The mutual fund industry added 11.13 lakh folios while the assets under management increased by Rs 2.54 lakh crore from Rs 23.52 lakh crore to Rs 26 lakh crore during June quarter 2020, shows the latest Association of Mutual Funds in India (AMFI) data.

Equity

Equity funds (excluding ELSS) added 4.68 lakh folios during June quarter. As a result, the equity folio base went up from 6.32 crore to 6.37 crore during this period.

The largest number of folios were added in the large-cap category (1.72 lakh), followed by Sectoral/thematic funds (93,799) and Multi caps (84,590). Value/Contra, Small Cap and Dividend Yield Funds saw a decline in the folio base.

The AUM of equity funds increased by Rs 77,897 crore from Rs 6.11 lakh crore to Rs 6.89 lakh crore in June quarter.

Debt

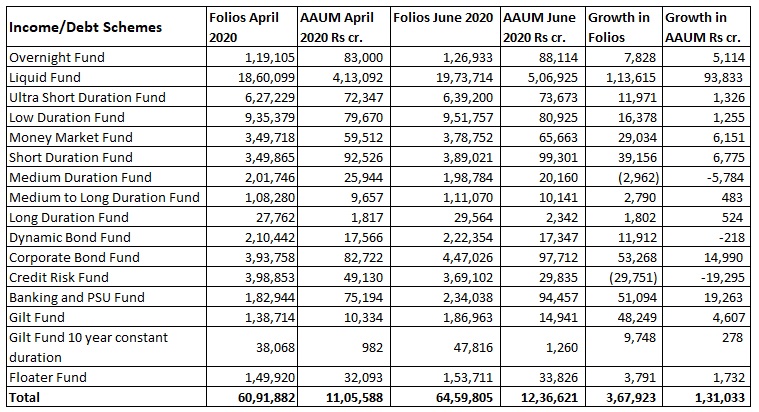

Liquid funds added the most folios at 1.13 lakhs in June quarter. Corporate Bond Fund and PSU Banking Funds saw a growth of 53,268 and 51,094 folios respectively during the same period.

Banking and PSU Funds category added Rs 19,263 crore assets in June quarter, taking its asset base to Rs 94,457 crore.

Similarly, Gilt funds added 48,249 folios in June quarter. The category has been gaining traction due to the attractive returns delivered on account of falling interest rates. Gilt funds with 10-year government bond holding have delivered 13% return over the past one year.

Corporate bond funds have delivered 10% return in the past one year. Advisers say that an inclination towards safety of AAA paper and lucrative past returns is making investors rush to this category. This category saw a growth of 53,268 folios while the AUM increased by Rs 14,989 crore during the June quarter.

Credit risk funds lost -29,751 folios while its asset base dipped by Rs -19,295 crore.

Overall, debt funds added Rs 1.31 lakh crore assets while folios grew by 3.67 lakh in June quarter. The growth in AUM was primarily due to inflows in liquid funds. Corporate Bond Funds and Banking and PSU Funds collectively contributed Rs 34,253 crore in June quarter.

Hybrid

Dynamic Asset Allocation Funds/Balanced Advantage Funds added 12,149 folios while their AUM grew by Rs 5,237 crore during the June quarter. Dynamic funds change their equity/debt allocation based on the valuations of the market.

Arbitrage funds added 41,857 folios while the AUM grew by Rs 18,126 crore in June quarter. These funds simultaneously buy and sell securities in cash and futures markets to take advantage of different prices.

Passive Funds

Passive Funds added 4.14 lakh folios in June quarter. A majority of the folios (2.60 lakh) were created in Other ETFs category. Gold ETFs added 64,980 folios while index funds added 53,709 folios.