The mutual fund industry has clocked 7% growth or added assets worth Rs 1.91 lakh crore, from Rs 25.68 lakh crore in September 2019 to Rs 27.60 lakh crore in September 2020.

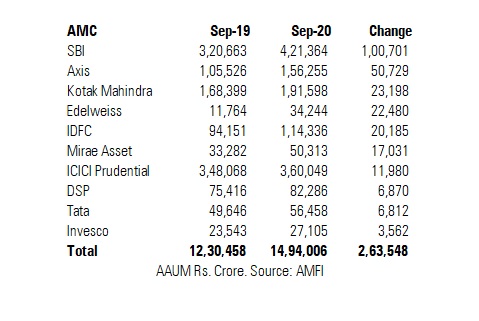

Here are ten fund houses that witnessed the highest growth in their assets in one year.

SBI Mutual Fund occupied the first position. The fund house received the highest inflows of Rs 1 lakh crore as its asset base jumped from Rs 3.20 lakh crore in September 2019 to Rs 4.21 lakh crore in September 2020. "The gain of assets has happened across asset classes and channels. SBI MF has outperformed in the industry in overall inflows and we have got over 50% of the industry inflows during this period," said D. P. Singh, Chief Business Officer, SBI Mutual Fund.

Kaustubh Belapurkar, Director – Manager Research, Morningstar Investment Advisers India, noted that a combination of process-driven fund management, consistency in performance, flows from EPFO, and a strong distribution network has helped the fund house reach the top position.

The second highest growth was recorded by Axis AMC. Its average assets under management (AAUM) increased from Rs 1.05 lakh crore in September 2019 to Rs 1.56 lakh crore in September 2020. Raghav Iyengar, Chief Business Officer, Axis Mutual Fund, said that the fund house has received inflows across schemes - Axis Bluechip, Axis Long Term Equity, Axis Banking & PSU Debt Fund and Axis Short Term Fund. Axis MF’s recent new fund offers have met with good response from investors. The fund house launched Axis ESG fund in February 2020 which mopped up Rs 1,715 crore. In September 2020, it launched Axis Axis Global Equity Alpha Fund of Fund which collected Rs 1,181 crore.

Kotak Mahindra AMC occupied the third spot. Its AAUM increased by Rs 23,198 crore, from 1.68 lakh crore to Rs 1.91 lakh crore during the same period. The fourth highest growth in AAUM was recorded by Edelweiss AMC. Its asset base increased by Rs 22,480 crore from Rs 11,764 crore to Rs 34,244 crore. Edelweiss launched Bharat Bond ETF - April 2023 and Bharat Bond ETF - April 2030 in December 2019 which garnered Rs 12,378 crore in its new fund offer, or NFO. The second tranche - BHARAT Bond ETF - April 2025 and BHARAT Bond ETF - April 2031, launched in July 2020 collected Rs 11,024 crore.

IDFC AMC recorded the fifth highest AAUM growth of Rs 20,185 crore.

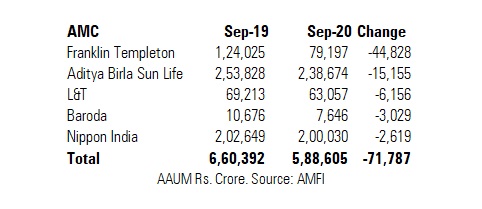

Highest outflows

Franklin Templeton AMC shut its six debt schemes in April 2020 citing heightened redemption pressure and lack of liquidity in the bond market. The fund house has seen an erosion of Rs -44,828 crore worth assets in the last one year. Its AAUM has plunged from Rs 1.24 lakh crore in September 2019 to Rs 79,197 crore in September 2020.

Aditya Birla Sun Life AMC saw the second biggest dip. Its asset base decreased by Rs -15,155 crore, from Rs 2.53 lakh crore to Rs 2.38 lakh crore during the same period. L&T AMC recorded the third-largest dip in its asset base. Its AAUM fell from Rs 69,213 crore in September 2019 to Rs 63,057 crore in September 2020.

Besides inflows and outflows, the AAUM figures reflect mark to market gains and losses too.