Global rating agency DBRS Morningstar assigned a BBB- rating to India. Economist and senior vice president, ROHINI MALKANI, shared her views during a webinar. The highlights have been reproduced below.

The pandemic has led to an unprecedented health crisis leading to an unprecedented economic crisis resulting in an unprecedented policy response.

The first quarter declines in real GDP have set records in countries that were first impacted by the virus. For instance, in China, first quarter GDP fell by 9.8%. On an annualised basis, it was 36.5%.

Italy, Spain and France witnessed first quarter GDP dip by 17% to 22% on an annualised basis.

Economies such as India which saw the spread of the virus in March, the second quarter numbers are expected to be adverse. With limited public health infrastructure, India had no option but to have a lockdown. Given the density of cities, social distancing has been a problem. India also had the deal with the unfortunate issue of migration of labourers.

Many highly rated governments have taken full advantage of the financial flexibility they have to come out with fiscal measure and there is probably room for more. However, some lower rated sovereigns, like India, are under pressure because of the limited fiscal space.

Going forward, the ultimate shape of the recovery will depend on the evolution of the pandemic and the public’s response. Everything is uncertain at this juncture.

Gross Domestic Product, GDP.

Growth had slowed to a decade low while India has limited fiscal space.

In addition, since FY17 we have witnessed growing stress in the financial system resulting in a flush of liquidity. Despite this, the credit growth has slowed to historic lows.

The International Monetary Fund (IMF) estimates India’s GDP growth contracting by 4.5% in FY21 before recovering to 6% in FY22. India’s deficit is expected to go up to double digits.

Consequently, the debt-to-GDP ratio will shoot up. The recovery will depend on the government’s ability to stimulate consumption and investment demand and sorting out of the issues in the financial system.

COVID-19 adds to the woes of the slowing economy.

India’s macro had seen a significant deterioration which COVID-19 is going to aggravate.

India entered the COVID world with growth slowing to a decade low of 4.2%. The slowdown is due to dip in both consumption and investment due to weak income growth, the stress in the financial sector and weak global demand.

We are looking at a sharp contraction in GDP. IMF predicts it to be at -4.5% this fiscal year. All the factors which impacted growth in the last 1.5 years are probably going to get worse.

Consumption will be impacted by social distancing, weak labour market and lower remittances. As regards investments, shutdown, weak business confidence and the core issue of financial stress have still not been resolved.

India’s fiscal situation worsens. COVID-19 exacerbates fiscal weakness and limits direct fiscal response.

On the external side, the demand is likely to be subdued due to supply chain disruptions as well as depressed demand.

Historically, India has had a high deficit. Over the last two decades, the average deficit has been around 7.5%. In FY20, there was a huge fiscal slippage at the central government level attributed to lower revenues.

COVID-19 has resulted in a difficult dilemma for all governments. Most advanced sovereigns do have the fiscal space, but it is very difficult for lower rated sovereigns do much.

In response to COVID-19, the government has come out with a direct fiscal stimulus package which is around 1% of GDP. As a result, we would see central government deficit shoot up from the budgeted 3.5% to 7% largely because of the contraction of growth which will impact tax revenue and a shortfall in non-tax revenue arising due to non-achievement of spectrum sales and privatisation targets.

The centre’s deficit is likely to be around 7%, state government will also see slippage because health expenditure is on the state level. The combined deficit will be around 12%.

High deficit combined with contraction in growth will result in debt ratios going high. IMF said that all countries are likely to see a significant increase in their debt ratios. India’s debt-to-GDP ratio has averaged around 69% for the last decade. For March 2020, it was 71%. COVID-19 will increase it further by 8%.

The key drivers for the growth going forward will be the pace of economic recovery and fiscal consolidation. India’s medium-term growth prospects are key.

The key for debt dynamics is medium-term growth potential.

This is one side where the government needs to take action.

While India’s overall financial system is relatively healthy, there are pockets of stress in the financial sector that have affected monetary policy transmission. This has resulted in credit growth slowing to 6.2% which in turn has taken a toll on the economy. For the financial sector to support recovery, it is imperative that policymakers tackle the impediments that have resulted in a deceleration of credit growth.

Could financial stress be India’s Achilles’ Heel?

Even prior to this pandemic, non-performing assets have been a problem. While RBI has done a detailed asset quality review (AQR) of banks, Non-Banking Financial Companies (NBFCs) which account for 20% of the financial system have not yet undergone a full-fledged AQR.

The government has to implement some of the measures it had announced. They have given 100% credit guarantee to Micro, Small and Medium Enterprises (MSME) sector. They have also offered a special liquidity scheme. These steps indicate that the government is willing to absorb credit risk. An effective and efficient implementation would be key to infuse liquidity to sectors that need it the most.

India’s external position has improved.

There has been a significant improvement since the taper tantrum of 2013. Low current account deficit combined with buoyant capital inflows have boosted international reserves.

India’s comfortable foreign exchange reserves, coupled with exchange rate flexibility and low external debt, provide buffers in the event of global market volatility. This reduces the country’s external vulnerability.

Structural Issues.

Positive: The government is simplifying business regulation; easing restrictions on foreign direct investments and has reduced corporate tax rates. The announcements on the agricultural sector could be transformative if implemented well.

Negative: While India has made good progress in ease of doing business, there has been very little improvement in starting businesses and enforcing contracts.

The BBB- rating.

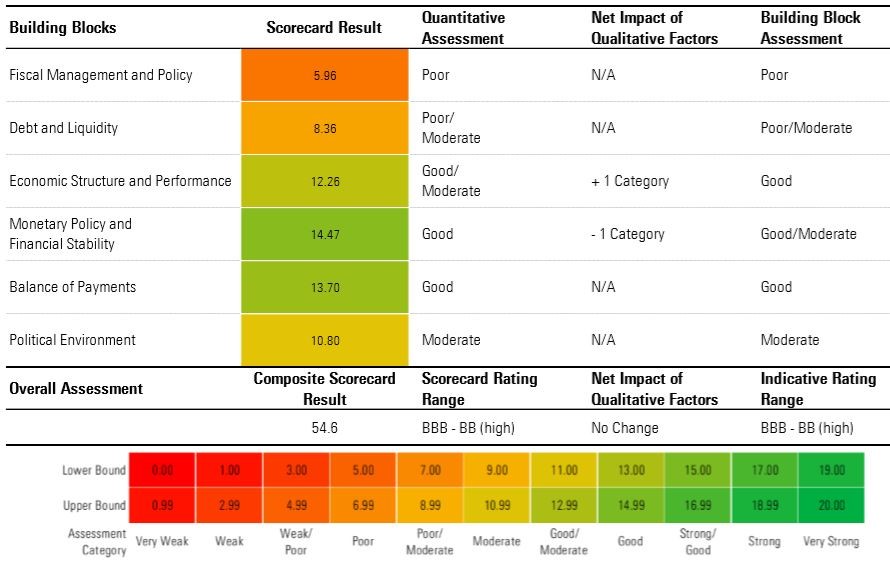

When applying the 6 building block assessment parameters, India’s score in fiscal management and policy was the lowest among all countries DBRS rates.

Here is a graphical representation on what led to the triple B sovereign credit rating to India, negative trend. While the government remains committed on macro policies, a severe COVID shock and weaker recovery prospect could have an even more adverse impact on the rating.

Click to enlarge image.