Every investor should establish his or her portfolio against the framework of asset allocation. Why? Because we at Morningstar honestly do believe that the heavy lifting of any financial plan starts well before individual investment selection.

There is the view that the interconnectedness of various financial markets and economics diminishes the validity of this principle. There is truth to that. But there is also the other side of the coin which shows that benefits do exists. It lowers portfolio volatility and betters the results.

In 4 lessons the pandemic enforced, I explained this by referencing my portfolio. When I checked my portfolio after the market collapse, I braced myself for a gut-wrenching dip. I was pleasantly surprised to see it down by just 11.11%. My personal portfolio is allocated between fixed return investments (which includes my emergency fund), debt mutual funds, and equity (stocks and mutual funds). I have no exposure to gold, as of now. I then looked solely at the equity portion of my portfolio, and saw that the dip was 25%. If my entire portfolio was a pure equity play, I would be quite miserable.

Also, asset allocation puts boundaries in place that save us from extreme behaviour. For instance, it would prevent you from going all in during a frenzied bull run.

I would like to bring out a difference between asset allocation and diversification. Though they are often used interchangeably, they do not mean the same thing.

Asset allocation is the process of determining the right mix of investments you should own; your exposure to various asset classes – equity, debt, cash, property, commodities, precious metals. How you invest within them is diversification.

For instance, you may decide to allocate 65% of your portfolio to equity. That is asset allocation. You could break it up between a large cap fund and take a tactical bet on, say, a pharma fund. Or, you could invest in one large cap fund and one multi-cap fund. Or, you could put all of it into one stock (a very bad idea), or go to the other extreme and invest in 10 funds (another bad idea). The combinations are many. But the point I want to make is that you may get your asset allocation right, but could go horribly wrong on diversification.

Below, I reproduce the images and commentary put forth by the MORNINGSTAR INVESTMENT MANAGEMENT in India.

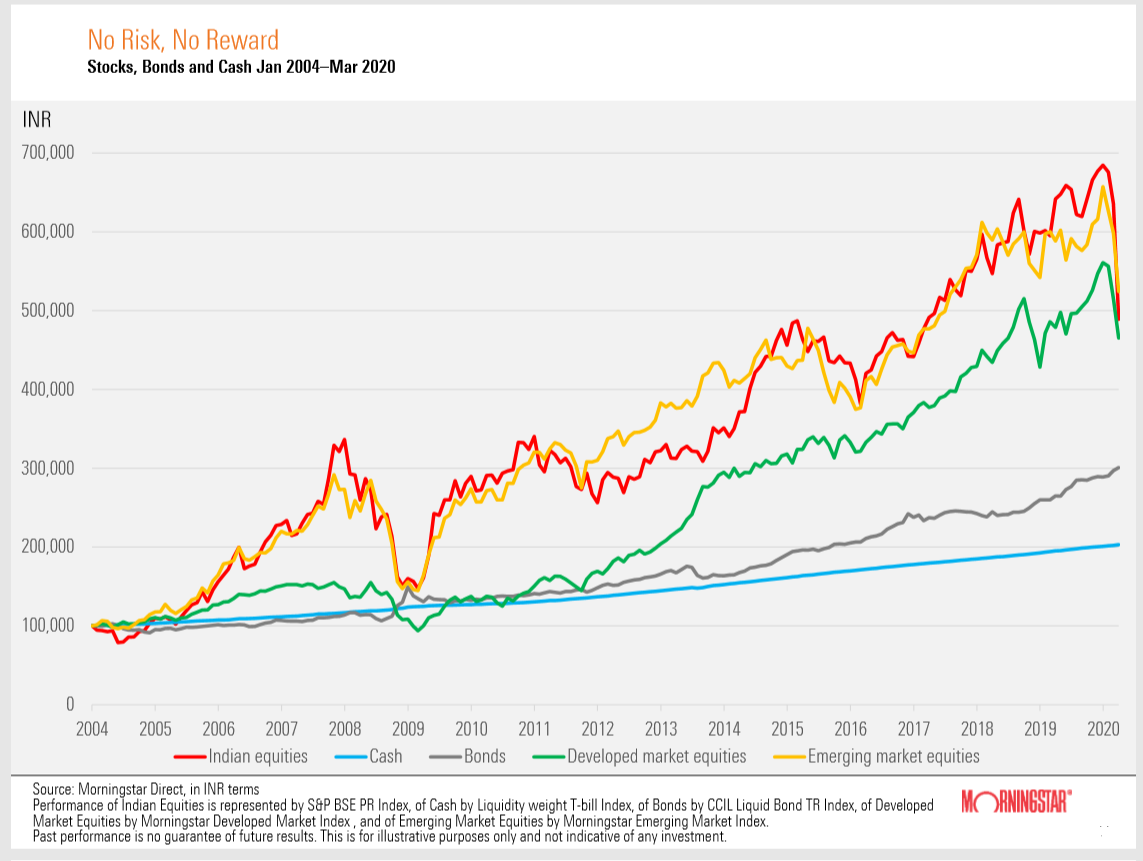

Diversification across geographies provides exposure to opportunities in other markets and acts as a hedge against currency risk.

No asset class has consistently outperformed on an annual basis, underscoring the need for diversification in a portfolio.

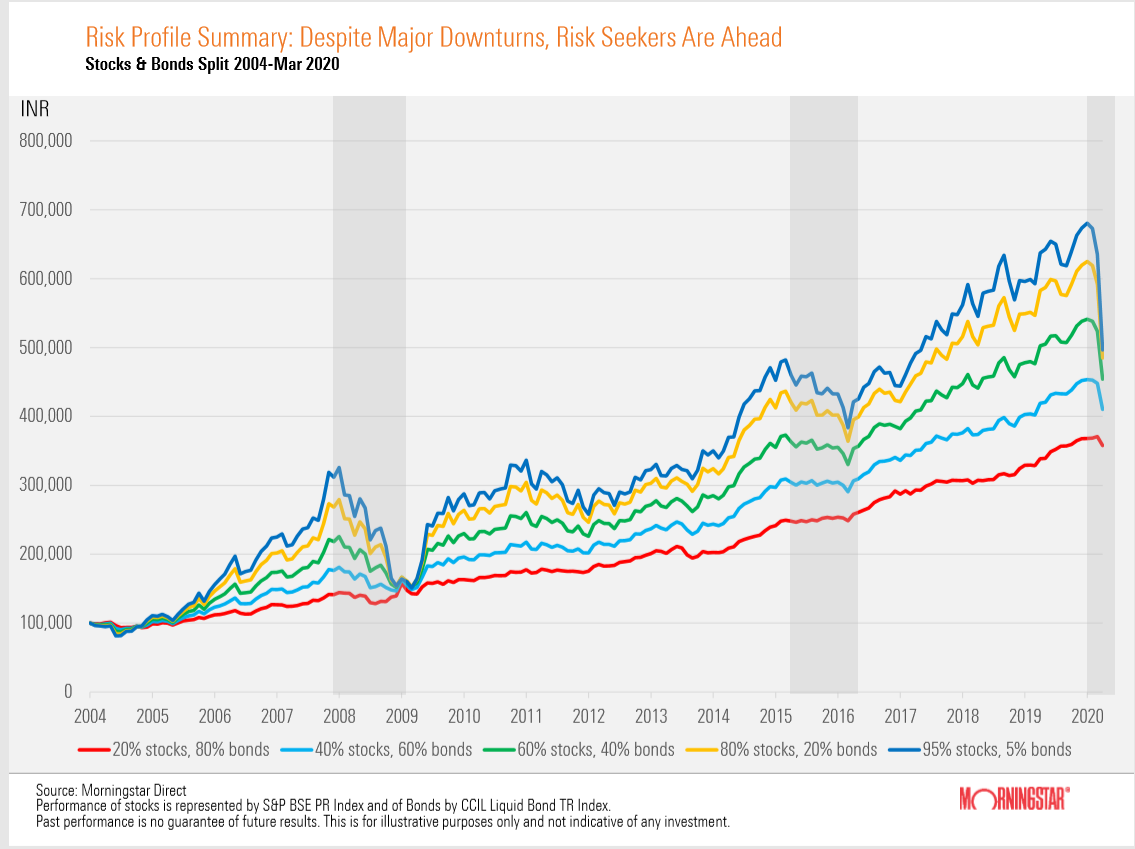

Differences in an investor’s stock/bond split can have a meaningful impact on the long-term outcomes. The last 20 years have witnessed major as well as smaller drawdowns. Yet, despite these setbacks, having a larger weighting to stocks has delivered a better net outcome. That’s not to say it always will, but historically these are facts.

Assets deliver higher returns due to the risk premium they offer, to compensate investors for the underlying risk of the investment. without taking risk. Risk and reward are connected in the long run. The chart shows that despite their higher risk/volatility and possible short-term underperformance, equities have outperformed lower risk assets significantly over long holding periods.