The global Coronavirus or COVID-19 pandemic continues to play havoc. The World Health Organisation (WHO) has signalled that this pathogen will be with us for a long time. The numbers of cases in India (and many parts of the world) are increasing by the day and there is no end in sight yet.

To contain the spread of this deadly pathogen, governments have extended lockdowns and travel bans continue in most regions. At present, as responsible citizens, following the necessary social distancing norms and lockdown rules is the only way forward.

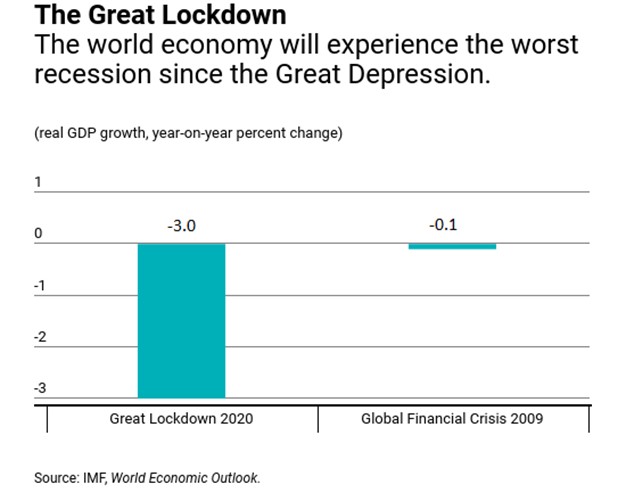

At some point in time, the lockdown will have to be lifted – after all people’s lives and livelihood are disrupted; a financial crisis is brewing.

But when exactly will the lockdown be lifted is unknown. And even after the lockdown is lifted, it will take quite some time (around 6 to 12 months) for normalcy to returns -- provided we do not have another wave of Coronavirus pandemic in the ensuing months.

Dr. Mike Ryan, the WHO’s Emergency Director, recently warned that coronavirus may never go away; which means it will turn to be an endemic virus.

So, it appears that we will have to live with the virus. To prevent infection social distancing and other precautions is the only way forward -- at least until an effective antidote is available. We indeed are sailing through challenging times.

We all are all in this together and to cope with the challenges, there are certain necessary changes you, as financial advisers need to make. Here are a few of them:

- Respect social distancing, follow hygiene standards and de-densify office space:

At the office, post lockdown for the well-being of your employees and clients, social distancing will need to be respected. Pursuantly, either you may need to build or buy more space, or de-densify and decentralise by allowing certain functions to ‘Work from Home’ and/or provide a flexible working environment.

Besides, for those who visit office -- be it your staff and/or your clients – acceptable sanitisation standards must be followed. These are of course propositions, but keep in mind the adage: an ounce of prevention is worth a pound of cure.

- Make efficient use of technology:

During the COVID-19 lockdown, many of us are successfully discharging our duties towards our valued investors with efficient use of technology. And, in turn, it has brought with it following key benefits:

- Reduced paperwork

- Saved precious time, and made it easy and convenient to transact

- Facilitated almost 24x7 access (as against being physically present in office)

- Eliminated personal biases

- Brought in more transparency for investors

- Reduced the conversion time

- Made it highly cost-efficient to conduct the business/advisory practice

- Added to your efficiency

- Gave us more time in hand to stay abreast with new developments in the industry, technology, and conduct

- comprehensive research

In a post-COVID-19 lockdown world too, technology will demonstrate to be an enabler. Try integrating technology in financial advisory practice – be it data software, CRM, etc. – that can help conduct the financial advisory practice/ mutual fund distribution business more efficiently and focus on serving clients promptly. Technology is the way forward.

- Make use of digital marketing and social media:

As you may know, people today (across age groups) spend a good amount of time on social media. During the lockdown, statistics show that average minutes per day on social media has almost doubled with a lot of individuals spending time on Facebook, Twitter, and WhatsApp – reading news, information and communicating with friends. This is also one of the best times to leverage on digital marketing to propagate your service and impress. This will potentially help you as financial advisers/ mutual fund distributor in the following ways:

- Open the gateway to a wider audience

- Identify the target audience and engage with them by building a community

- Sizzle by growing a brand presence and offering many more products/services

- Build brand equity

- Will serve to be a more economical medium of marketing vis-à-vis traditional marketing

Articulate your views via Twitter, WhatsApp, Telegram, LinkedIn, Facebook etc. Share videos, infographics, e-books, guides, articles, research findings, etc. to engage with prospects. At times, run a few dedicated social media campaigns to reach out to a targeted audience and build a community. You see, social media today is an influencer and with its efficient use, you can on-board new clients.

- Build robust processes & systems:

Keep in mind that companies which have grown in size and been able to weather all storms, is because of the robust investment processes & systems they adopted. So, alongside the use of social media and digital marketing, build robust investment processes and systems so that you can scale up your financial advisory practice/ mutual fund distribution business. Once the process & systems are set, the entire sales funnel is in place, all you ought to do is work efficiently to serve investors/clients. Hence, work on perfecting the processes & systems from one level to another now and in a post-COVID-19 environment.

- Back your recommendations with thorough research and be transparent:

It is possible that some of the investment recommendations you made in a pre-COVID-19 time, may not have performed very well. But before clients’ wealth is eroded further, review and cull out underperformers and replace them with better and suitable ones backed by thorough research. Given that the path to recovery is often not linear (there are challenges-- ups and downs), thorough unbiased research, proficient need-based advice, and transparency (with the best disclosure norms) will add to your credibility as a financial adviser in testing times.

- Handle clients with empathy and care:

Given that in this COVID-19 crisis, investors’ wealth is being eroded, plus the money tap in running thin (and in some cases dry) due to extended lockdowns, investors/clients are bound to have a barrage of questions. But address their concerns promptly, with enough empathy, care, diligence, and with ethics being the foundation stone. After all, it’s a relationship!

In times like these (and even in a post-COVID-19 environment), focus on client service. Set a process to handle client’s queries, so that scaling up operations is possible.

That being said, it is also possible that certain investors/clients require handholding and prudent counsel. Stand by them, and be a good counsellor, one who understands investors’ apprehensions and addresses their concerns. Serve investors/clients like a Financial Guardian. There is an old saying, “No one cares how much you know until he knows how much you care.” And remember, good service will always be appreciated and endorsed by clients.

- Set realistic return expectations:

The road to recovery from the COVID-19 pandemic is not going to be easy. So, make sure you have set realistic return expectations for clients. There is no point being optimistic or pessimistic, on the contrary, be realistic.

When investors/clients keep unrealistic expectations, educate them that risk and returns go hand-in-hand and how irrational exuberance can cost dearly. Do this by citing appropriate examples, and eventually, investors/clients will look up to you, their financial adviser/ mutual fund distributor, with trust and respect (as what doctors’ command). Do not simply push investment products; understand the needs of the investor/client -- his/her risk profile, the investment objectives, financial goals, the time to goal, and thereafter recommend investment avenues to accomplish those envisioned goals.

To conclude…

The battle against the Coronavirus pandemic is global and would continue. If advisers take the challenge as an opportunity, it would bring a positive change in the way you practice and/or conduct the business.

Wealth creation, as you know, is a journey – enjoy every twist and turn that comes your way – and profit from the processes in place. Furthermore, resort to judicious practices and follow high fiduciary standards in the financial advisory practice/ mutual fund distribution business and make a positive impact on the investors/clients. Earn their goodwill!

Like all other challenges, COVID-19 pandemic too shall pass one day and there will be bright and happy days ahead!

Until then, surround yourself with positive energy.