In 1997, Amazon’s IPO was priced $18/share. In 2020, Amazon is trading at over $3,300/share.

Had you invested in the company’s IPO, imagine the vast amount of wealth you would have accumulated.

Let’s go one step further and consider the stock splits (two of the splits were 2-for-1, while the other was a 3-for-1 split.) Now the fantasy gets even more pronounced.

But for this flight of fancy to be probable, a number of ingredients are expected to blend together. You would have needed money to invest. Remember, this was way back in 1997. Even if you did have the money, you would have to possess deep faith in the brand and its potential for disruption. Then there is the patience to hang on through many volatile markets. Also, you should not have found yourself in a position where you were required to sell the shares for want of cash.

Last week, there were a number of tweets singing the same song with HDFC Bank. The bank celebrated 25 years of being listed in May.

The essence of the tweets were: Without dividends reinvested, the CAGR is 25%. With dividends reinvested, the CAGR is 30%. Maximum price correction has been 55%. A Rs 1 crore investment during the IPO would be worth Rs 800 crores today.

Basavaraj Tonagatti of BasuNivesh decided to crunch the numbers.

Here again, the above assumptions hold.

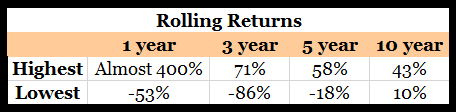

Looking at the returns, it was obvious that there was a fair amount of volatility. Would you have been able to hold on steadfast to your investment?

Over these 25 years, would you not have needed the money at any given point in time? Would you not have been tempted to sell earlier not knowing if the future would support such a price? Would there be no point in time where you felt that the stock was overvalued and it would make sense to exit?

Now that we know how the story played out, we can convince ourselves of our behaviour. But reality could have been different.

Twenty five years ago, would you have had Rs 1 crore to invest in just one single stock? Or, even Rs 1 lakh? The value of that amount, assuming an inflation rate of 6% per annum, would be Rs 4.3 crore or Rs 1 crore, respectively, in today’s terms. Would you have had the courage to invest such a huge amount in an IPO?

Most importantly, you might have not got an allotment. HDFC Bank went public in 1995. The Rs 50-crore initial public offer (5 crore equity shares at Rs 10 each at par) was oversubscribed 55 times, and listed at around Rs 40 per share.

Such stories make for great reading but there are plenty of mishaps that are conveniently relegated to the dustbins of history.