I started systematically investing Rs 1,000 every month in a mutual fund. Over 3 years, the total invested amount is Rs 36,000 and the current value is about the same. No profit. No loss.

My question is, if today someone invests Rs 36,000 lumpsum in the same scheme of the same fund, would it be the same as I did in the form of SIP 36 months ago?

Technically, yes.

If someone invests in the same fund today, their purchase Net Asset Value, or NAV, will be similar to your weighted average purchase NAV for over the last 3 years (since you mentioned your portfolio is more or less at no profit or no loss).

But reality is different.

It is important to note you are speaking from the benefit of hindsight. Market movement is never a straight line, rather it is a series of ups and downs (typically defined as volatility). Thus, in the short term, it is likely that the current value of your investments could be the same or in many cases even lower than the purchase price. But over the longer term you should expect to make reasonable returns on your equity investments.

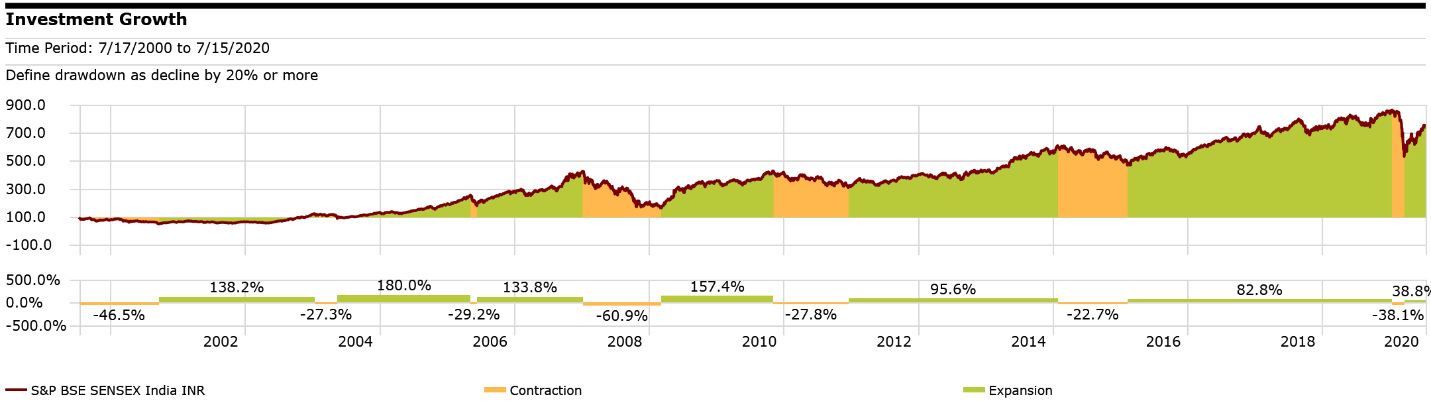

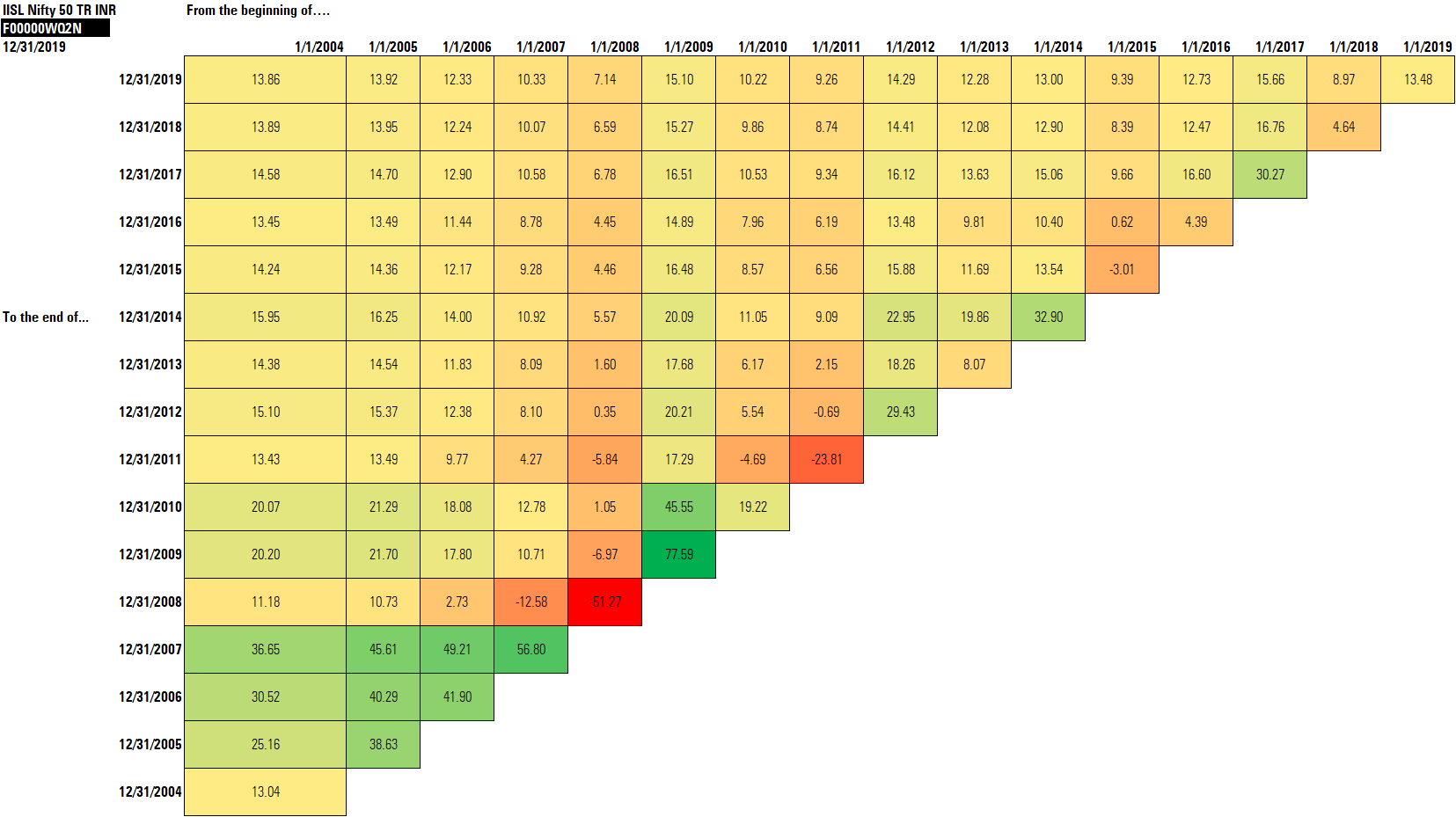

The two visual representations (click to enlarge) will emphasize the importance of thinking long term (7-10 years at the least) when investing in equities.

SENSEX

Over the last 20 years, there have been multiple occasions where the market fell more than 20% from the peak and could have taken some time to recover. Over the longer term, returns have been reasonable.

NIFTY

Observe the return over varying time periods. As the holding period increases, the range of return narrows, but there is a greater probability of positive returns.

Keep these simple rules in mind while investing in equities:

- A long-term investment horizon

- Invest regularly through SIPs to reduce market timing risk

- Be mentally prepared for potentially large drawdowns in the short term

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries ONLY relating to mutual funds and portfolio planning.