At the Morningstar Investment Conference, Lawrence (Larry) Siegal and Paul Kaplan shared their views on prior market crashes. Below are three pertinent observations.

In the light of history, this pandemic-induced market volatility has no comparison.

Many investors are scouring the historical record for precedents. In reality, we have nothing to compare it to.

The plague killed a third of Europe’s population and did it again 300 years later, though not quite as bad. You can read more in 5 worst pandemics, but this is nothing compared to those in terms of devastation. More recently, we had the Spanish Influenza pandemic of 1918.

But the economic consequences are probably worse cause the economy was shut down. The world has experienced pandemics before, but never a government-invoked lockdown of economies. That too, across almost the entire world, more or less in concert.

It may or may not be justified. We cannot really know. But it is the recovery after the crash that is the big puzzle.

Have a perspective when it comes to bad news.

The stock market is the only store that has everyone running out of when it has a sale. That is the time everyone should be running into the store. Buy when cheap and buy less when things get expensive.

There is always a very clear bias towards bad news that is reflected in market volatility. Investors should not react to every blip in the market, large or small, up or down.

The world has had and will continue to have pandemics, wars, depressions, downturns, and once over we move on to new highs. The world continues to move on. And over decades, we have substantial improvements in the way we live. We do have better standards of living than our ancestors.

Bad news gets the headlines and mind share but we are making steady and slow progress that is more difficult to discern.

Black Swan or Black Turkey?

During the global financial crisis, or GFC, some observers described the events that unfolded as a “black swan,” meaning a unique negative event that couldn’t be foreseen because nothing similar had happened before. But data demonstrates a long history of market crashes.

So, if black swan events happen somewhat regularly—too frequently to render them true black swan events—then what are they? They’re more like “black turkeys,” according to Larry Siegel. In a 2010 article, he described it as “an event that is everywhere in the data—it happens all the time—but to which one is willfully blind.”

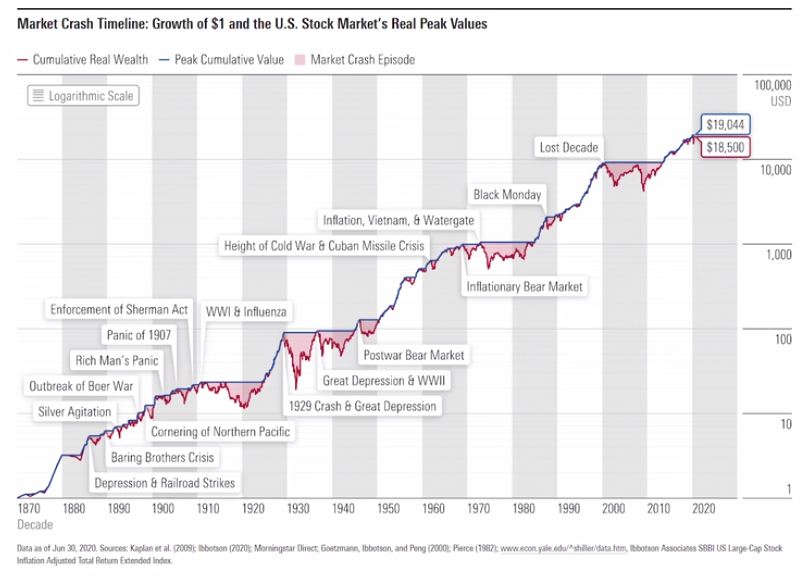

The chart shows that over this period of almost 150 years, $1 (in 1870 U.S. dollars) invested in a hypothetical U.S. stock market index in 1871 would have grown to $18,500 by the end of June 2020.

But it wasn’t a smooth ride to get there. There were many drops along the way, some of which were severe. The market always eventually rebounded and went on to new highs, but it may have been hard to believe this during some of the long-term bear markets, including:

- The 79% loss due to the crash of 1929, which led to the Great Depression.

- The 54% drop from August 2000 to February 2009, also known as the Lost Decade. This period started when the dot-com bubble burst. The market began recovering but not enough to get the cumulative value back to its August 2000 level before the crash of 2007-09. It didn’t reach that level until May 2013—almost 12 and a half years after the initial crash.

- The 51% drop between June 1911 and December 1920.

These examples show that market crashes have occurred numerous times. Recognizing their frequency can help provide a better sense of the volatility of equity investing.