At the 2020 Morningstar Investment Conference, Rupal Bhansali, the CIO and portfolio manager of international and global equities at Ariel Investments, shared these insights.

- To succeed in sports, you must understand the rules of engagement. Investing is the same.

The active-passive debate has gained tremendous traction in the U.S. as stock pickers find it hard to beat the benchmarks. That is because the rules of investing are not just different, they are asymmetric.

In most things in life, being right can send you off to the races. If you are a student and you get all your answers right during an exam, you ace the class.

Not in investing. Getting it right is insufficient. For example, if you thought APPLE was going to report X earnings and it did, you are correct. But if everyone thought the same, they too are correct. The stock will not move because the consensus views is already priced in. There is no payoff for the right answer.

For the correct answer, you score no points. For the incorrect answer, you incur penalty points that can wipe out your investment and performance track record. The payoff happens when you are right, but the consensus is wrong. When your non-consensus view is the correct one.

There are outsized payoffs for upset victories and outsized penalties for being wrong.

If you lose 50% on an investment, it is not sufficient for it to go up 50% to offset what you lost. In fact, it will have to go up 100%. If Rs 100 declines to Rs 50, it requires a 2x gain to break even. Imagine how hard it is to come up with 100%+ idea and that too, only to break even.

Let’s say, instead of losing 50%, you only lost 20%; Rs 100 declines to Rs 80. Now if you put that 100%+ idea to work on Rs 80, you will end up with Rs 160, which is 60% capital appreciation. The 100%+ idea got more play because you lost less money. That is why, avoiding losers is more important than picking winners.

Attention to risk management does not come at the expense of return management. You deliver better capital appreciation even as you deliver better capital preservation.

- If history was always going to be the prologue to the future, then we could all be just reversion-to-mean investors. And we know that is not true.

The world is dynamic. Evolving. Businesses change.

The big play in stock markets for the past 30 to 40 years has been computers, technology, semiconductors, and so on. I think the best days of that strategy are behind us. What I would actually bet on is Genomics and new technologies like gene splicing which are allowing us to come up with path breaking and paradigm shifting ways in which we control disease and cure it.

I am very bullish on Healthcare, much more than I am on Technology. Innovation is not only occurring in Silicon Valley and in tech companies. The amazing innovation happening in healthcare does not have the clock speed of mainstream awareness. It is a non-consensus view that has not been priced in yet.

You can read more of Rupal Bhansali’s investing here: Risk is a mosaic, not a formula.

Instead of buying heady growth stocks with hefty multiples, you are better off buying steady growth (even if it means slower growth) and plan for multiple compression. Don’t overpay. Valuations always matter. History has shown that repeatedly. Don’t be on the wrong side.

Gains takes years and years to make. When a bull market lasts for a long time, a sense of complacency sets in. Bear markets don’t last a long time, but when they transpire, they are fast and furious. You can lose money rapidly.

When the market is very overvalued, keep some powder dry. Cash is the only negatively correlated asset class.

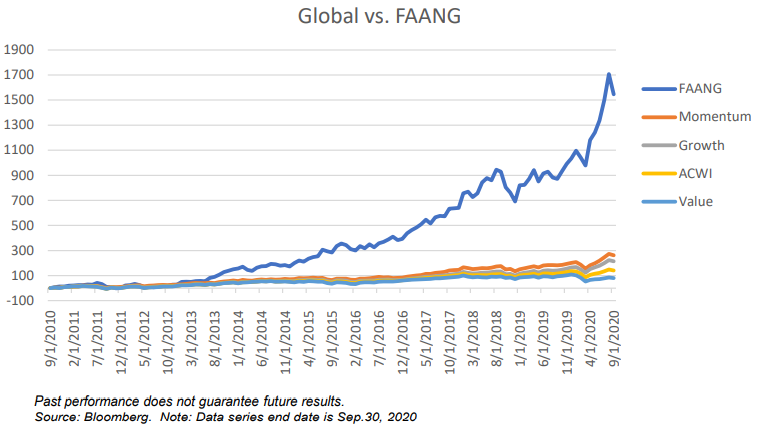

Over the last decade, momentum investing was one of the best performing styles, going up about 260%. Going with the flow has become the mantra of many investors. Momentum’s best days are behind, and value’s best days are ahead.

Everyone wants a piece of the U.S. market because it has performed the best compared to other global markets. I think there is a comeuppance moment on the horizon.

The S&P 500 has already exceeded the peaks of valuations reached in previous recessions. The COVID-19 crisis has caused earnings to collapse and yet stock market valuations have exceeded prior peaks close to levels of 30x.

When I talk of valuations, I look at it from the prism of Enterprise Value, and EV to EBIT. EV incorporates debt in the numerator and the corporate world has gone on a debt binge. If you don’t add debt onto market cap, you get a misleading picture of valuations.