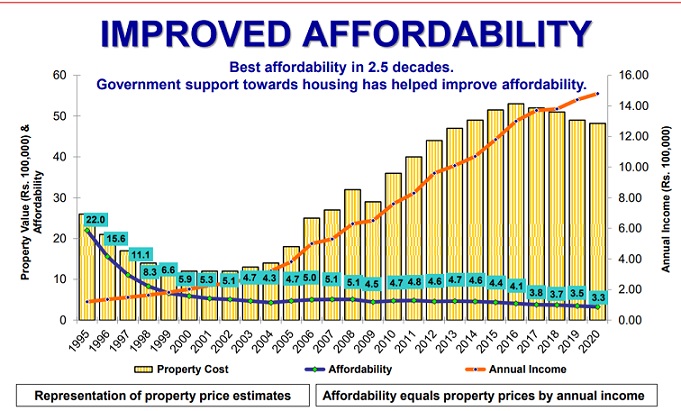

According to data from HDFC, affordability of a home has risen over the years. In 2020, the average home price stands at around Rs 50 lakh, and the average annual income, Rs 15 lakh. Hence, the affordability factor is at 3.3.

Affordability = price of home / annual income of the purchaser.

However, economic commentator Vivek Kaul points out to a very pertinent factor. The data used in the chart is based solely on HDFC’s historical customer data. Hence, the conclusion arrived at is based on that very limited sample.

In July 2019, a survey by the Reserve Bank of India pointed out that housing has become less affordable over the prior four years. The study measured affordability by comparing the price to monthly income of average home loan borrowers.

- The cities surveyed were 13: Mumbai, Chennai, Delhi, Bengaluru, Hyderabad, Kolkata, Pune, Jaipur, Chandigarh, Ahmedabad, Lucknow, Bhopal, Bhubaneswar. Mumbai was the least affordable, and Bhubaneswar the cheapest.

- The house price to income ratio increased from 56.1 (March 2015) to 61.5 (March 2019).

- The loan to income ratio increased from 3 (March 2015) to 3.4 (March 2019).

- The loan to value ratio moved from 67.7% (March 2015) to 69.6% (March 2019). A spike in this ratio reflects lenders taking higher risks as they would have a lower security if real estate prices crash.

While one can reach different conclusions based on the above, the reality is that the pandemic has hit real estate adversely.

According to the RBI’s Financial Stability Report, house sales and launches, which declined by 16% and 35% (y-o-y) during the third quarter of FY20, were pulled down by around 26% and 51% respectively, during the fourth quarter.

A nation-wide ebbing of consumer confidence triggered a preference for purchase of completed houses, which adversely affected the sale of under-construction houses.

According to PropTiger, 19,038 units were sold during April-June 2020, compared to 92,764 units during the same quarter last year.