When Finance Minister Nirmala Sitharaman announced a stimulus package to help India’s stalled economy recover from the pandemic lockdown, it was pegged at 10% of GDP, upfront it was a humongous effort.

In a recent Twitter thread on May 13, 2020, Trinh Nguyen, Senior Economist – Emerging Asia, Natixis, explained her thoughts on why the 10% fiscal stimulus could be misleading.

We have reproduced her views below.

The “10% of GDP stimulus” by India resembles Japan's “20% of GDP stimulus”, in that if you dig deeper, it is much smaller than it looks.

The word fiscal stimulus is used pretty loosely by Asian governments.

Let me break it down.

FISCAL

There are two sides to this: Taxation and Expenditure.

When the government lowers taxes or social security costs, it is lowering the burden on companies/individuals that are likely running a loss anyway. Hence, the benefit is marginal.

This is called discretionary support.

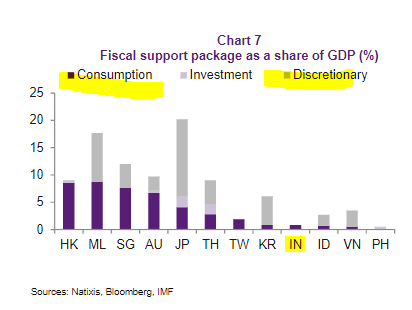

Here is a chart that breaks down fiscal support as a share of GDP by consumption and investment (actual on budget spending or expenditure support), and discretionary (revenue side support like lower taxes and social security requirement etc).

This is before the stimulus package.

Why do we distinguish between this?

Well, if you have income collapse, or shall I say DEMAND collapse, lowering taxes or social security requirements help on the margin but companies are running at a loss so they are not gonna spend more on this. Same with households.

So you need DEMAND.

The government can do consumption oriented or investment spending (the U.S. style cash-handouts and +2,400 dollars per month unemployment handouts on top of state, to make sure people got income to demand stuff).

Asia is more stingy. In Hong Kong, the announcement was made but has not found its way into the pockets of citizens.

MONETARY

Monetary policy can be broad-base or targeted.

Just because the central bank of a nation lowers key rates, it doesn't mean that it automatically gets transmitted into the economy. The VaR model may lead to transmission lags. Central banks may try to do targeted approach or even resort to direct lending to bypass this issue.

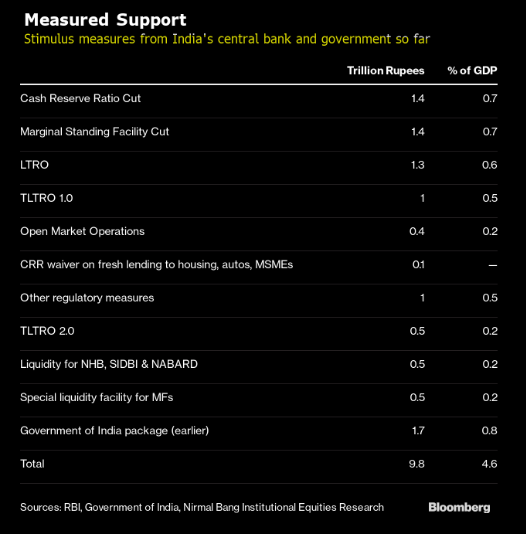

Monetary policy usually is not counted in fiscal.

When it comes to even fiscal, I am very stringent to count what's actually stimulative in terms of demand. And this is what the 10% of GDP adds up to.

Having said that, I would like to point out that most of the monetary policy has already been announced in the past.

So the 10% of GDP sounds a lot bigger than it really is because it includes previously announced monetary and fiscal measures.

So what really is new?

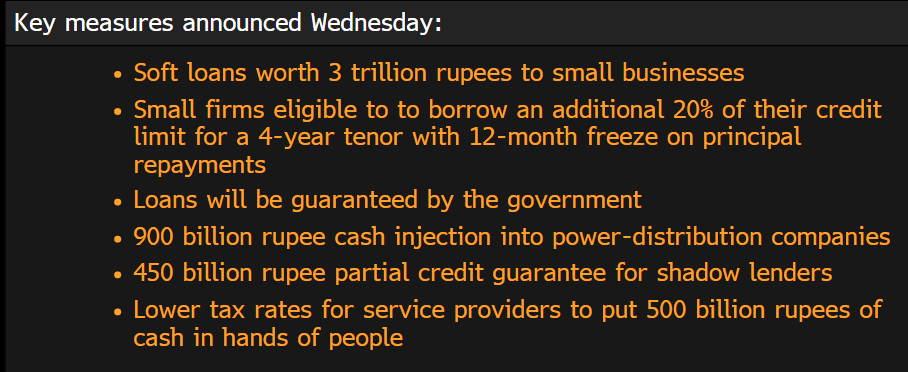

I am not for a moment saying that these measures are not important. They are very much so, especially because they focus on small businesses. We know that small businesses are KEY, but limited in access to credit.

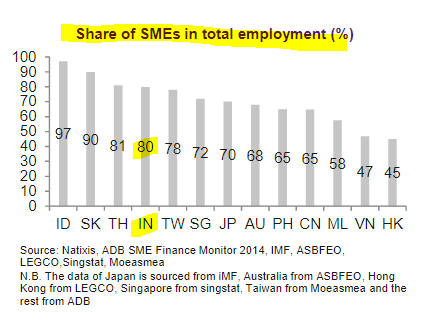

In India, small and medium enterprises (SMEs) employ 80% of total employment. So it is very crucial to lend to small firms (+$40 billion in unsecured loans).

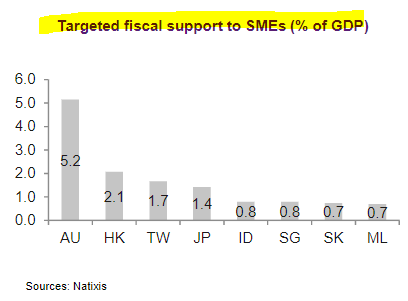

Here is the fiscal support for SMEs in Asia before India announced new measures. After the loan support, India would jump to the spot between Taiwan and Japan in terms of fiscal support for small firms.

In short, new measures are great and target where most vulnerable! But the meaning of it is not 10% of GDP fiscal stimulus but rather much smaller in support.

On May 14, 2020, Trinh Nguyen came out with a brief note.

A closer analysis of the 10% stimulus shows that it includes previous measures that amounted to 0.8% of GDP for fiscal and monetary policy easing, which the government counted as 3.8% of GDP.

The new measure is about 2.3% of GDP that includes SME non-collateralized loans guaranteed by the government, support for power distribution companies and relief for shadow banking. That means that we have about 3.1% of GDP left to be unveiled.

We argue that the actual fiscal impulse is much smaller than counted due to the discretionary nature of bank loans and monetary support that requires banks to be willing to have the risk appetite to lend. That said, the support for small Indian firms through government guaranteed unsecured loans means that it is targeting the back-bone of the Indian economy (80% of employment is in SMEs), which is helpful.

Given the limited support so far and the bulk of it discretionary in nature, we do not think the stimulus is proportional to the fall of demand and expect GDP to fall by -2% in 2020 and bounce back in 2021 to 5.2%.