I am 24 years old. I can invest Rs 20,000 per month. How are these funds? Axis Mid Cap, Nippon India Small Cap, Axis Small Cap, Franklin India Feeder Franklin US Opportunities, Parag Parikh Long Term Equity.

Excellent to see you save a considerable amount at such a young age. Before we answer your questions about the specific fund selection, a few pointers to keep in mind.

Time horizon

How long are you willing to stay invested? The longer the better from an equity perspective. We would think 5 years is the absolute minimum, where we would recommend a predominantly large-cap exposure. When it comes to a mid and small-cap exposure, we would advocate a 7-10 year outlook.

Risk

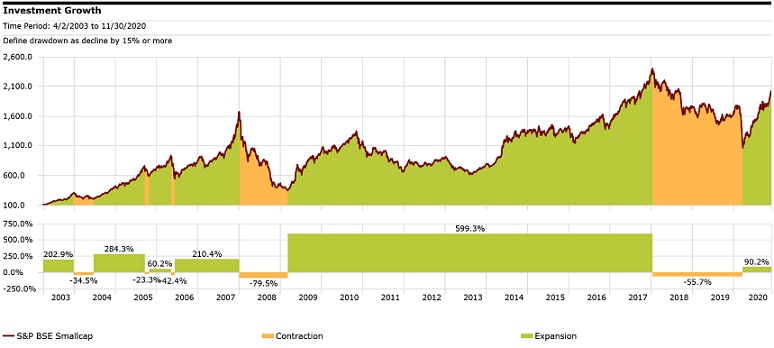

Most investments are fraught with some type of risk, albeit of varying magnitude. While risks associated with investing can’t be done away with completely, they can certainly be reduced by matching the investors willingness and ability to take risk with the right funds. For instance, small and mid cap funds come with significant market risk and accompanying volatility. Investors need to have the right time horizon plus the ability to weather large drawdowns in the portfolio value in the interim, which could even be to the magnitude to 50-70%. Investors need to be mentally prepared to see such large drawdowns in the interim and more importantly stay invested for the long term.

Liquidity

It is always good to have a part of your portfolio in highly liquid investments for emergency reasons. When we say highly liquid investments, it doesn’t simply mean funds that you can redeem at any point, but rather funds that have very low volatility (i.e. limited exposure to any form of risk), where the value of the investment will be more predictable at any point of time.

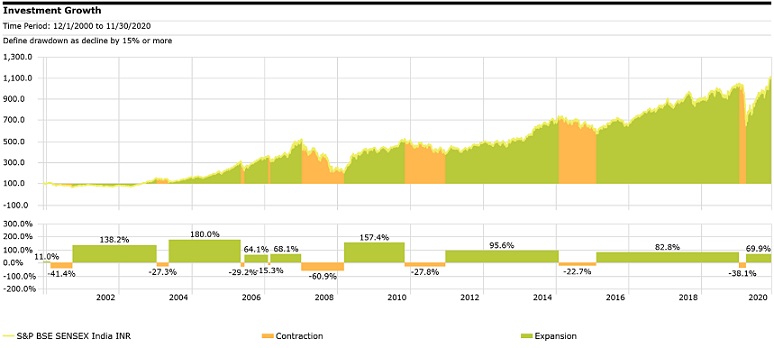

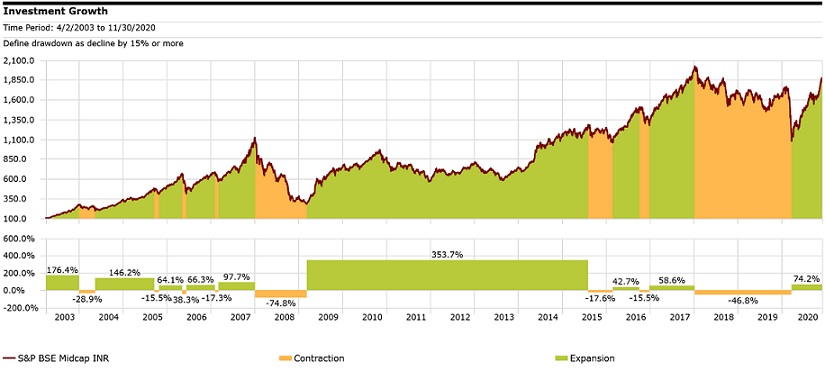

Below are the growth charts of the large, mid and small cap indices. Clearly, the mid and small cap indices have witnessed larger drawdowns and taken longer to recover. Which underpins the fact that investments in such funds need a longer investment horizon as compared to large caps.

Large Cap

Mid Cap

Small Cap

Portfolio allocation

Before you narrow down on select funds, you would need to think about your allocations to various market caps, and their role in your portfolio.

These are the funds you have selected:

- Axis Mid Cap: Mid Cap

- Axis Small Cap: Small Cap

- Nippon India Small Cap: Small Cap

- Parag Parikh Long Term Equity: Multi Cap with international exposure

- Franklin India Feeder Franklin US Opportunities: Global Equity

We would advise you to consider adding a large-cap fund to your portfolio as a core holding.

Given that you are just 24, and further assuming that you have at least a 10-year investment horizon with limited liquidity needs from your investments, here is a suggested allocation.

- Large-cap funds: 45%

- Mid-cap funds: 20%

- Small-cap funds: 10%

- International funds: 15%

- Fixed Income (Ultra Short Duration/Low Duration): 10%

Fund selection

The funds you have selected are good funds. Do take a look at the views of our analysts on various funds, and access fund performance data here.

But do remember, we have just presented you with a broad and general blueprint. We are clueless about your risk-taking ability or your time frame. Do seek the help of a financial adviser to ascertain your risk-return objectives as well as investment time horizon to construct a portfolio with an appropriate asset allocation.

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries ONLY relating to mutual funds and portfolio planning.