Mutual fund investors seem to be embracing volatility, which is evident by the rise in net inflows in February 2020.

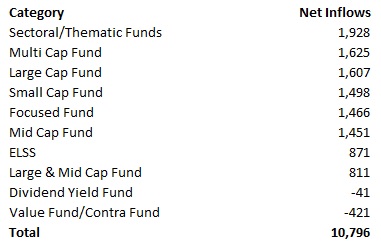

Net inflows in equity funds increased by 37% from Rs 7,877 crore in January 2020 to reach Rs 10,796 in February, when the Sensex dropped by 6%.

The inflows were spread out almost evenly among different categories of equity funds.

Investors rushed to the safety of gold amid heightened volatility in markets, which was evident by Rs 1,483.33 crore net inflow in February 2020.

Systematic investment flows also remained robust. “Continued vibrancy in monthly SIP flows at Rs 8,513 crore. Market indices have grown year-on-year by 6% against 15 % jump in MF industry AUM. We expect continued buoyancy in SIP flows in March too, though a few institutional investors may reassess their investment strategy, given the deep correction in markets. ELSS schemes continue to find favour with individual investors, with positive net flows at Rs 871 crores during the month, despite the Budget for 2020-21 proposing alternate simplified tax structure,” said N. S. Venkatesh, CEO, AMFI.

Banking and PSU Funds gain traction

Debt fuds witnessed outflows of Rs - 27,939.56 crore owing to net redemptions from liquid funds (Rs -43,825.43 crore). Low duration, money market and short duration funds saw combined net inflows of Rs 9,781 crore. Banking and PSU Funds continued to attract investor interest with net inflows of Rs 3,205 crore in February. Banking and PSU Funds assets now manage Rs 78,603.28 crore. It is now the seventh largest category in the debt funds space, surpassing the AUM of credit risk funds.

New Fund Offers

Combined inflows from new fund offers stood at Rs 19,168. A bulk of this was due to the launch of CPSE ETF FFO 6 which collected Rs 16,500 crore. IDFC Emerging Businesses Fund and ITI Small Cap Fund collected Rs 699 crore. Axis ESG Equity Fund collected Rs 1,715 crore.

Industry’s asset base touched a new high of Rs 28.28 lakh crore in February 2020.