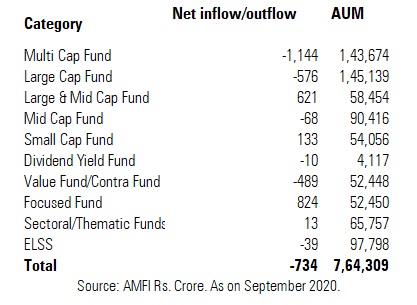

Net outflows from equity funds subsided to Rs 734 crore in September 2020 from Rs 4,000 crore in August 2020.

Multi cap funds saw the highest outflows at Rs - 1,144 crore in September 2020. In September 2020, the Securities and Exchange Board of India, or SEBI, mandated fund houses to invest a minimum of 25% each in large, mid and small cap stocks, from January 2020, limiting the flexibility available to fund managers to invest where they see value. Clarity is still awaited on the final rules as the industry body Association of Mutual Funds in India, or AMFI, has shared its feedback with SEBI on this issue.

Inflows from systematic investment plans, or SIPs, stood at Rs 7,788 crore in September 2020. Net inflows from SIPs have dropped from the 8,000 crore levels. In March 2020, SIP collection peaked at Rs 8,641 crore. Despite the marginal drop in SIP inflows, the SIP folio base continued to increase. The total number of SIP accounts increased from 3.31 crore in August 2020 to reach 3.33 crore in September 2020.

“Regular investing through SIP route has remained robust. This is demonstrated by the healthy growth in number of SIP folios as well as by the monthly flows which seems to have stabilized. It appears that interest in equity mutual fund schemes is seeing a good revival. Mobilisation into open ended equity schemes in September has been the highest in the current financial year. The number of folios in the industry as a whole and specifically in equity funds has also gone up significantly,” said G Pradeepkumar, CEO, Union Mutual Fund.

The recovery in markets seems to have made investors return to equity funds. The markets are back to pre-COVID level as the BSE has crossed the 40,000 mark. Gross sales of equity funds increased from Rs 14,558 crore in August 2020 to Rs 16,951 crore in September 2020.

Equity funds manage assets worth Rs 7.64 lakh crore as of September 2020.

"With a net inflow of Rs 823 crore, focused fund category was the biggest beneficiary during the month, followed by large & mid-cap fund (net inflow of Rs 621 crore). Both the categories have seen launch of new funds which garnered good traction from investors. Additionally, uncertainty around the multi-cap category would have prompted investors to focus on categories such as large & mid cap instead," said Himanshu Srivastava, Associate Director - Manager Research, Morningstar Investment Advisers India.

New fund offers

There were seven new fund launches in September 2020 which mopped up Rs 3,474 crore. Axis Global Equity Alpha Fund of Fund collected Rs 1,181 crore while Invesco India Focused 20 Equity Fund mopped up Rs 602 crore.

Debt funds

Due to quarter end, liquid funds saw Rs -65,952 crore worth net outflow in September 2020. Categories like Ultra Short Duration Fund and Money Market Fund saw net outflows of Rs -4,867 crore and Rs -4,857 crore, respectively.

Banking and PSU Fund, which manage Rs 1.11 lakh crore worth assets, continued to gain traction among investors as the category received inflows of Rs 6,416 crore in September 2020. Investors are rushing to safer avenues that offer high credit quality issuers. “On the fixed income side there appears to be a preference for schemes with good credit quality which can offer reasonable returns e.g. Banking and PSU Fund, Medium Duration Fund, Corporate Bond Fund etc. are gaining traction,” added Pradeepkumar.

Floater funds category received Rs 5,199 crore in September 2020. “These funds are being managed like fixed maturity plans by a few funds. Some funds adopt a run-down strategy so there is predictability of returns. They maintain a constant maturity. Investors get a guidance on what returns they can expect,” said a Mumbai-based distributor.

HDFC Floating Rate Fund is the largest fund in this category. The fund’s AUM has increased from Rs 10,681 crore in August 2020 to Rs 13,351 crore in September 2020.

Medium Duration

Himanshu observes that the flows into Medium Duration category have stabilized over the last three months. While the category received net inflows of Rs 379 crore in July and Rs 1002 crore in August; it received a robust net inflow of Rs 1,304 crore in September. This category houses some credit-oriented strategies and suffered significantly during the March, April and May period of credit crisis. From March 2020 till June 2020, the category witnessed a net outflow of Rs 10,274 crore. However, since then, the credit profile of these funds has improved with higher investments in AAA or equivalent rated securities. Also, on the duration front, the category is positioned well in the current environment. This would have prompted investors to have a relook at the category."

Fund of funds investing overseas

International diversification has caught the fancy of investors after a sharp rally in the U.S market. The rush towards diversifying outside Indian markets is evident by the rapid growth in AUM of this category. The AUM of international fund of funds has increased by 188% from Rs 2,254 crore in August 2020 to reach Rs 6,497 crore in September 2020.

International fund of funds tracking the U.S. market have generated returns in the range of 20% to 50% in the last year.

Overall, the industry’s asset base fell by 2% from Rs 27.49 lakh crore in August 2020 to Rs 26.85 lakh crore in September owing to outflows from liquid funds.