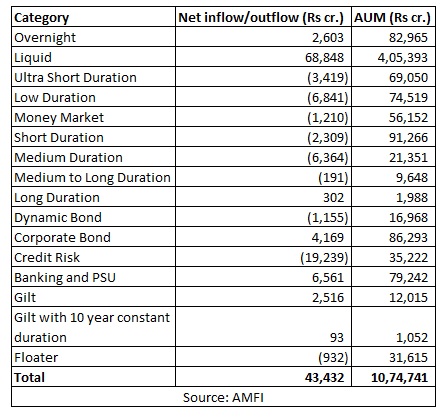

Net outflows from credit risk funds reached an all-time high of Rs 19,239 crore in April 2020 due to panic redemptions post Franklin Templeton’s decision to shut its six debt schemes. During FY19-20, credit risk funds saw outflows of Rs 28,028 crore. As a result, assets under management, or, AUM, in this category has dipped by 56% to Rs 35,222 crore in April 2020 from Rs 79,644 crore in April 2019.

Medium duration funds saw the second-largest net outflows at Rs 6,364 crore. Combined outflows from nine debt fund categories stood at Rs 41,660 crore.

Liquid funds received the highest net inflows at Rs 68,848 crore in April 2020, followed by Banking and PSU Funds (Rs 6,561 crore) and Corporate Bond Funds (Rs 4,169).

Close-ended debt funds saw net outflows to the tune of Rs 9,119 crore, mainly due to outflows from Fixed Term Plans.

Inflows in equity funds slow down

Net inflows in equity funds dropped by 47% to Rs 6,213 crore in April 2020 from Rs 11,723 crore in March 2020. Except dividend yield funds, all categories recorded net inflows.

Among Hybrid funds category, only arbitrage funds received net inflows of Rs 6,587 crore while other funds saw net outflows.

With assets under management at Rs 9,198 crore, Gold ETFs saw net inflows of Rs 731 crore. The yellow metal has delivered 46% absolute return over one-year period.

All in all, the industry received net inflows of Rs 45,999 crore in April 2020, largely on account of inflows in liquid funds. The industry’s asset base fell by 5% to Rs 23.52 lakh crore in April 2020 from Rs 24.70 lakh crore in March 2020.