My investment horizon is 7 to 10 years. Here are my current SIPs of Rs 3,000 each; I want to start two more.

- ICICI Prudential Banking and Financial Services

- ICICI Prudential Bluechip

- ICICI Multi Asset

- ICICI Prudential Technology

- Axis Mid Cap

- Axis Focused 25

- SBI Focused Equity

- SBI Multicap

- DSP Midcap

- Raju

Observations on your funds…

Overall, the funds in your portfolio are fine. Here are our views on select funds that we have analysed, along with the date of the analysis.

Observations on your asset allocation…

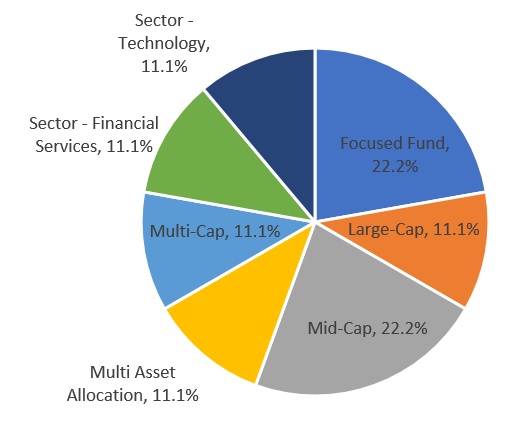

Your current asset allocation is:

- Equity: 91%

- Fixed Income: 7.6%

- Gold: 1.4%

This portfolio is highly skewed towards equity. While we acknowledge that your horizon is anywhere from 7 to 10 years, that does not negate the need for asset allocation. It is important to create some liquidity buffer by investing at least 10-15% in fixed income funds.

While you have some gold allocation through holdings in one of your funds, you can take the overall gold allocation up to 5% by investing in a Gold ETF. Gold acts as a good hedge in a portfolio.

Observations on the market-cap breakup…

The portfolio has a tilt towards large-cap stocks, which we think is prudent and we will continue to maintain that tilt. Large-cap fund give stability to a portfolio and provide a foundation upon which to build.

- Large Cap: 69.1%

- Mid Cap: 26.2%

- Small Cap: 4.7%

Observations on sector funds…

From a fund allocation perspective, you have a significant allocation to sector funds (22.2%). We recommend bringing this down to 5% per sector and not more than 10% of overall portfolio. Sector funds are a good vehicle to express a sector view but are also subject to cyclicality of returns.

The core part of your equity portfolio should be the foundation, and must always be through diversified equity funds, where a fund manager will express overweight/ underweight calls on sectors depending on his/her views.

A small satellite allocation to sector funds should only be made if you are able to take an informed view yourself when to enter and exit a sector fund.

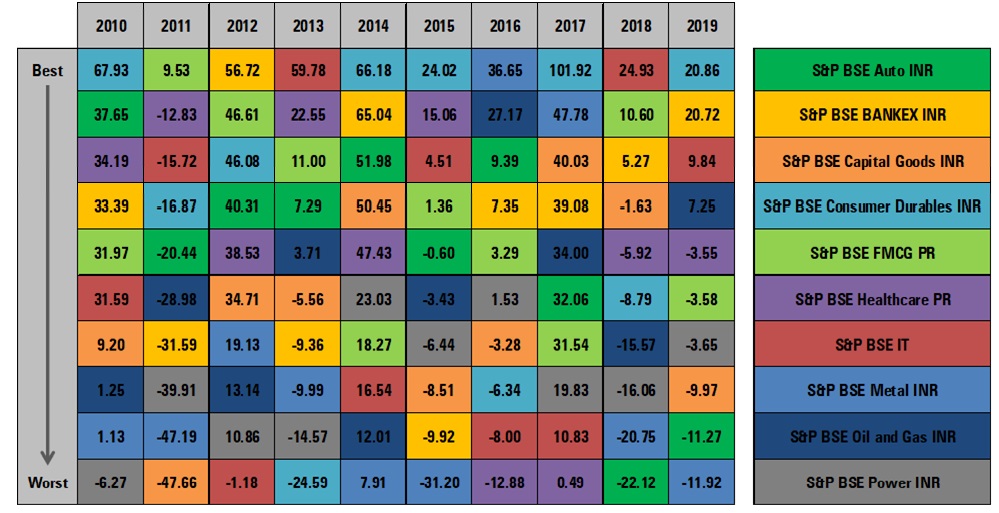

Here is an example of the calendar year returns of various sectors over the last 10 years, as you can see sectors will go through cycles:

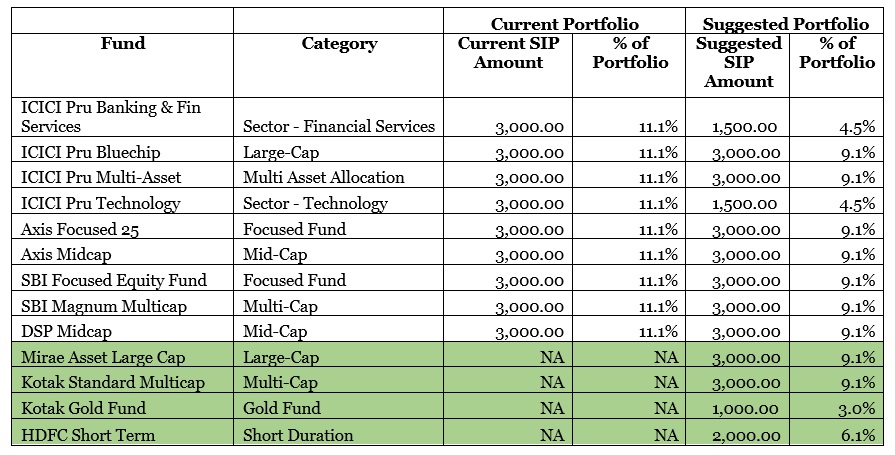

Suggested changes …

- Reduce SIP in ICICI Pru Banking & Financial Service and ICICI Pru Technology to a maximum Rs 1,500.

- Add SIP of Rs 3,000 in Mirae Asset Large Cap, Kotak Standard Multicap and HDFC Short Term.

- Add SIP of Rs 1,000 in Kotak Gold Fund.

Your new asset allocation:

- Equity: 83.2%

- Fixed Income: 12.4%

- Gold: 4.4%

You can post your query by accessing the Ask Morningstar tab. Our team will answer queries ONLY related to mutual funds and portfolio planning from our registered readers. We shall pick up selected queries to give a detailed answer.