balance sheet, the government and regulators will be in overdrive to find the best possible resolution in the interest of all parties involved, especially the deposit holders. The draft resolution by RBI proposes that all Additional Tier I Bonds issued under Basel III framework will be permanently written down to zero, this also triggered a downgrade to default rating by the rating agencies. Mutual Funds have marked down these to zero and moved the bonds into segregated portfolios. While the lenders may seek legal recourse given that Additional Tier I bonds are being proposed to be written off entirely, while equity continues to have some value. If the draft resolution does go through there will be no recovery in these bonds, which is also reflected in the NAV of the funds. With a sidepocket now being enabled, investors can then take a call depending upon their risk objectives regarding the continuing suitability of these funds in their portfolio.

Given the limited holding of Yes Bank stock in equity portfolios, equity investors are best advised to stay invested as the impact on their portfolios value purely from a fall in Yes Bank stock will be limited.

Other Aspects

Given the withdrawal cap of INR 50,000, investors currently using Yes Bank accounts for their Mutual Fund investments should immediately apply for a change of bank mandate to ensure smooth purchase, redemptions and SIP transactions from their accounts.