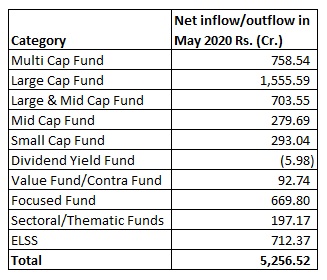

Net inflows in equity funds dipped by 15% from Rs 6,212.96 crore in April 2020 to Rs 5,256.52 crore in May 2020 as investors waited on the sidelines to make fresh allocations towards equities amid the Coronavirus pandemic.

Experts are recommending investors to invest in a staggered manner in this market. Also, advisers say that some investors are pausing their systematic investment plans due to cash flow shortages.

While governments around the world have announced stimulus packages to kickstart economies, there is no cure for the virus yet. The lockdown has taken a toll on the economy. An RBI survey estimates that gross domestic product, or GDP, is likely to contract by 1.5 % in 2020-21 but is expected to revert to growth terrain next year, when it is likely to grow by 7.2 %."

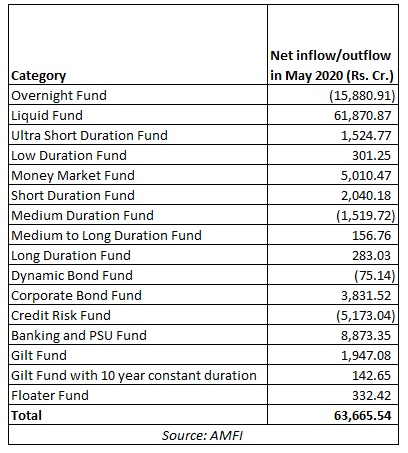

Debt Funds

Debt funds received net inflows of Rs 63,665.54 crore largely on account of inflows of Rs 61,870.87 crore in liquid funds and Banking & PSU Fund which received Rs 8,873.35 crore. Banking & PSU Funds manage assets worth Rs 89,944.83 crore as on May 2020.

Net outflows from credit risk funds abated from Rs - 9,238.98 crore in April to Rs - 5,173.04 crore in May 2020.

Among the hybrid category, arbitrage funds saw good traction with net inflows of Rs 10,806.16 crore in May 2020. All in all, the industry received net inflows of Rs 70,813.41 crore across categories in May 2020.

The average AUM of the industry stood at Rs 24.28 lakh crore in May 2020.